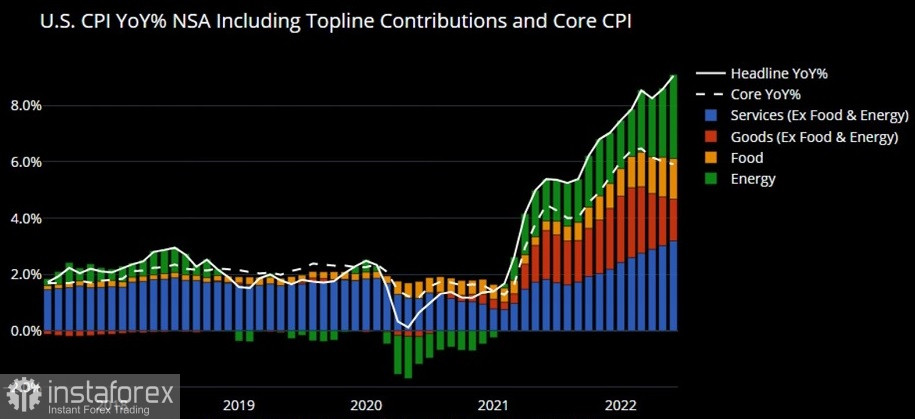

The latest CPI report shows that US inflation is still extremely high at 9.1%, a level not seen since November 1981. The US Bureau of Labor Statistics said the CPI for all urban consumers rose by 1.3%, higher than the seasonally-adjusted 1.0% increase in May.

The report mentioned that the increase was wide-ranging, and the largest contribution was made by the indices of gasoline, housing and food. Meanwhile, energy continues to be the greatest concern, with its index rising by 7.5% m/m and 41.6% y/y.

Headline inflation also increased substantially, exceeding the expectations of economists polled by the Wall Street Journal. As for the underlying CPI report, which excludes food and energy costs, there was a partial decline. The index was reportedly 0.7% higher in June, which pushed core CPI up from 6% in May to 5.9% in June. This supports the assumption that the Fed can influence core inflation but not headline inflation.

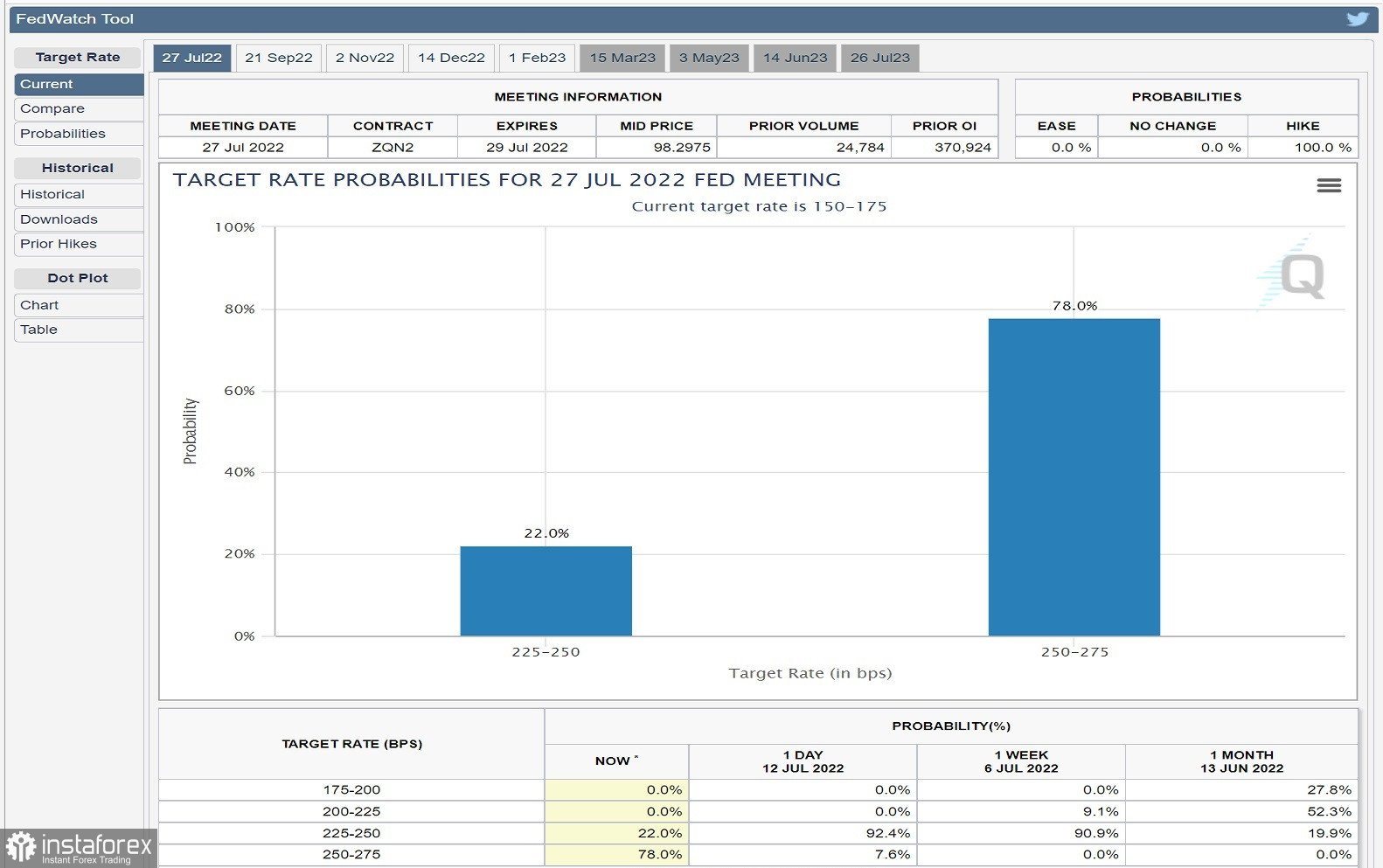

That being said, the US central bank is on track for a much bigger rate hike than expected.Yesterday, the CME FedWatch tool showed a 92.4% chance of rates increasing by 75 basis points, and a 7% chance of rates rising by 100 basis points at the next FOMC meeting on July 26-27. Today, the tool forecasts a 22% chance of a 75 basis point rate hike this month and a 78% chance of a 100 basis point increase.