Hello, dear colleagues!

The readiness of the quote to continue moving in the north direction during yesterday's trading was fully confirmed. Moreover, this morning, the euro/dollar pair continues its ascent and is already trading near 1.1207. However, not everything is as clear as it might seem at first glance.

As for the main events of this week, they are still ahead, and market participants will have to react to them in some way. Let me remind you that on Thursday, the European Central Bank (ECB) will announce its decision on interest rates, and a little later there will be a press conference of ECB President Christine Lagarde. On the last day of weekly trading, reports on the US labor market will be released, which may significantly affect the results of the current five-day trading period.

Regarding the ECB meeting, expectations remain that the European Central Bank may announce additional stimulus measures to restore economic activity in the Eurozone. Let me remind you that the European Commission has proposed a large-scale stimulus package of 1.85 trillion euros to urgently help the European economy from the negative consequences of the COVID-19 pandemic. In turn, the ECB may increase the emergency purchase of securities, which is currently determined by the amount of 750 billion euros, by another 500 billion. There is no doubt that such expectations support the single European currency, which is strengthening across a wide range of markets. I believe that the events of Thursday and Friday will determine the future price dynamics of the main currency pair on the Forex market.

As for the US dollar, it continues to experience pressure associated with the gradual normalization of the epidemiological situation in the world and a drop in demand for safe assets. It is difficult to make a clear conclusion about the direct connection of the USD weakening with the events in Minnesota, as well as the behavior of US President Donald Trump concerning the Hong Kong issue. Most likely, the main pressure on the dollar is due to the continued risk appetite and optimistic sentiment on global trading platforms.

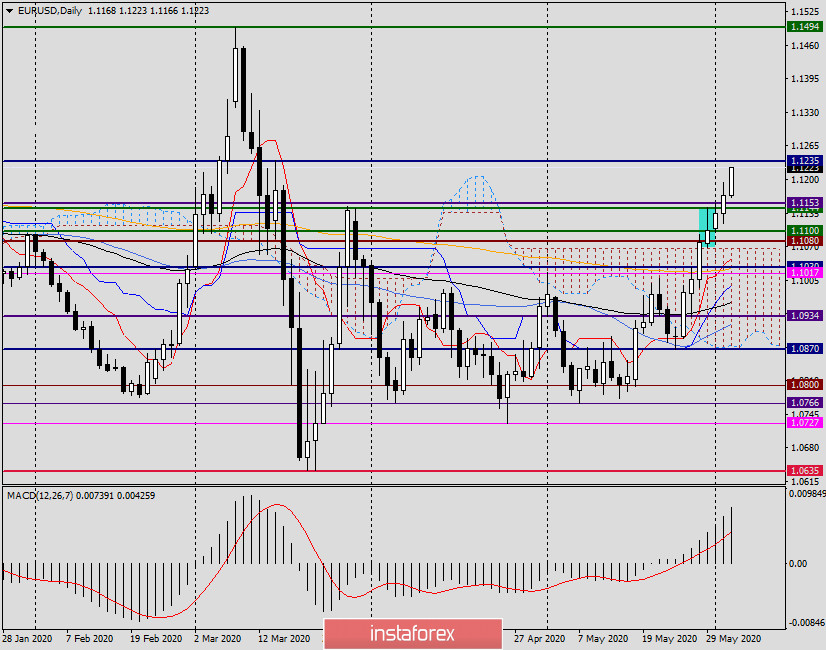

Daily

On the daily chart, everything seems to be fine. The pair continues its steady growth and rises higher and higher. However, I would like to note that the price zone of 1.1200-1.1235 is very strong and has repeatedly had a strong impact on the price dynamics of the euro/dollar pair. Let's see how the price will behave this time in the designated area. If a bearish candlestick pattern appears here, there is a high probability, if not a reversal and change of the current upward trend, then an exchange rate adjustment, the goals of which may be the price area of 1.1150-1.1100.

