To open long positions on EURUSD, you need:

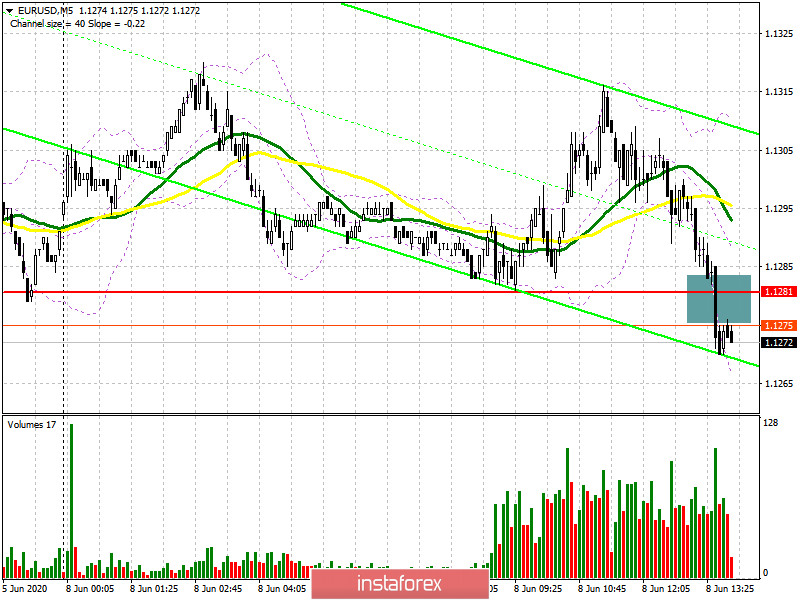

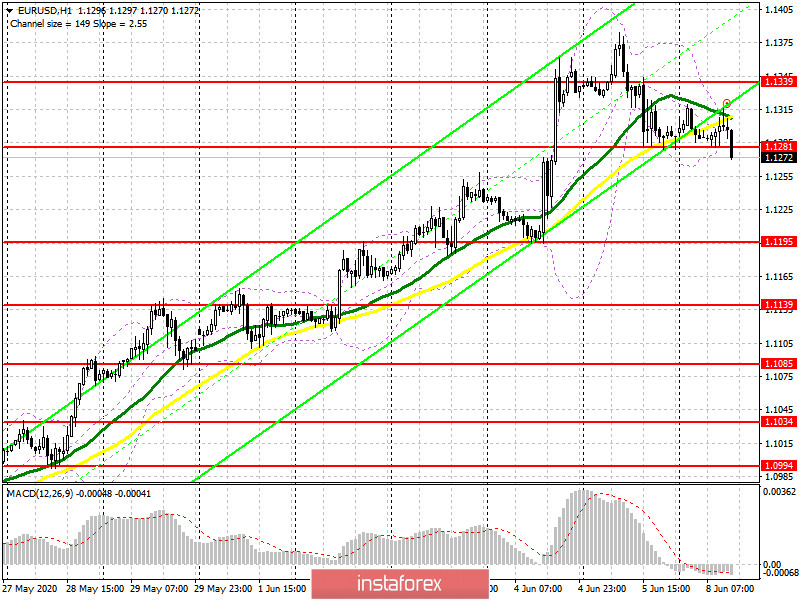

In the first half of the day, nothing has changed. Low trading volume and weaker indicators for German industrial production, which showed a decline in April this year, did not lead to any special changes in the market, leaving everything in its place. On the 5-minute chart, we see how the bears are trying to take the level of 1.1281 and gain a foothold under it. Buyers in the second half of the day need to return the price above this level, which will be a signal to open long positions in the expectation of a breakout and consolidation above the resistance of 1.1339, which will lead to larger bullish growth in the area of highs 1.1422 and 1.1459, where I recommend fixing the profits. If the pressure on the euro persists in the North American session, we can only expect a speech by the President of the European Central Bank, Christine Lagarde, who can change the situation on the market in favor of the bulls with her statements. I recommend considering long positions immediately for a rebound only after updating the major support level of 1.1195, counting on correction of 30-40 points within the day.

To open short positions on EURUSD, you need:

Bears will try to maintain pressure on the euro, and for this, they just need to stay below the support level of 1.1281 and listen to what the President of the European Central Bank, Christine Lagarde, will say. A bottom-up test on the volume of the level of 1.1281 will be a signal to open short positions in order to further reduce the pair to the area of the minimum of 1.1195, from where a large increase in the euro occurred last Thursday. The longer-term goal is the support of 1.139, where I recommend fixing the profits. If the euro rises and returns to the level of 1.1281, the bears will again need to keep the pair above the resistance of 1.1339, where the formation of a false breakout will be an additional signal to open short positions. It is best to sell EUR/USD immediately on a rebound from the new weekly resistance in the area of 1.1422, based on a correction of 25-30 points within the day.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily moving averages, which indicates that the bears are trying to continue the downward correction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

The break of the lower border of the indicator in the area of 1.1280 has not yet led to increased pressure on the euro. A break in the upper limit of the indicator at 1.1310 may bring new buyers back to the market, who expect the bull market to continue.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20