To open long positions on GBP/USD, you need:

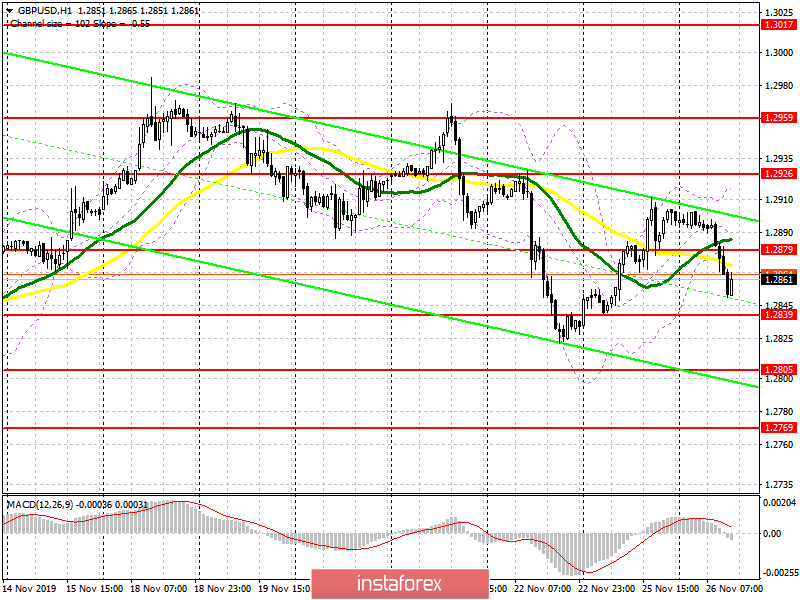

Back in the morning review, I paid attention to the likely decline of the pound after the breakdown of the support of 1.2890, which happened. At the moment, the struggle will be for the resistance of 1.2879, on which it depends whether the upward correction will continue or the market will be pushed further down. Only a return and consolidation above the level of 1.2879 on weak data on the US economy will allow you to return to the maximum of 1.2926 and update it, reaching the resistance of 1.2959, where I recommend taking the profits. However, a scenario with a decline in the support area of 1.2839 and the formation of a false breakdown there, which will be the first signal to buy the pound, seems more likely. Otherwise, I recommend opening long positions immediately on the rebound at the minimum of 1.2805, but this is subject to good statistics for the US and the absence of significant news on the elections in the UK.

To open short positions on GBP/USD, you need:

Sellers did a great job with the morning task, and now the important point is to keep GBP/USD below the resistance of 1.2879. The formation of a false breakdown at this level will lead to a larger downward correction to the support area of 1.2839 and, quite possibly, to the update of the minimum of 1.2805, where I recommend taking the profits. However, such a strong bearish momentum will be realized only with good data on consumer confidence in the US, where the index is expected to rise to 126.9 points. If the bulls manage to regain the resistance of 1.2879, the big players will leave the market. In this case, it is possible to maintain the side channel or a larger upward correction to the maximum area of 1.2926, from where I recommend opening short positions immediately on the rebound.

Indicator signals:

Moving averages

Trading returned around the 30 and 50 daily averages, indicating that the market may remain in the side channel.

Bollinger Bands

Growth will be limited by the upper level of the indicator around 1.2915, while bears should cope and not let the pair above the average border of the indicator around 1.2885, which will keep the pound in a downward channel.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. The chart is marked in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. The chart is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20.