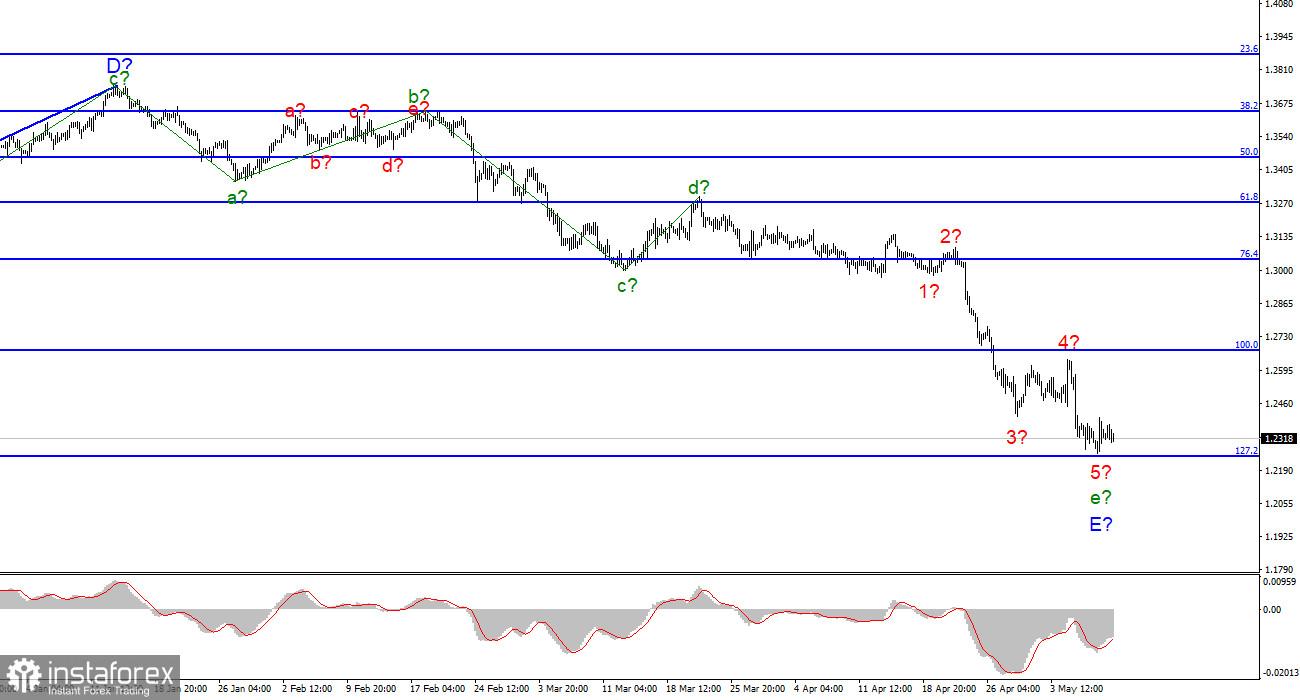

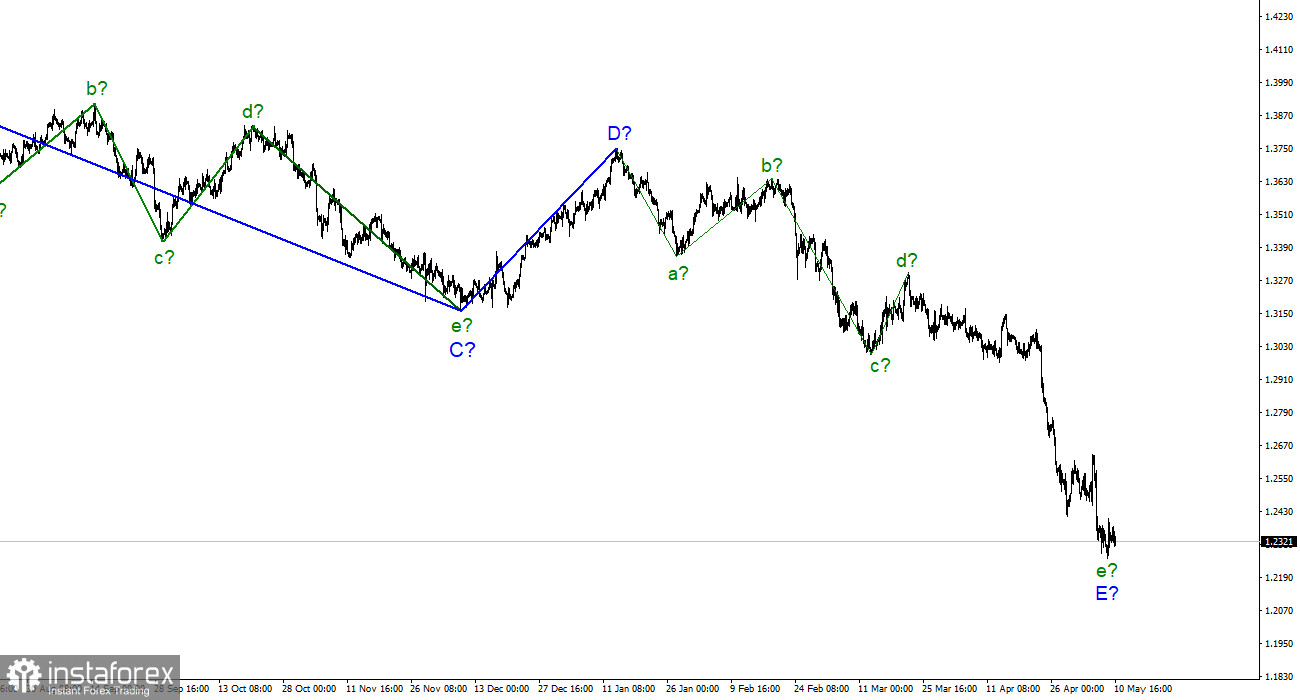

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of the wave e-E, and its internal wave marking looks quite complicated. Nevertheless, I have identified five waves inside this wave, and if my markup is correct, then wave 5, the last internal wave, is being built at this time. Thus, we get almost identical wave markings for the British and the European, each of which indicates the possible imminent completion of the downward trend section. Or everyone will have to take a much more complex and extended view, which can be facilitated by a weak news background or a complex geopolitical one. The wave 5-e-E may already be completed, and an unsuccessful attempt to break through the 1.2245 mark, which corresponds to 127.2% Fibonacci, indirectly indicates this. The meetings of the Bank of England and the Fed led to a new decline in demand for the British dollar, although their results cannot be considered "positive only for the dollar." If the current wave marking does not become more complicated, then the decline in the British dollar may end during the current week.

UK economy may slow down

The pound/dollar exchange rate did not lose or gain a single base point on May 10, and the amplitude was already much lower compared to the previous day. The news background was practically absent in the first two days of the week, so I will not talk about it. However, in the second half of the week, there will be interesting reports that will help the instrument determine whether the current downward trend section will be complicated. Tomorrow, a report on American inflation will be released, and on Thursday, a report on GDP in the UK. Market expectations are now 0.9-1.0% in the first quarter. This is lower than in the fourth quarter (1.3%). Thus, the British economy may begin to slow down, and this can be correlated with a 0.9% increase in the Bank of England rate at the last four meetings. Tightening monetary policy almost always leads to a slowdown in the economy, although central banks themselves often talk about a "neutral rate", below which there is practically no negative impact on the economy. However, in the case of the British central bank, this is not too important, since according to its forecast, inflation in 2022 will reach an astronomical 10% for the UK. To lower it, we will have to raise the interest rate more than once, which means that there will be a negative impact on the economy in almost any case. Given that the Briton is now going through far from his best times, this may put additional pressure on him. The pound can only hope that the market has already played these factors and will not pay any attention to them in the future. In this case, the entire wave marking will be almost perfect, and in the near future, the construction of a corrective, upward trend section will begin.

General conclusions

The wave pattern of the pound/dollar instrument still suggests the imminent completion of the construction of wave E. Now I still advise selling the instrument with targets located near the level of 1,1704, which corresponds to 161.8% Fibonacci, but only in case of a successful attempt to break through the level of 1,2246. From my point of view, the construction of a downward section of the trend is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it.

At the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is far from obvious. Wave E has taken a five-wave form and looks quite complete.