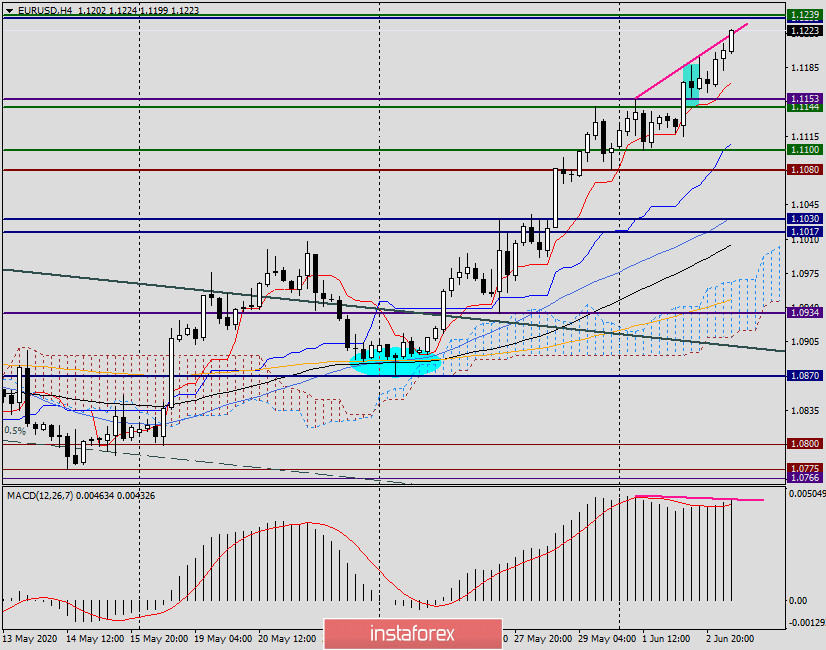

H4

But on the 4-hour chart, you can see the overbought pair, which is indicated by the bearish divergence of the MACD indicator. If a reversal pattern of candle analysis or a combination of bearish candles appears on this chart, it is worth considering opening short positions with the nearest goals in the area of 1.1165-1.1145. A more distant reference point for potential sales will be the area of 1.1130-1.1100.

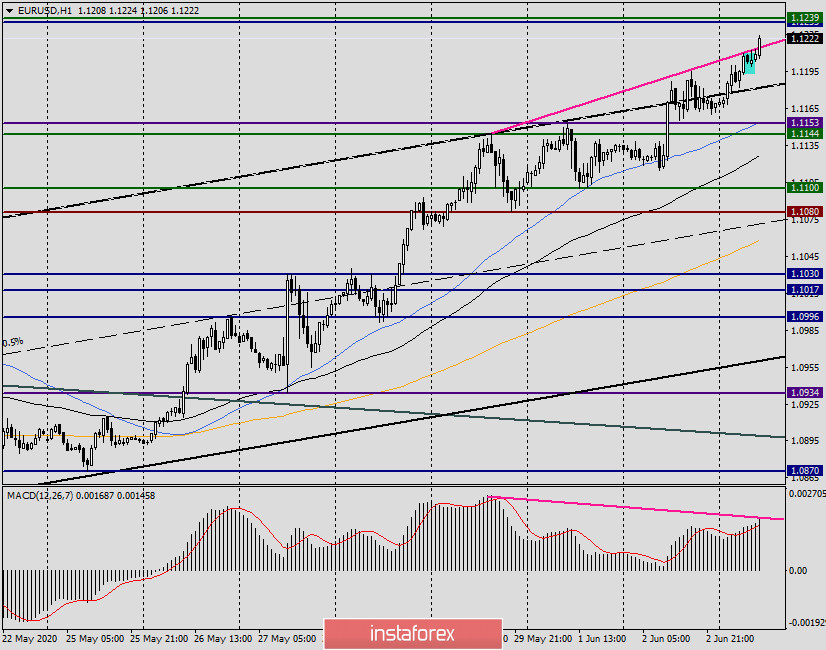

H1

The hourly chart also shows a bearish divergence of the MACD. In such cases, when divergence appears on several timeframes, the chances of its working out increase significantly. At the same time, it should be emphasized that divergence is an additional signal to open deals. For greater confidence in the upcoming correction of the pair, the appearance of appropriate candle signals is necessary. Two selected hour candles can be recognized as such, but I would like to see a third similar candle.

Conclusion and trading recommendations for EUR/USD:

Although the pair is in an upward trend, no one canceled corrective pullbacks or changes in trends. Given a fairly long rise and the strength of the price zone of 1.1200-1.1235, there is a high probability of a corrective pullback. If the corresponding signals appear in the selected price zone, we sell EUR/USD with the goals of 1.1165, 1.1145, 1.1130, and 1.1100. Since this positioning is against the current upward trend, I would like to draw your attention once again to the fact that it is advisable to open sales deals only if there are confirmation signals. As for opening long positions, for some reason, there is no special desire to buy at such prices.

From today's macroeconomic statistics, we can distinguish the composite PMI for the Eurozone and the United States, as well as data on unemployment in the Eurozone. These events may affect the price direction of EUR/USD, but I do not think that such an impact will be strong and lasting.

Good luck!