So, the British pound continues to be under significant selling pressure, and the strong downward dynamics of the GBP/USD currency pair lasted for the third week in a row. It is characteristic that the Bank of England's decision to raise the main interest rate did not support the British currency. Moreover, on Thursday, when the British Central Bank once again raised the rate by 25 basis points, the decline in the "Briton" was especially strong. It is clear that such a BoE decision was expected, which means that it was already included in the price of the British currency. It turns out that the pound was sold in fact. However, there must be a limit to everything. Sterling did not deserve such aggressive sales. Many experts associate this market reaction with the soft rhetoric of the Bank of England. And what else can it be, if the economic situation in the UK is still far from that observed in the United States of America? There is no doubt that it is necessary to fight too high inflation by tightening monetary policy, but for such a pronounced "hawkish" attitude, which the Fed demonstrates, there must be a strong economic foundation. Namely, it is not observed in the United Kingdom, for several objective reasons. This is the main detail on which the Bank of England takes a softer or more cautious monetary policy. Friday's data on the US labor market was described in detail in today's article on the euro/dollar, so I will not repeat myself. I will only note that the April labor reports turned out to be quite ambiguous, which could not but affect the mood of traders. However, more on that later, but for now let's take a look at the weekly timeframe.

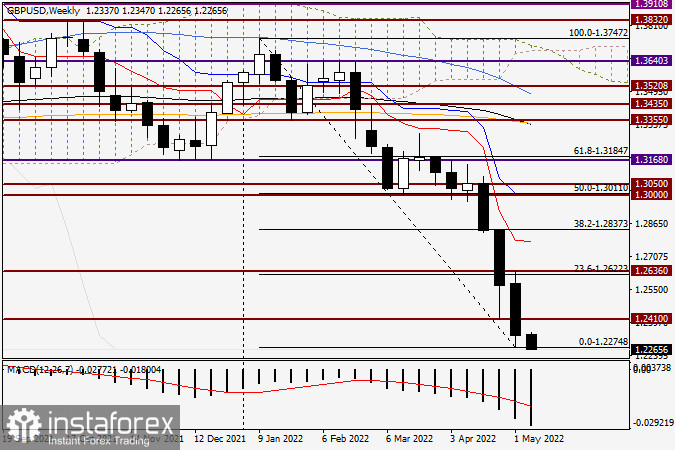

Weekly

As noted above, the pound/dollar currency pair is not just declining for the third week in a row but falling. If the trades of the last five days opened at 1.2582, then their closing price was 1.2335. At the same time, it is worth noting that the rather long lower shadow of the previous weekly candle turned out to be fake, in other words, the market simply ignored it. Another interesting and characteristic point is that, despite all its hardships, the pound remains quite technical. This can be judged by a clear pullback to the previously broken support level of 1.2636, after which sterling turned towards the breakdown and continued the downward trend. It is also necessary to pay attention that the GBP/USD bears failed to push through the strong technical level of 1.2300 at the first attempt. After reaching 1.2274, there was a slight rebound, and the pair ended trading on May 2-6 significantly above 1.2300. If we consider that 1.2250 is a very tough nut to crack, we can assume that a reversal may occur from the price zone of 1.2300 to 1.2250 to adjust the exchange rate. Looking at the grid of the Fibonacci instrument, which was stretched to a decrease of 1.3747-1.2274, the corrective pullback is not that ripe, but already overripe.

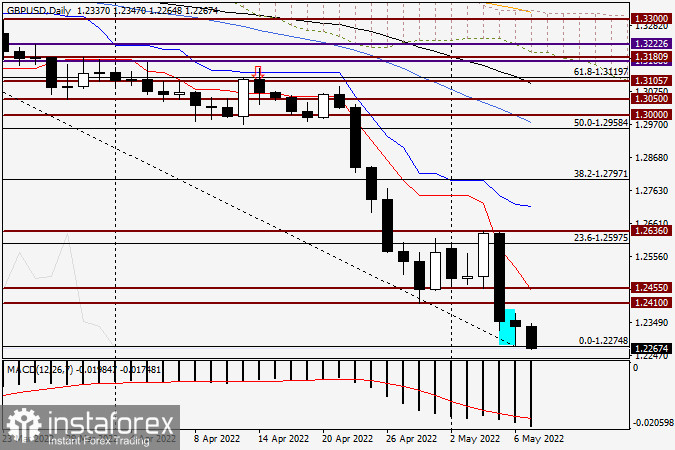

Daily

If you go back to Friday's US labor market data and the reaction of investors to them, look at the candle for May 6 and everything will become clear to you. Given its rather long lower shadow, as well as the fact that it was formed after an unsuccessful attempt to break through the strong technical level of 1.2300, this candle can well be perceived as a reversal model. If this is the case, we should expect a rollback to the two previously broken support levels of 1.2410 and 1.2450. And this is at least. Knowing the tendency of the "Briton" to deep corrective pullbacks, it is not necessary to exclude a rise to the red line of the Tenkan Ichimoku indicator, which runs at 1.2522. At the same time, a rollback will be given to the broken psychological mark of 1.2500. In the case of such a scenario, I recommend trying on potential sales of GBP/USD from the price zone 1.2400-1.2450 and (or after rising to the area 1.2500-1.2525). Despite the highlighted Friday candle, in my personal opinion, this is still not enough to open purchase deals. Given the strong pressure under which the sterling is located, it is better to wait for such a candle on the weekly chart and only after that plan options for opening long positions.