Gold price is overbought in the short-term and justifies a pullback towards $1,240. It is important for Gold bulls to hold above $1,230 and create a new short-term base of a higher low in order to move above $1,280-$1,300 which is the long-term resistance.

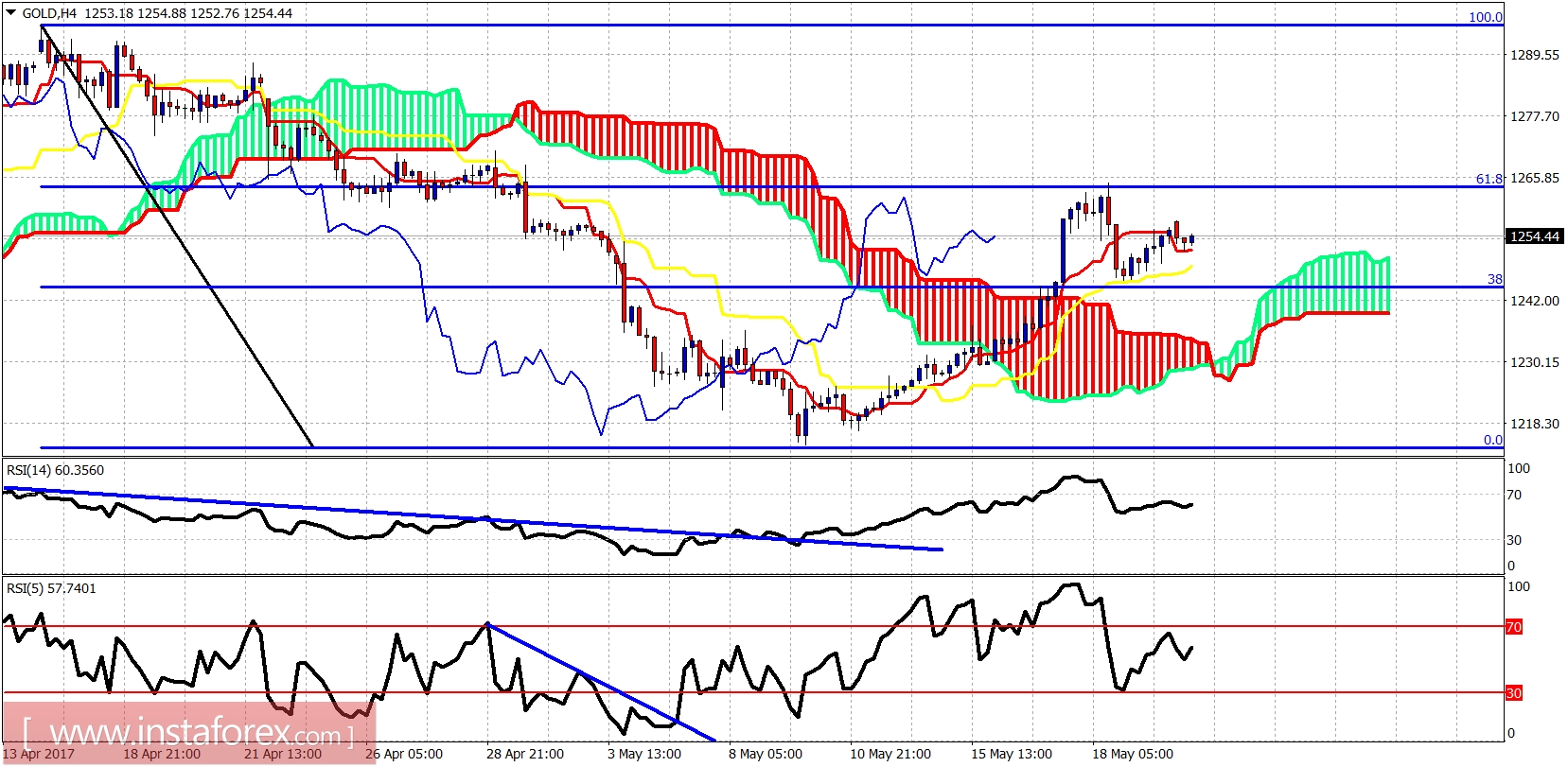

