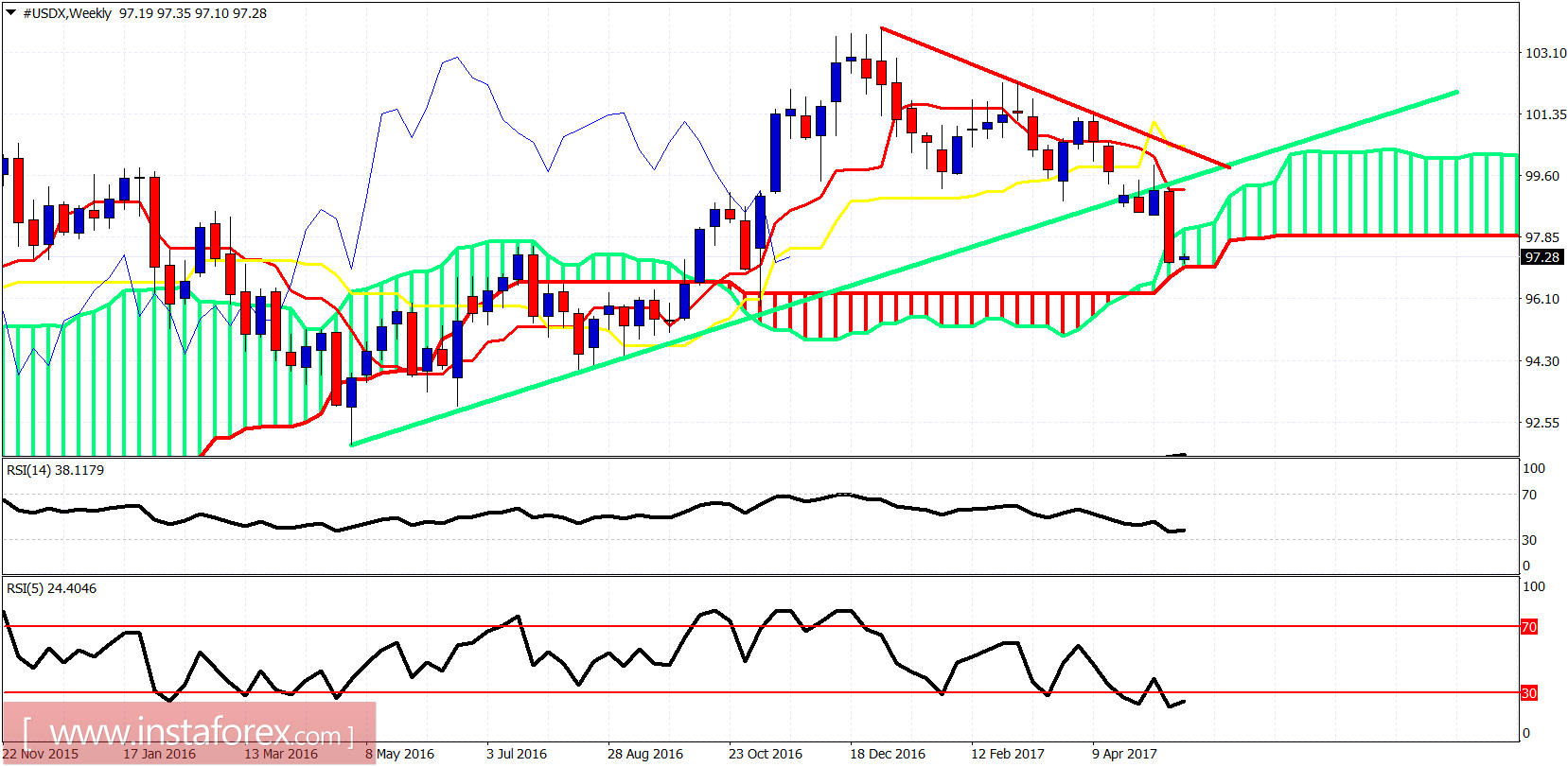

The Dollar index is oversold, diverging and is expected to move higher this week towards at least 99 - 99.50. Price is expected to reverse upwards this week so I prefer to be Dollar bullish. Price is at important weekly support.

