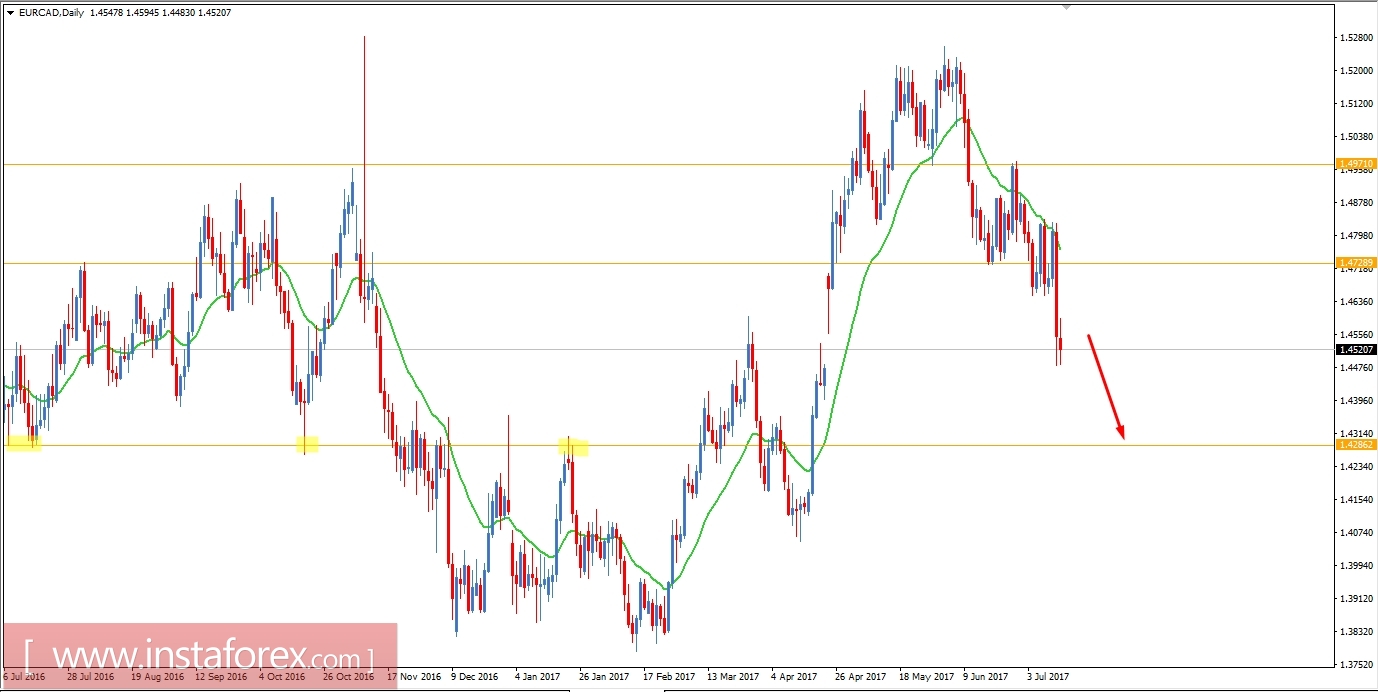

EUR/CAD has broken below the corrective area support level of 1.4730 recently after the CAD Rate hike. After a good amount of struggle at the level, the price has finally broken below the corrective structure and now heading towards 1.4290 support level. Recently CAD Overnight Rate increased to 0.75% which previously was at 0.50% which did help the currency to gain more strength over almost all major currencies in the market. The BOC Press Conference was also hawkish in nature which is expected to lead further gains on the CAD side against EUR in the future. Today CAD NHPI report was published with a better than expected outcome at 0.7% which was expected to be at 0.3% though it is a bit less than the previous value of 0.8%. On the EUR side, today German Final CPI report was published with an unchanged value of 0.2% and French Final CPI report was also published with an unchanged value of 0.0%. The unchanged reports did not quite help the currency to gain against the dominant pressure of CAD today which may lead to further gain on the CAD side against EUR in the coming days. To sum up, CAD has been quite stronger than EUR since it bounced back from 1.52 which is expected to proceed further downward in this pair as of recent CAD Rate Hike and better economic reports.

Now let us look at the technical view, the price has broken below the corrective structure after bouncing off from the 20 EMA dynamic resistance level yesterday. Currently, the daily candle is showing some indecision after rejecting the bulls in this pair. As the price remains below 1.4730 resistance level the price is expected to proceed further down towards 1.4290 support level in the coming days.