Expectation is the root of all heartache. Shakespeare was right, and the financial markets were once again convinced of this. The S&P 500 rally on the eve of a major release on US inflation suggested that investors were seriously hoping that the slowdown in consumer prices in August would force the Fed to slow down. Nobody expected the report to be so bad. It's bad for the Fed, and therefore for everyone else. Jerome Powell and his team still have a lot of work to do to bring inflation back to the 2% target. The federal funds rate could rise to 4.5%, which is bad news for both stock indices and EURUSD.

US consumer price growth slowed to 8.3% year-on-year, but unexpectedly added 0.1% month-on-month. Experts expected more serious changes, but the biggest surprise came from core inflation. Its acceleration to 6.3% YoY and 0.6% MoM was a real revelation for the markets. The yield of 10-year Treasury bonds jumped above 3.4%, the S&P 500 marked the worst daily dynamics in 27 months, and CME derivatives gave a 35% probability of raising the federal funds rate at the FOMC meeting on September 20-21 by as much as 100 bps!

How can the US dollar not grow in such an environment? It is a win-win. The Fed will continue to tighten monetary policy, and if the economy survives the Central Bank's aggression, everyone will talk about American exceptionalism and sell EURUSD. If it fails and plunges into a recession, they will still buy the dollar, but as a safe-haven currency.

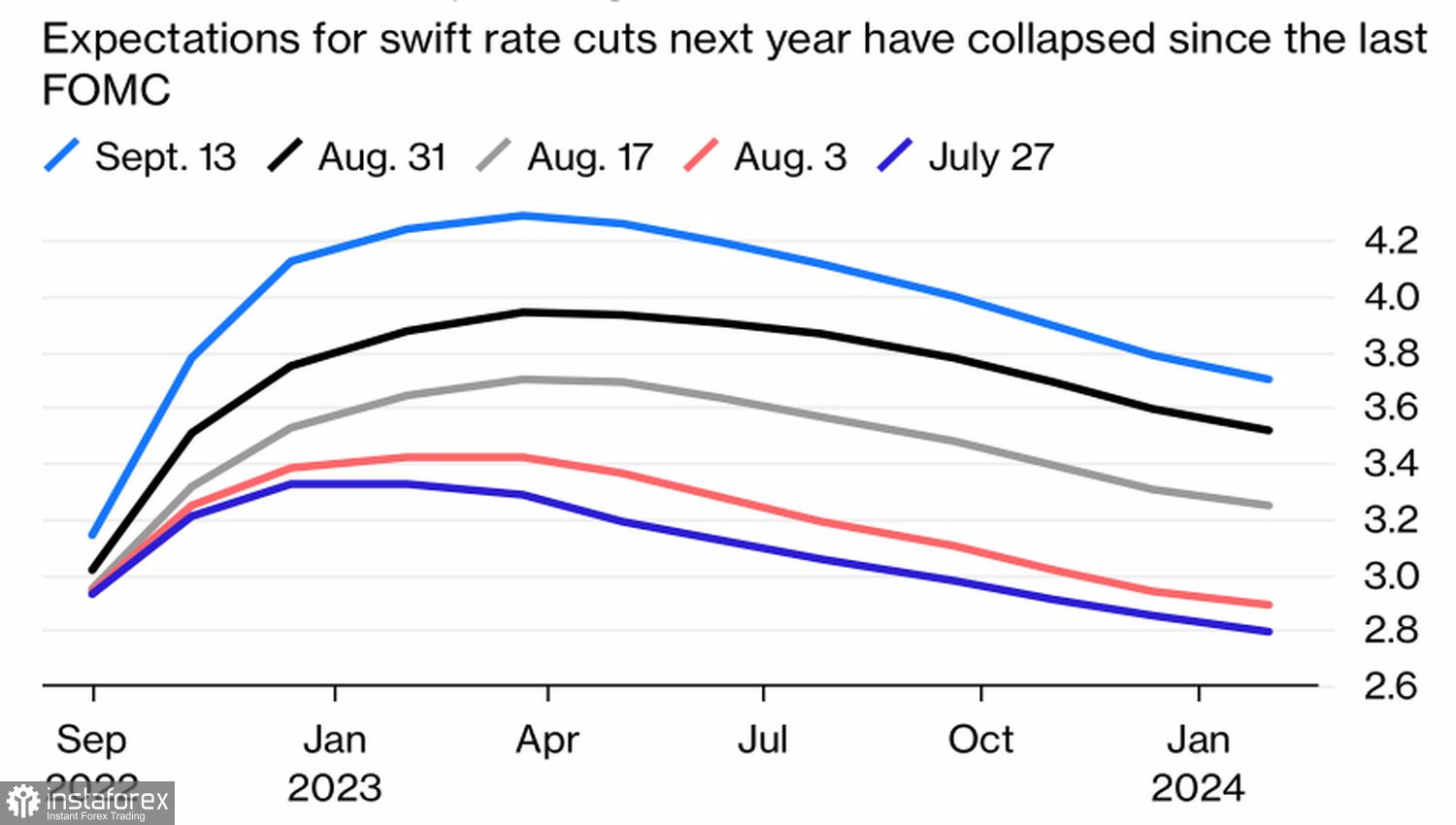

Currently, the Fed-ECB rate differential is 175 bps. According to a Reuters insider, the European Central Bank is going to bring borrowing costs to a neutral level of 2%, which does not stimulate or cool the economy. The federal funds rate, according to the derivatives market, will rise to 4.3% in 2023, that is, the spread will increase to 223 pp. This means only one thing—the potential of the downward movement of EURUSD is far from being revealed. The pair has room to fall!

