Speeches by Fed officials who spoke out against lowering interest rates at the last meeting, as well as statements by the US President on the trade conflict with China, all this led to purchases of the US dollar on Friday. However, there was no turning point or formation of any trend.

Federal Reserve Bank of Boston President Eric Rosengren said on Friday that a healthy economy did not require lower rates, and the adoption of such measures only increased the risks of financial instability. Rosengren also fears that lowering rates just to combat "uncertainty" will only increase financial risk-taking.

Richard Clarida, Rosengren's "teammate" at the Fed, also expressed his opinion. Let me remind you that Clarida opposed lowering rates at this meeting. He argued that there were no risks to financial stability in the American economy. According to the Fed representative, although the world economy is slowing down, the US economy is stable, and it feels pretty good this year. Clarida also estimated that inflation is starting to move towards the target value of around 2.0%, and did not assess the likelihood of another rate cut by the end of this year.

On Friday, data also came out that showed that the growth of the welfare of American households is gradually slowing down. According to the report of the Federal Reserve System, net household wealth in the US in the 2nd quarter of this year increased by only 1.64% to 113.5 trillion dollars, after an increase of 4.99% in the 1st quarter. The growth was due to the rise in the price of shares in several companies that are owned by Americans. The value of property owned by households has also increased. Pension assets showed an increase of 1.4%.

On Friday, the US President made a series of statements on the trade conflict with China, which he called a "small dispute". Trump noted that the US seeks a comprehensive agreement with China, not a partial agreement, and expressed dissatisfaction with the volume of purchases of agricultural products by China. The US President also said that intellectual property remains an important issue in the negotiations. Let me remind you that representatives of the White House and the Chinese government continue negotiations, and in October this year, the leaders of the two countries are scheduled to meet again. Many traders hope that the agreement will still be concluded by the end of the year, and tensions related to the trade conflict, which negatively affect the world economy, will decrease sharply.

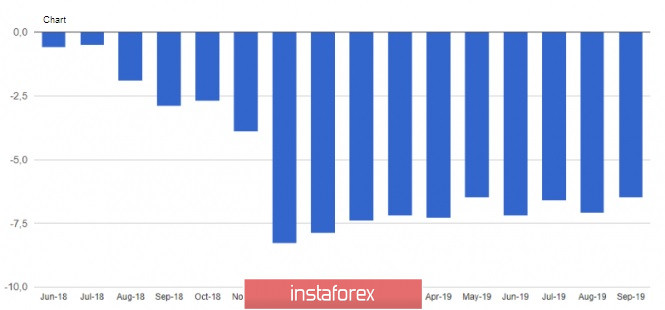

Data on eurozone consumers' assessment of their prospects supported the euro by the end of the day. According to the report, eurozone consumers were more optimistic about their prospects in September this year, which could support the economy in the 2nd half of the year.

The European Commission report indicated that the consumer confidence index rose to -6.5 points in September from -7.1 points in August. The growth of consumer confidence will necessarily have a positive impact on the increase in consumer spending.

Another important news for traders was the statements of the Fed-New York, from which it became clear that repo operations, which could be observed this week, will continue until October 10. In total, starting this week, the Fed-New York will conduct three 14-day repo operations worth at least $ 30 billion each. However, this news did not put any pressure on the US dollar, as it was clear for a long time that the Fed would more actively provide liquidity to banks despite all the statements that the bond redemption program would not be launched shortly.

As for the technical picture of the EURUSD pair, the bulls managed to stop the fall at the lows of the week. The target of sellers of risky assets is still the same support level of 1.0995, the breakthrough of which will provide a larger pressure on the pair and will lead to the renewal of the monthly lows in the area of 1.0960 and 1.0925. If the bulls return to the market, the upward potential will be limited by the resistance around 1.1035, however, a larger area is seen around 1.1075.