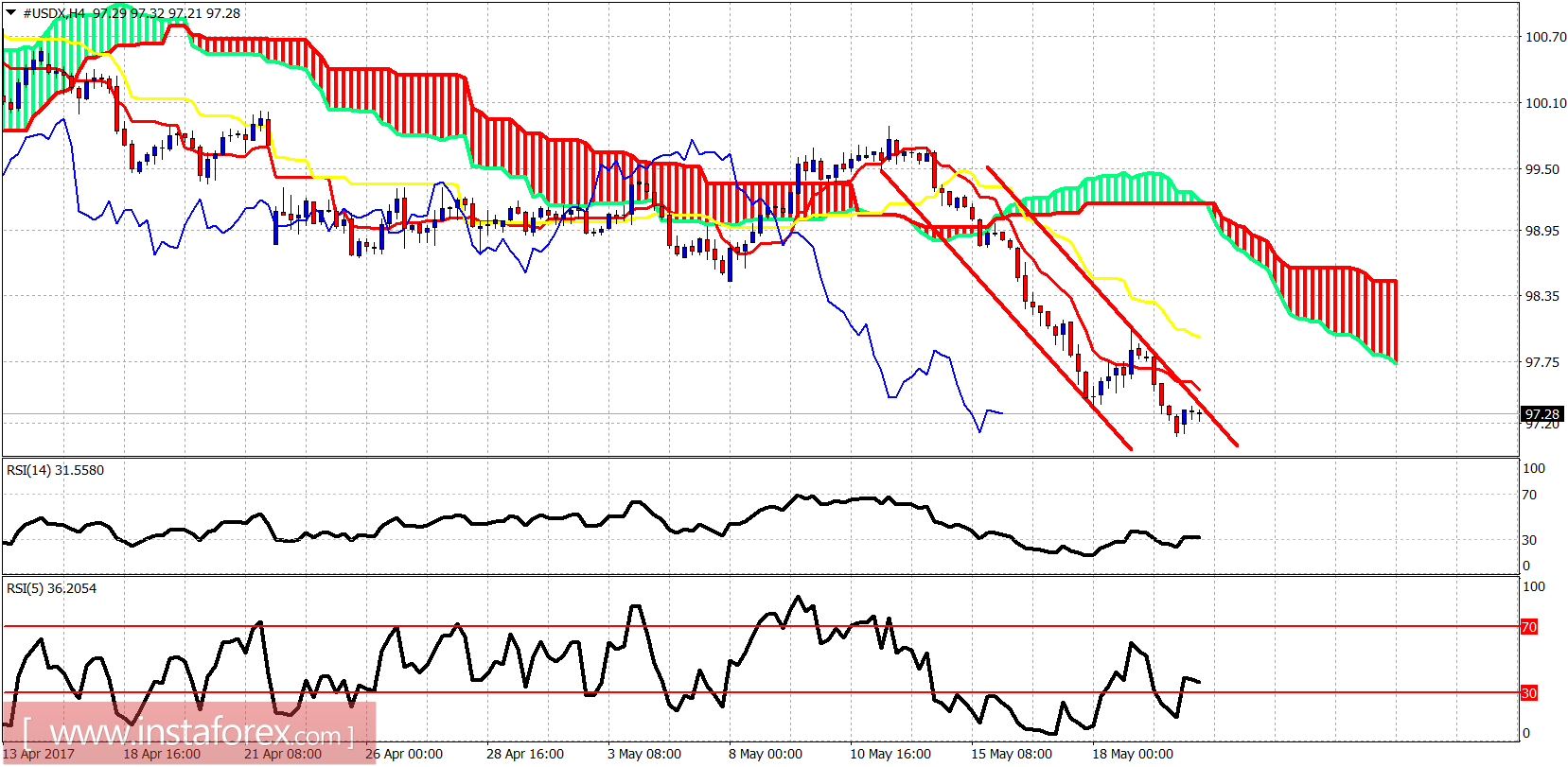

The short-term trend remains bearish as price is inside the bearish red channel and price below both the tenkan- and kijun-sen. I expect the Dollar index to bounce at least towards the Kumo (cloud) at 99.

Green line - long-term trend line support (broken)

The Dollar index is at the weekly Kumo. Trend is about to turn bearish with price having broken the long-term trend line support. In the short-term, I expect a strong bullish reversal as the RSI (5) is oversold and about to turn higher. Price at the weekly Kumo should at least make a technical reflex bounce to 99. So I would wait for a bounce higher before re-entering short Dollar positions.