Crypto Industry News:

South Korea will allocate approximately $ 177 million to the metaverse, to finance companies and jobs in the space. Life in the virtual world is not a new concept, but only now the hype around it attracts the attention of many industries.

South Korea recently announced its intention to directly invest its money in metaverse-based companies and projects. Lim Hyesook, Minister of Science and ICT, announced the investment plan and pointed out that the virtual world combined with advanced technology has great potential.

This investment is a huge part of the Asian country's Digital New Deal, i.e. the guidelines set by the government for a smooth transition to full digitization.

Seoul is opening up to a metaverse that could become mainstream in the next few years. This move also provides other countries with an example to follow.

Investing in a metaverse is risky as you are allocating money for something unsustainable or with a value based on demand and "hype".

However, Seoul wanted to be part of the preparatory phase. Many well-known brands such as BTS and LG Electronics have joined the trend with new crypto and NFT initiatives.

Immersing yourself in the metaverse is risky due to its volatile nature. Every unexplored and destructive technology meets resistance. People are going to be somehow looking at risks more than opportunities, especially with the rise in cryptocurrency and NFT scams over the past few weeks.

Legal issues, security and privacy are the most common challenges when investing in a metaverse. However, as South Korea boldly plunges into the virtual world, it is likely that more countries will follow.

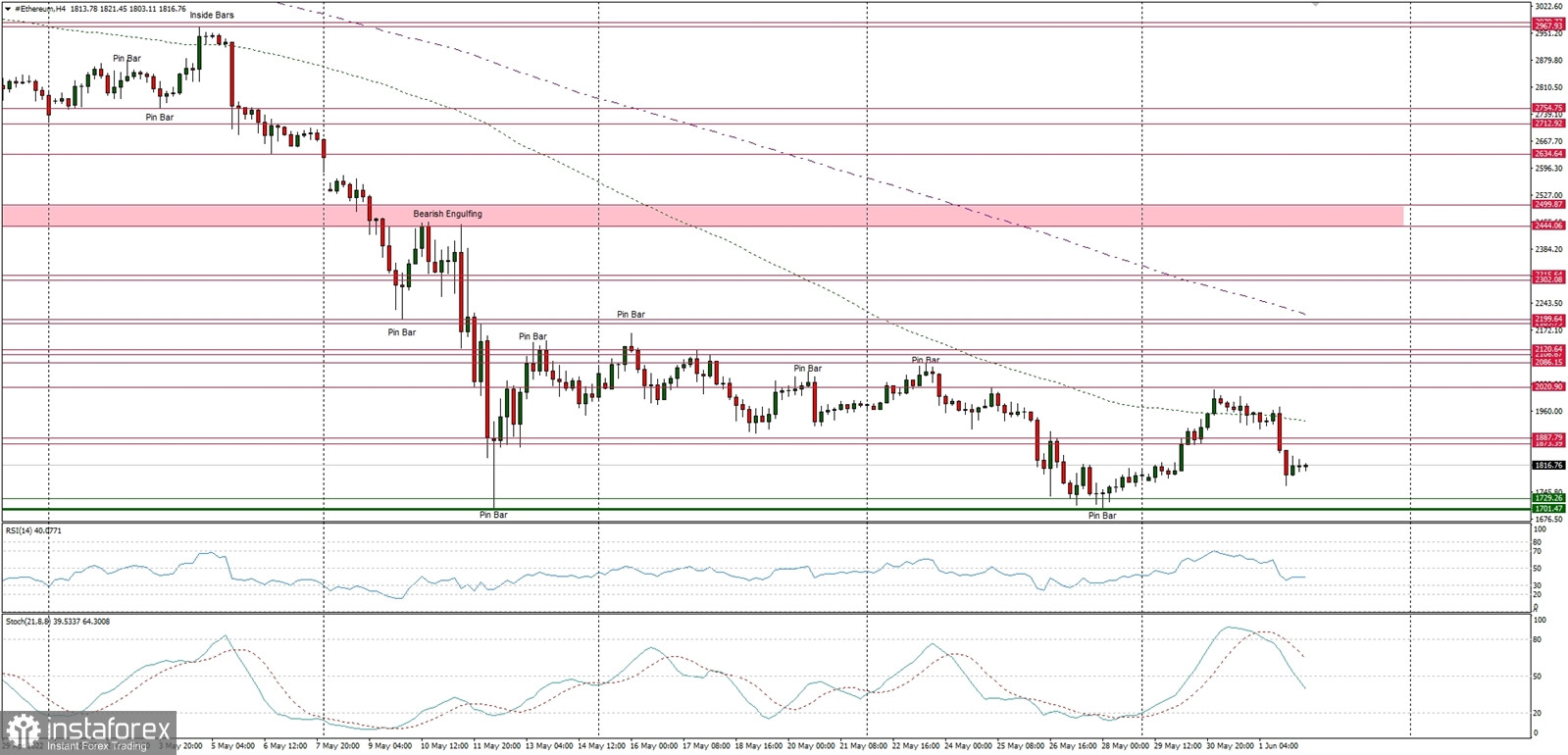

Technical Market Outlook:

The ETH/USD pair has terminated the bounce at the level of $2,014, just below the technical resistance seen at $2,019. Despite the recent efforts, the market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is still intact. In order to terminate the down trend, the bulls must break through the key short-term technical resistance located at the level of $2,199. The nearest technical support is seen at $1,729 and $1,701.

Weekly Pivot Points:

WR3 - $2,344

WR2 - $2,313

WR1 - $1,970

Weekly Pivot - $1,829

WS1 - $1,578

WS2 - $1,463

WS3 - $1,233

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.