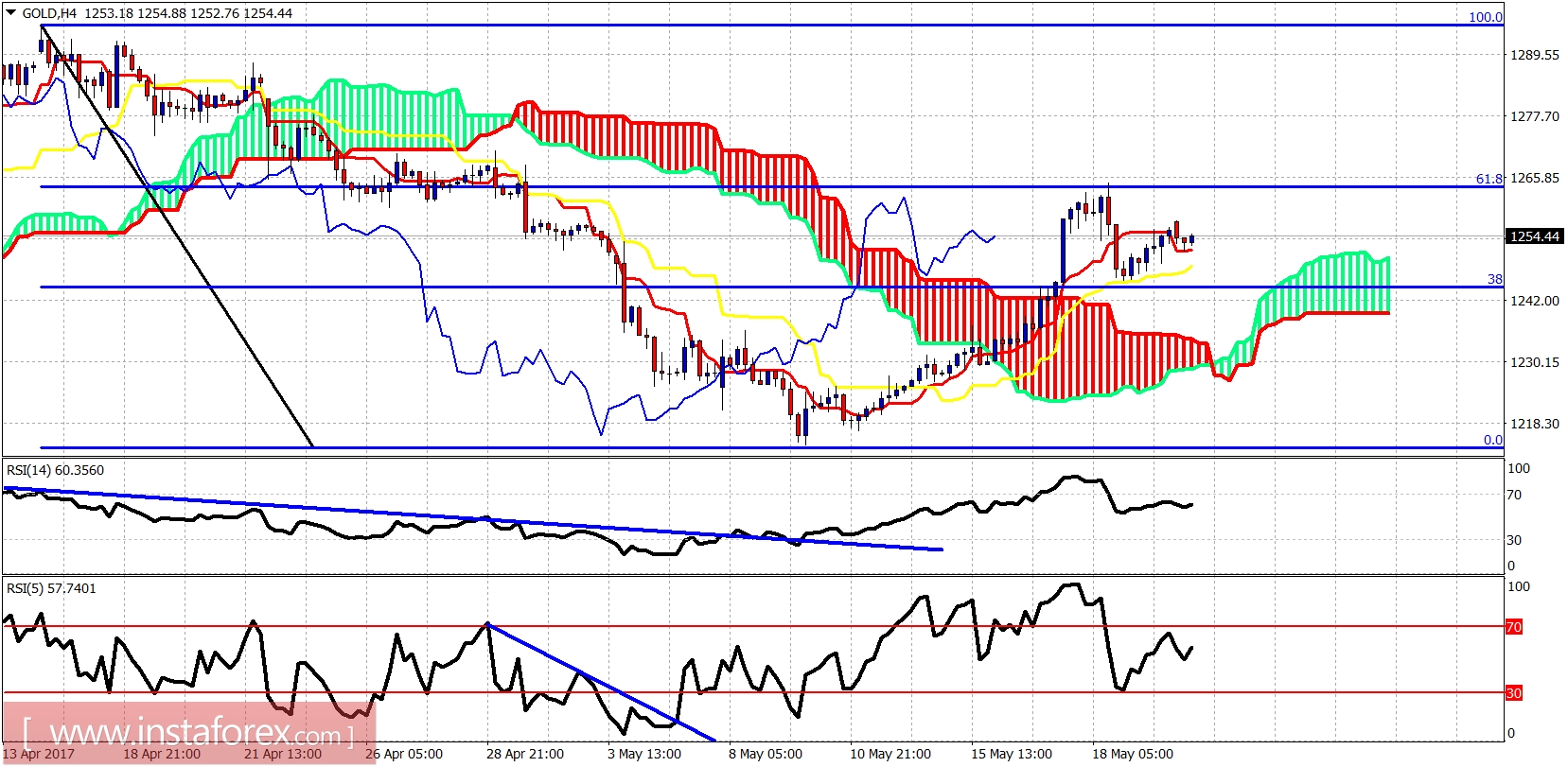

Gold price is trading above the Ichimoku cloud support. Price got rejected at the resistance of the 61.8% Fibonacci retracement. Short-term support is at $1,247 and next at $1,230. Price is expected to move lower before higher.

