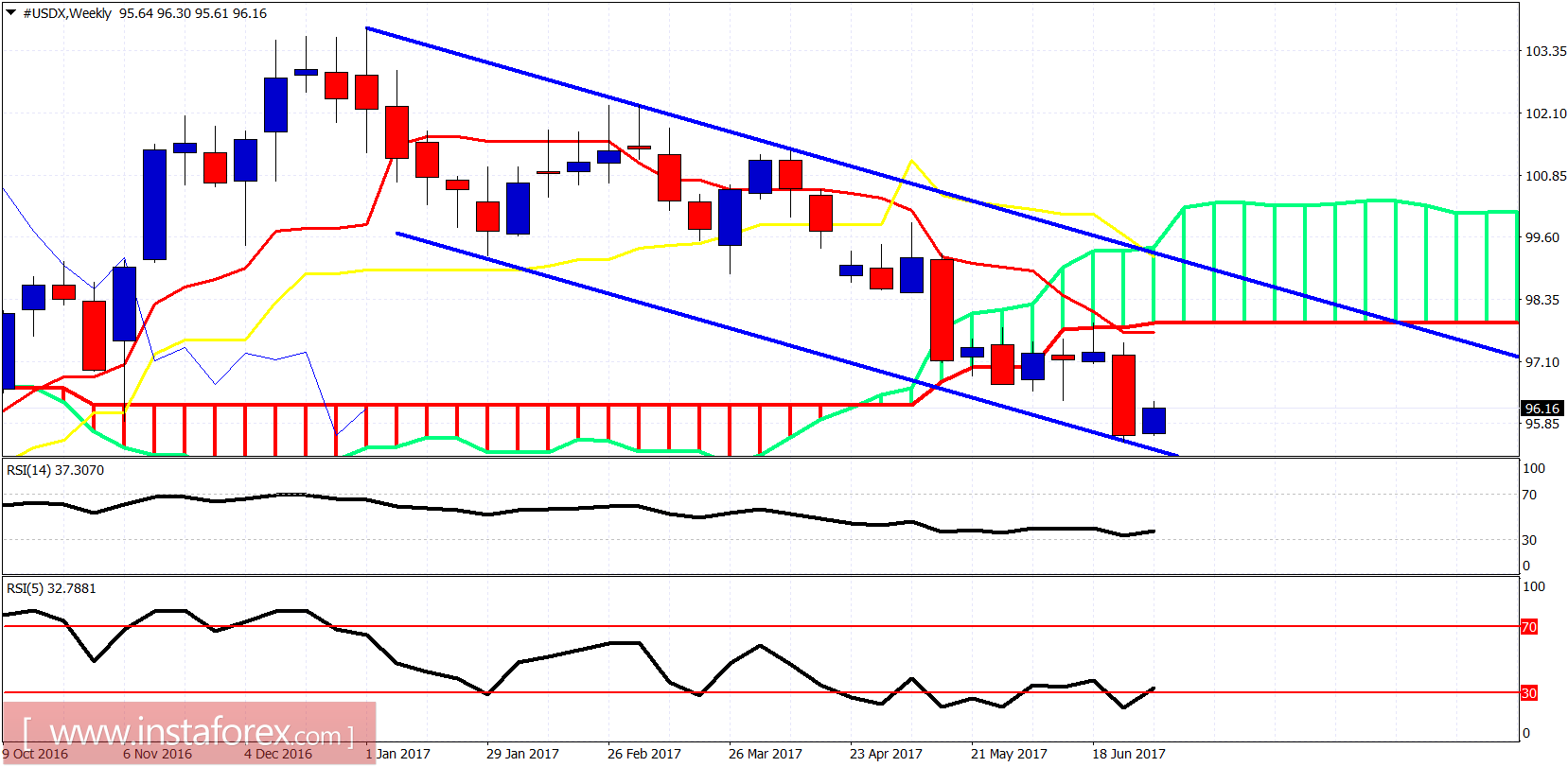

The Dollar index is bouncing as expected. The price is now making the minimum bounce requirements towards short-term resistance and previous support at 96.50. Overall I expect a bigger Dollar index bounce towards 98.

