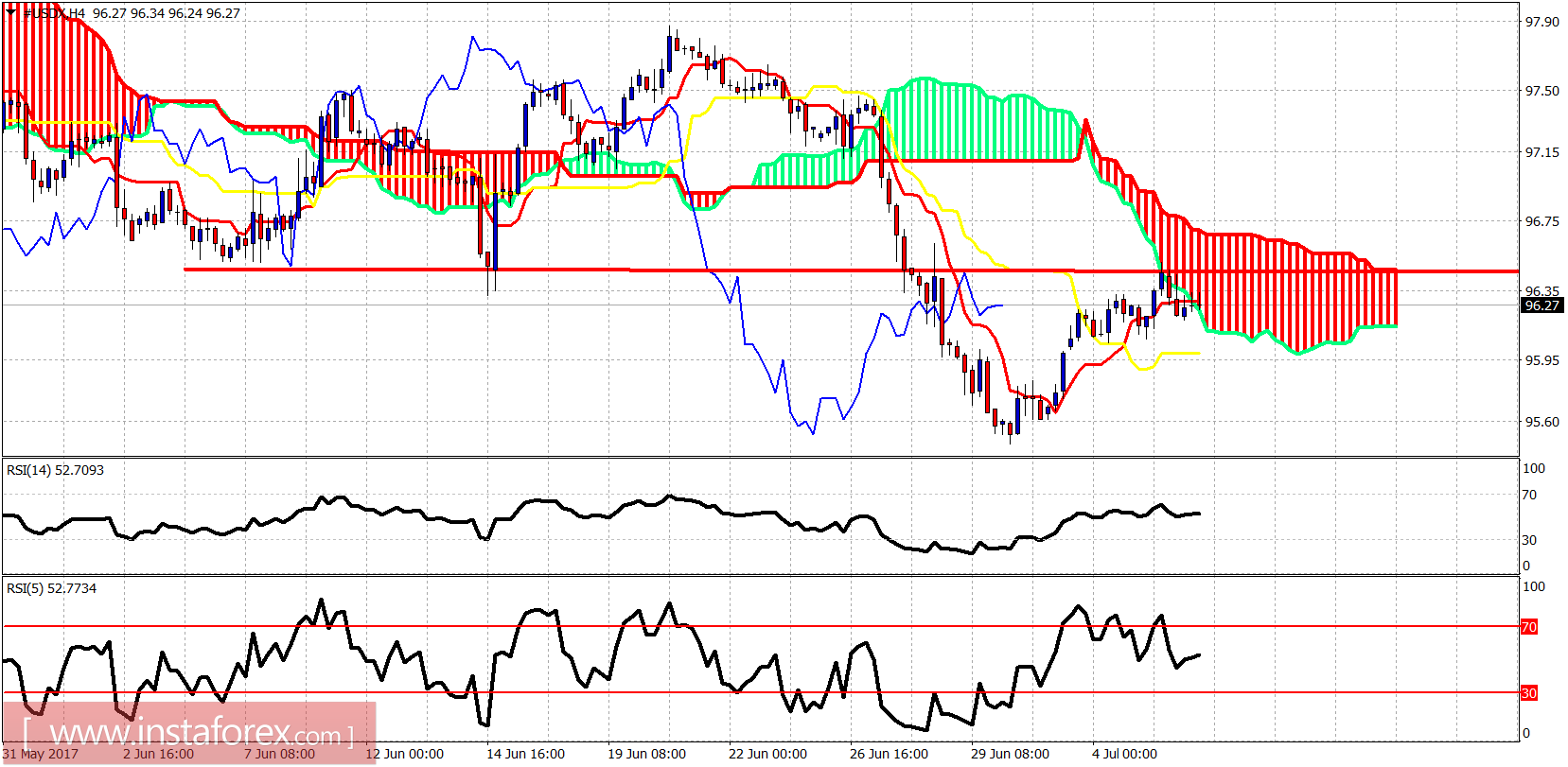

The Dollar index continued its bounce towards 96.5 resistance but got rejected. Bulls need to hold above 96 and make a higher low before the next leg up. Trend remains bearish and there is no trend reversal confirmation yet.

Red line - resistance

The Dollar index bounced towards the 4-hour Kumo (cloud) and trend line resistance at 96.50 and got rejected. This increases the chances of making a new lower low. However if support at 96 holds, we could see a higher low being formed before the next leg up towards 98.50.