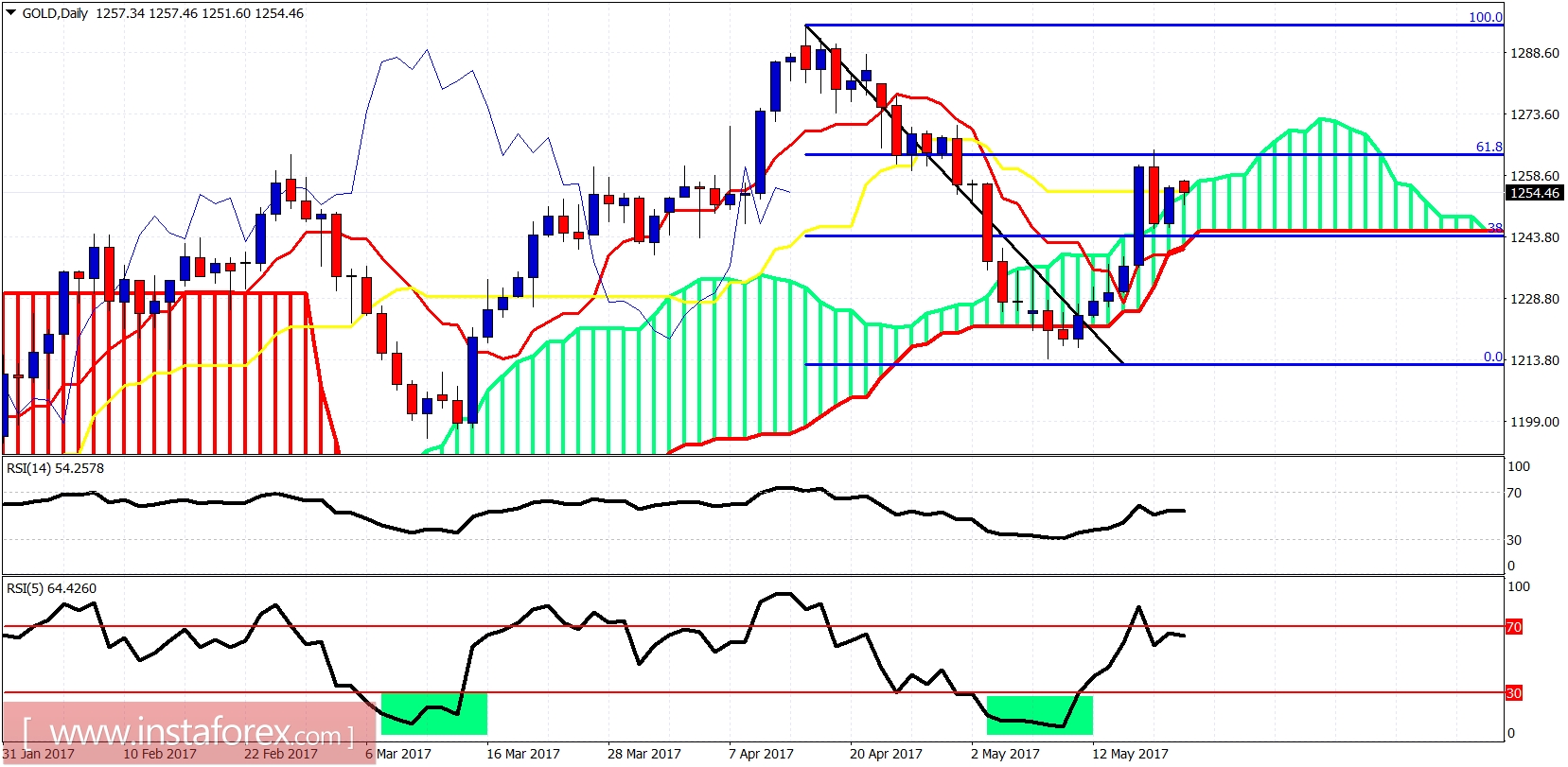

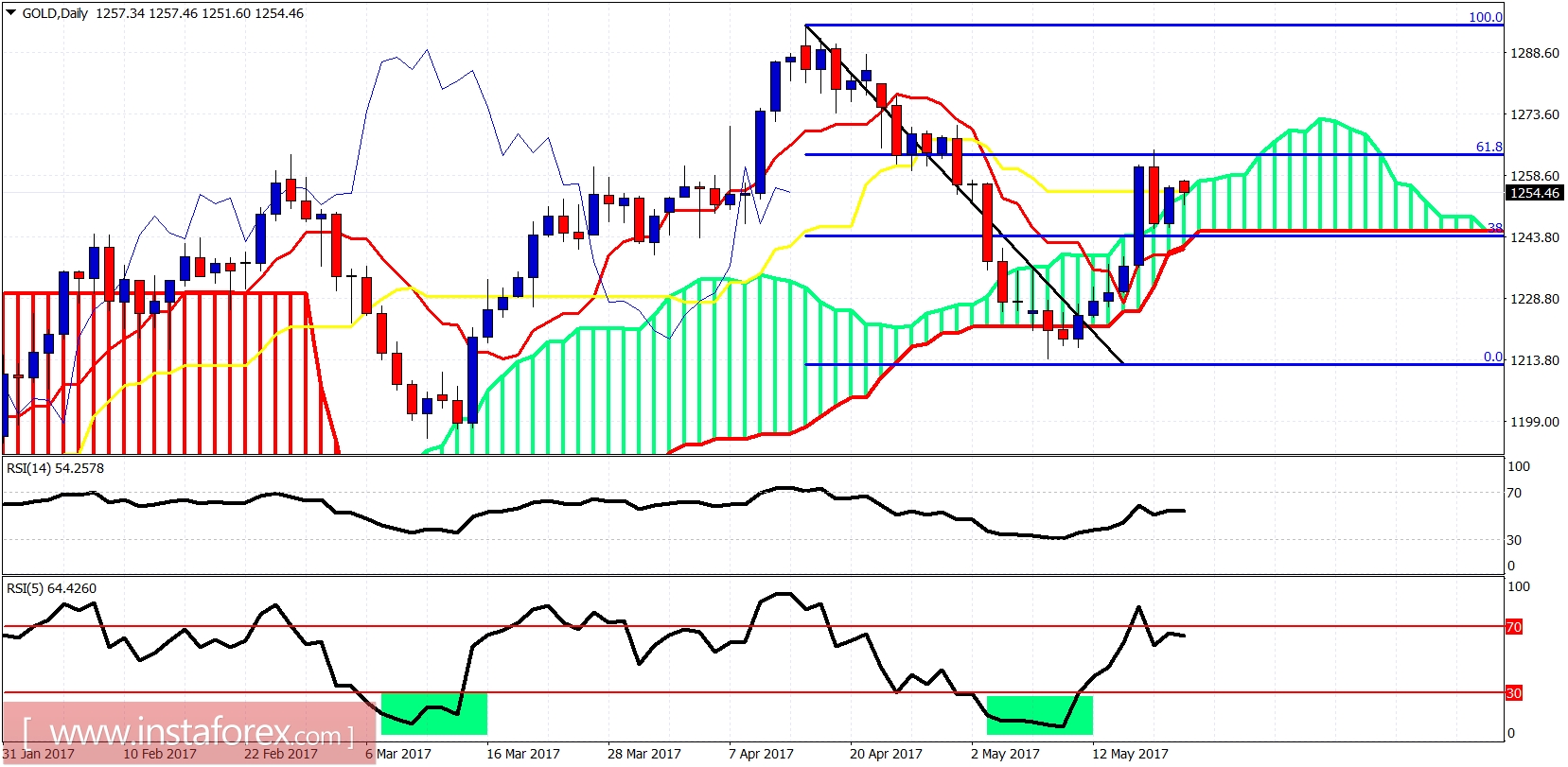

Gold daily chart shows price above daily cloud but below the 61.8% Fibo level resistance. I expect a pullback and a higher low to be created over this week. As long as price is above $1,213 we target $1,230-40 and next $1,280-$1,300. If the $1,213 low is broken, expect a move towards $1,150-60.