To open long positions on GBPUSD, you need:

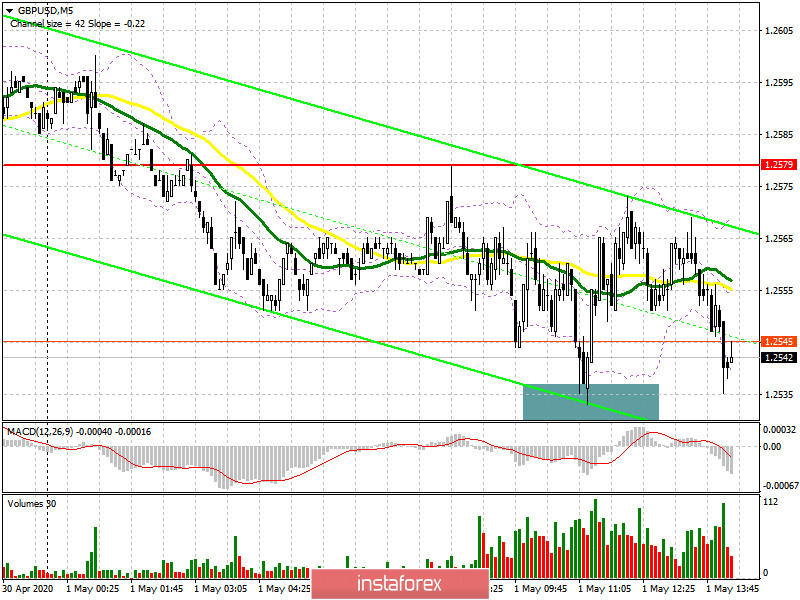

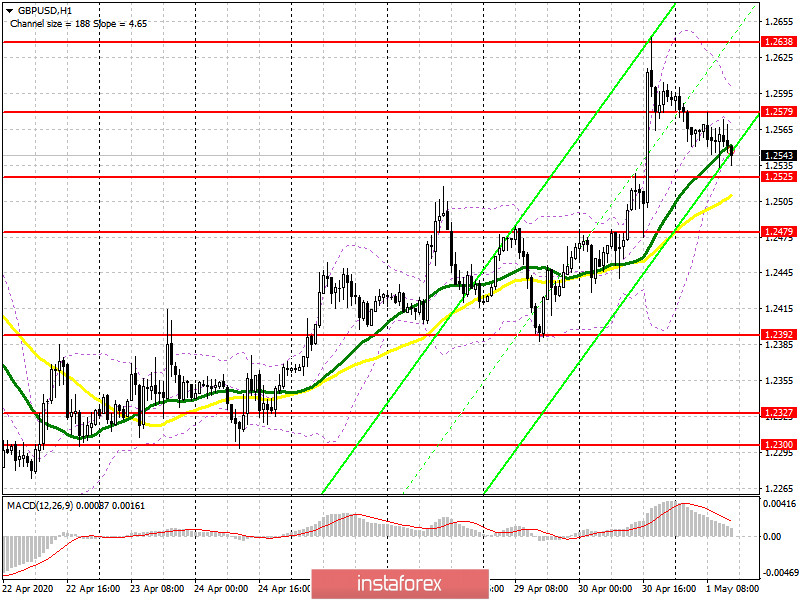

From a technical point of view, nothing has changed. If you look at the 5-minute chart, you can see how the bears failed to reach the morning support of 1.2526, as a result, the buy signal did not work out. A similar story occurred with an attempt to grow to the resistance area of 1.2579, where a false breakout could be formed. At the moment, the task of buyers of GBP/USD is to break through and consolidate above the resistance of 1.2579, which will lead to a new upward wave in the area of the maximum of 1.2638, where I recommend fixing the profits since it will be quite problematic to break above this range. In a scenario of a falling pound in the second half of the day after a report on manufacturing activity in the US, for the long positions, it is best to look at after a test at 1.2526 with the formation thereof a false breakout or buy for a rebound from support 1.2479.

To open short positions on GBPUSD, you need:

A slight discrepancy with the forecast in the report on UK manufacturing activity did not allow the bears to build a larger downward trend and break below the support of 1.2526. At the moment, the task of sellers is to form a false breakout in the resistance area of 1.2579, after which a second larger downward correction may be formed in the area of important support of 1.2526, where I recommend fixing the profits. However, weaker-than-forecast data on manufacturing activity in the United States may dump the British pound to a minimum of 1.2479, which will mean a reversal of the current upward trend formed on April 21 this year. In the scenario of growth above the resistance of 1.2579, it is best to return to short positions on a false breakout from the maximum of 1.2638 or sell the pound immediately on a rebound from the resistance of 1.2686.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates a possible break in the upward trend.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.2530 will increase the pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20