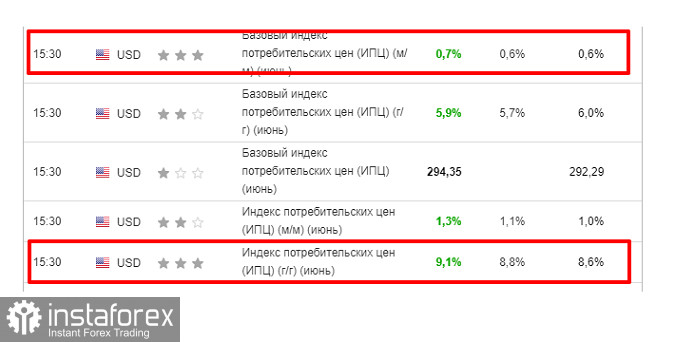

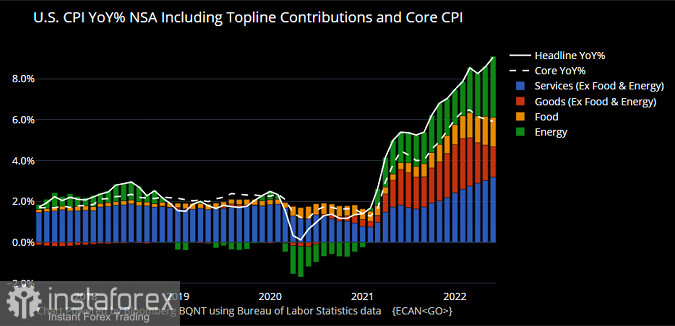

Fed officials may discuss a historic 100-basis-point rate hike as early as this month, following the latest US inflation report.

Currently, many investors believe that the central bank will raise interest rates by 1 percentage point at its July meeting, the biggest increase since the early 1990s. Many are furious at the sky-high prices, with critics blaming the Fed for its initial slow response.

Cleveland Fed President Loretta Mester said they, at the Fed, must remain cautious and focused in continuing the cycle of raising rates until there is hard evidence that inflation has turned the corner.

The US central bank has obviously become more aggressive in its fight against inflation, after being accused of showing a slow response before, which roiled financial markets and increased the risk of recession. Fed members Raphael Bostic and Loretta Mester opposed the idea of a trade-off between inflation and employment, arguing that price stability must be ensured even if it hurts the labor market.

Other Fed officials such as Christopher Waller, is scheduled to speak on Thursday, while some like Raphael Bostic and and James Bullard are scheduled on Friday.

The US central bank has clearly decided to aggressively tighten policy in order to counter the highest inflation in 40 years. They raised rates by 75 basis points last month - the biggest increase since 1994 - despite earlier signals that they were on track for a smaller half-point cut.

On another note, the USD index continues to rally after the devastating inflation report.

Andrew Hollenhorst, chief economist at Citigroup, warned that everyone should be careful about the peaking inflation.