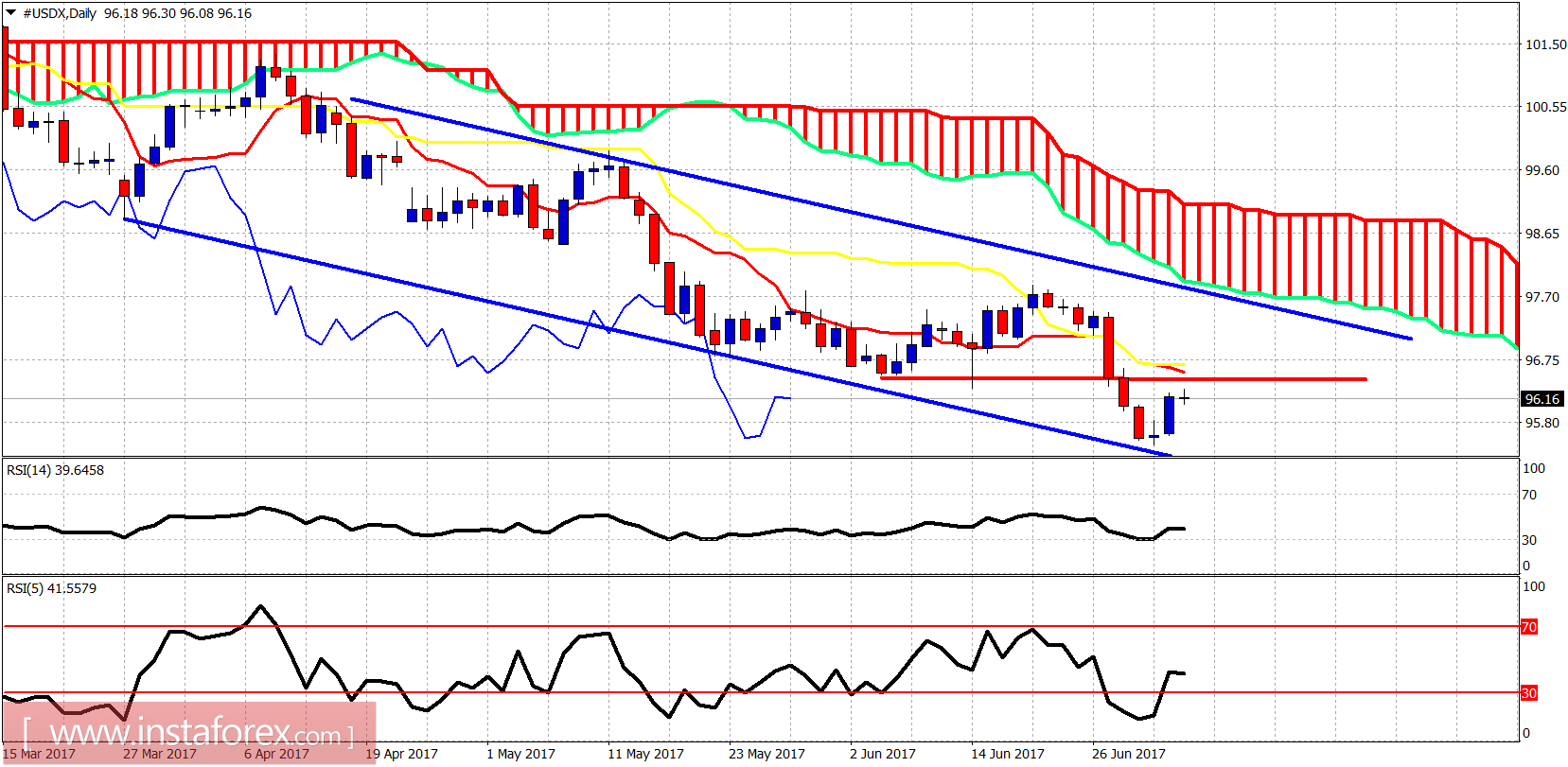

Blue lines - bearish channel

The Dollar Index is testing short-term resistance at 96.50 where we also find the 4-hour tenkan- and kijun-sen indicators. Oscillators bounce off oversold levels. I expect this bounce to continue higher.

Blue lines - bearish channel

On a weekly basis, although the trend is bearish and the price is below the weekly Kumo (cloud), I expect a short-term bounce for a week or two towards 98-98.50. The RSI is diverging and oversold. I expect at least a move towards the lower Kumo boundary.