The pound/dollar pair showed super-high activity yesterday, which resulted in the formation of an inertial upward movement in the direction of the psychological level of 1.3000. The dynamics are directly related to the information noise – Brexit, where the price sharply changes in accordance with the incoming data. In fact, we have a direct interaction of speculators with the quote, in its local consideration

The dynamics are extremely high and the quote easily passes hundreds of points. Thus, it is a useless idea to talk about the week-month perspective now, if we can pass a sufficient number of points in the period of one day and stay in tact with the market.

The market development is based on short-term positions, where the trading signal is based on the levels of price interaction with market participants, as well as information noise, where the second element is considered the main incentive for speculative surges.

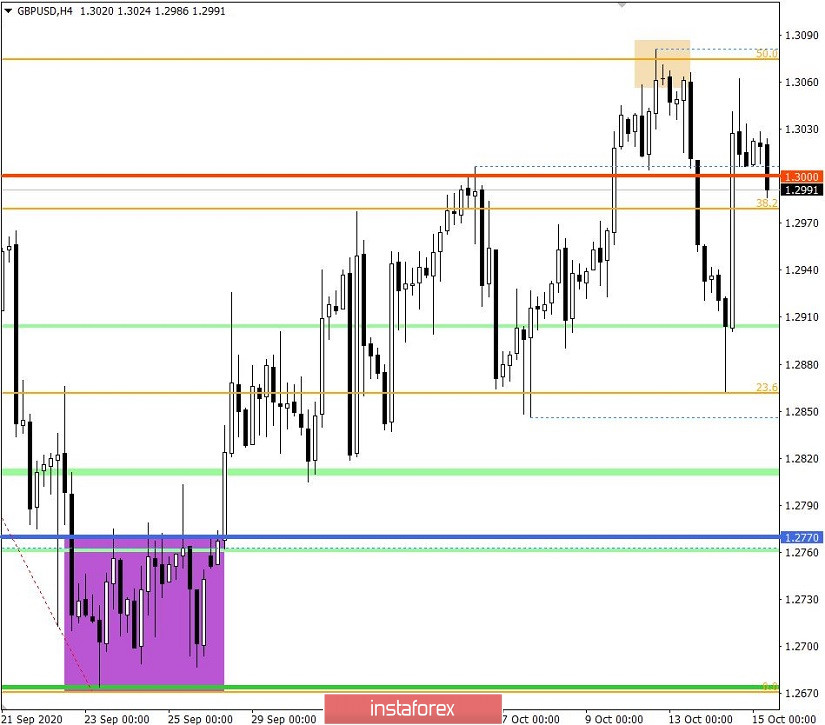

Analyzing yesterday's fifteen-minute period, a round of long positions appeared in the period 7:15-14:30 UTC+00, where an inertial move was recorded with a local high of 1.3062. After that, there was a pullback towards the level of 1.3000.

In fact, a recovery was obtained relative to the decline last October 13. The movement took the form of a V-shaped pattern, where the role of resistance, as before, is played by the maximum correction in the form of the 1.3060/1.3080 area.

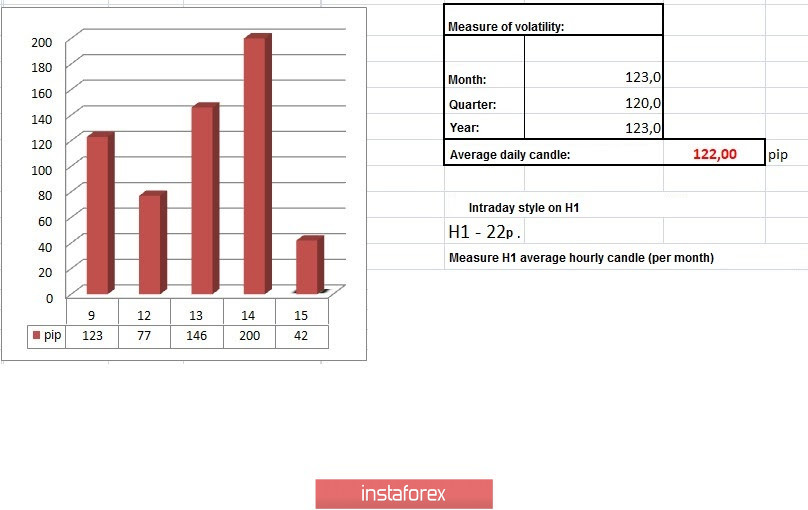

In terms of daily dynamics, the highest indicator for 24 trading days was recorded yesterday. It amounted to 200 points, which is 63% higher than the average. The speculative position ratio had a high level, which is confirmed by the volatility.

