According to an analyst at the reputable Citigroup bank, the continuation of the golden Autumn may turn out to be the same golden time for the British pound. Experts are sure that the next month will be the most suitable for the purchase of the "British" against the US dollar.

Citigroup estimates the potential growth of the GBP/USD pair in October to be very high. Currency strategists of the bank argue that the purchase of sterling against the US currency is the most preferable transaction.

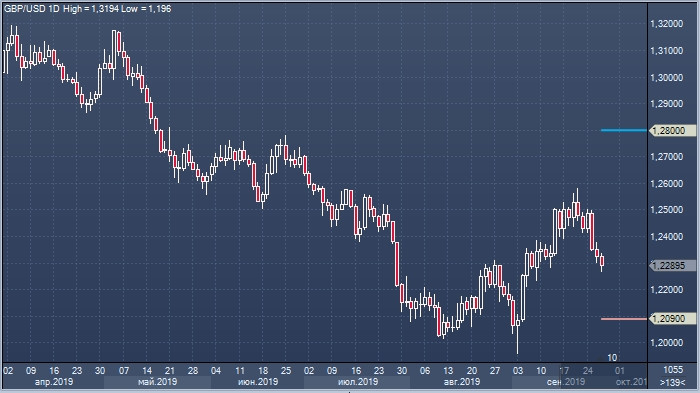

The GBP/USD pair completed the previous trading week at 1.2290. Currently, the pair is trading in the range of 1.2303–1.2308 that shows steady growth. Citigroup analysts recommend choosing long positions with the target of 1.2800 and a protective stop order to limit the potential loss at 1.2090.

This Monday, September 30, will be the last trading day of this month and the third quarter of 2019. Closing the pair above 1.2310 will put an end to the "bullish" trend that persists for a month. A similar situation was recorded following the results of January of this year, Citigroup reminds. At the current moment, the GBP/USD pair has rebounded down from the level of 1.2320 and trades in the structure of a small wave of decline in the range 1.2313-1.2315. Experts admit the possibility of correction and return to the level of 1.2320. However, a fall to the level of 1.2242 is expected in the forecast.

Currently, in the GBP/USD pair, the advantage remains for the greenback. The US currency, as well as the growth of the dollar index, is favored by the unstable dynamics of the pound. The precarious position of the British currency is due to the maximum dollar yield, as well as the problems of the eurozone and the high likelihood of a "hard" Brexit. The next month may bring surprises to the British currency, but Citigroup expects that they will mostly be with a plus sign.