Dynamics of market expectations for the Fed rate

Such a wide move as 100 bps at the September FOMC meeting may be unlikely. If it were the Fed, the markets would think it was panicking about inflation. Another thing is forecasts. Previous estimates suggest that the federal funds rate will not rise above 4%. The new ones will certainly show its growth to 4.25%, if not 4.5%. And this will be enough for stock indices to continue to fall, Treasury yields to rise, and the US dollar to strengthen.

How can the euro respond? Nothing before the FOMC meeting. After—perhaps, but the Italian elections to the parliament, on the contrary, can worsen the position of the euro.

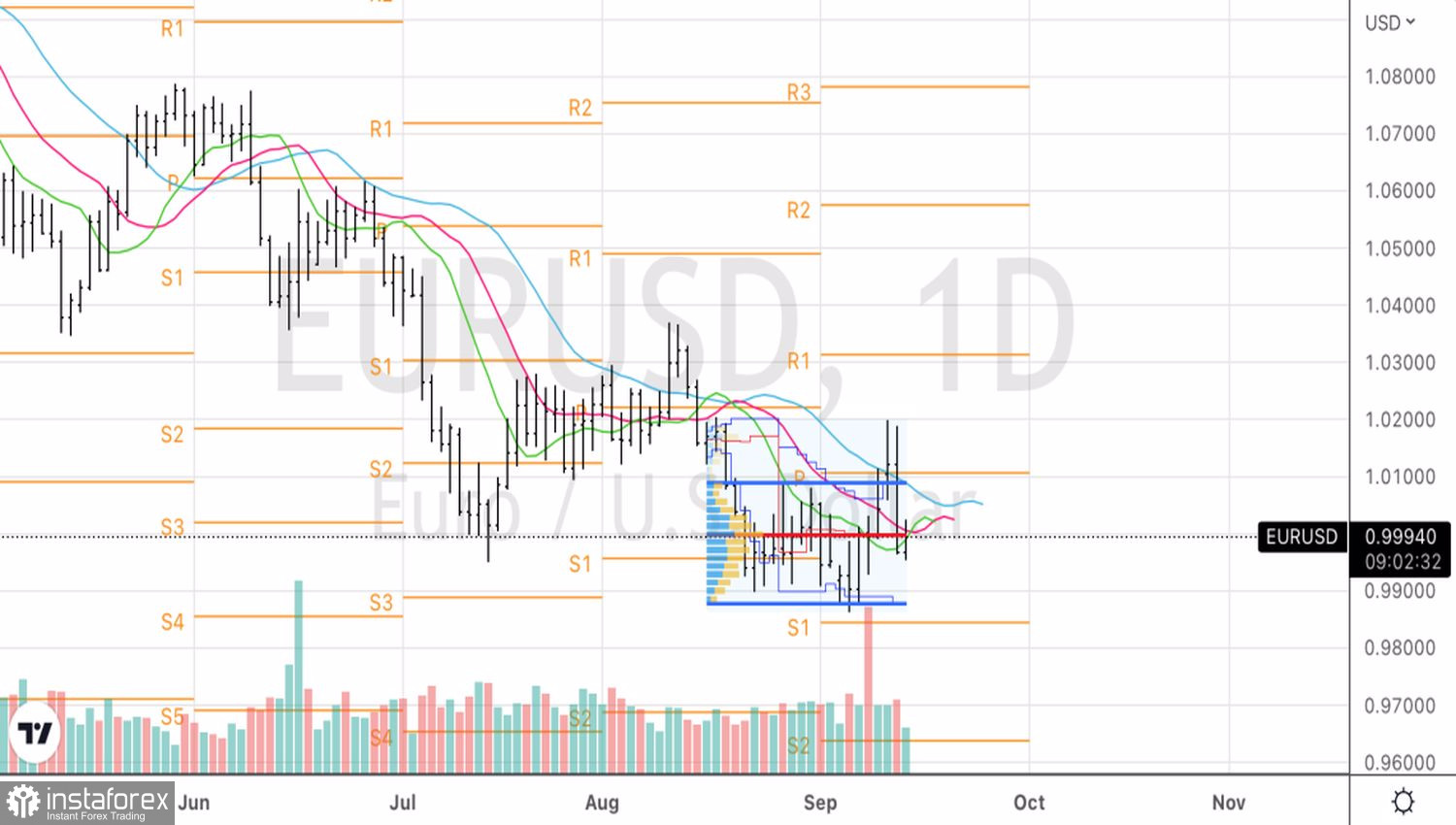

Technically, on the daily chart of EURUSD, a false breakout pattern has formed. Any close below fair value in the parity area, which is also near the middle of the 0.988–1.009 trading channel, is a selling signal in the direction of at least 0.97.