As discussed in the previous analytical review, traders were prepared for high activity and knew that a strong information background was expected, on which they could earn money on the principle of speculative price surges.

On the other hand, information noise can be detected by monitoring resources such as Bloomberg, Wall Street Journal, Reuters, CNN for hot topics like Brexit, COVID, statements of influential persons from the EU, USA and Britain.

Considering the trading chart in general terms (daily period), we can see that the corrective movement from the local low of 1.2674 is still relevant, while the quote is still at its conditional high.

Yesterday's news background had data on US producer prices, where the decline was replaced by a growth of 0.4%, which will positively affect the US dollar in the future.

The market did not react at the time of publication of the data due to the strong information noise.

In terms of the information background, Brexit served as a hot news, where British Prime Minister Boris Johnson said during his telephone conversation with the head of the European Commission (EC) Ursula von der Leyen, that London would not abandon trade negotiations with the EU in the form of an immediate decision. Moreover, he expressed disappointment at the lack of new success in the negotiations between London and Brussels, but speculators considered all the noise only as to the fact that there will still be negotiations and London will not make an exit without a deal right now.

In turn, Ursula von der Leyen noted that the EU is working on a deal, but not on getting it at any cost. The conditions must be suitable in terms of fishing, common rules and management.

Speculators' attention is focused on the EU summit today and tomorrow, where the main topic will be Brexit. Thus, it is worth paying close attention to the comments and statements, as they may lead to impulse changes in the market.

We should also continue monitoring these resources: Bloomberg, Wall Street Journal, Reuters, and CNN for hot topics.

In terms of statistics, the US weekly data on claims for unemployment benefits will be released today, which is expected to be not bad.

Initial applications can be reduced from 840,000 to 825,000, while repeated applications can be reduced from 10,976,000 to 10,700,000.

Further development

Analyzing the current trading chart, you can see the pullback process relative to yesterday's activity surge, where the quote is trying to consolidate below the psychological level of 1.3000. In terms of technical analysis, focusing the price below 1.3000 may open the prospect of a decline towards 1.2950, which would be logical in terms of recovery.

In turn, Brexit's information background can make adjustments to technical analysis in the form of speculative surge, where it is worth carefully monitoring the incoming information.

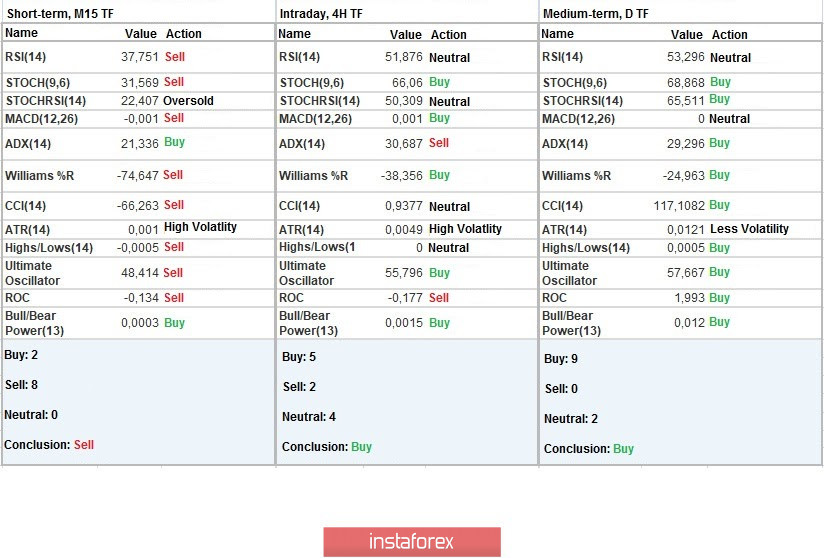

Indicator analysis

Analyzing different sectors of time frames (TF), we see that the minute and hourly TFs have a variable buy/sell signal due to high activity and the recovery process. Meanwhile, the daily TF still has a buy signal by focusing within the level of 1.3000.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month / Quarter / Year.

(It was built considering the publication time of the article)

The dynamics of the current time is 42 pips, but if we consider the anticipating position of speculators, we can assume that the volatility will grow further.

Key levels

Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.3000 ***; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română