Oil prices were extremely volatile on Monday: briskly rising in the morning hours, then falling in the afternoon and steadily rising again in the evening. And all this against the backdrop of the news about the Keystone pipeline and signals from China.

But the forthcoming meetings of the world's biggest central banks, including the Federal Reserve, the European Central Bank and the Bank of England did not play the least role in the volatility of quotes.

Brent crude futures were $77.68 per barrel by 6:33 p.m. London time, which was 2.08% higher than the close price of the previous session. The price of West Texas Intermediate crude climbed by 2.65% up to $72.94 during the electronic trading on the New York Mercantile Exchange (NYMEX).

Brent was down 11.1% last week, while WTI dropped 11.2%. Both contracts ended trading at their lowest levels since December 2021. This was due to the fact that the information about the excess of cheap Russian oil, which is still not in demand on the European market, was played out. Europeans are still not presenting an increased demand for alternative supplies, which determined the fall in prices. This skew may be temporary, but it is worth considering the current weakness of the European economy, which is already affecting demand.

Investors are clearly afraid that with the continued high level of business activity in the U.S. and at the same time high inflation, the Federal Reserve will decide to maintain a tight monetary policy in the country as long as possible and will not rush to reduce rates. It is obvious that such tactics will have a negative impact on economic growth both in the United States itself and in the whole world. Analysts do not rule out the possibility that the strategy of keeping interest rates high could lead to a global recession, i.e. a significant drop in production and slower economic growth. It is clear that this unhappy state of affairs in the world will reduce the global demand for fuel.

The easing of quarantine restrictions in China after the mass protests gave hope for the restoration of the former economic growth rates in China and, accordingly, the increase in demand for oil. After all, China is almost the main oil consumer in the world. And you could already start clapping your hands, but official data on COVID-19 in China still draws unfortunate figures – allegedly the virus continues to grow. Experts of the consulting company FGE are extremely pessimistic and warn not to rush to conclusions, as Beijing may well resume strict restrictions.

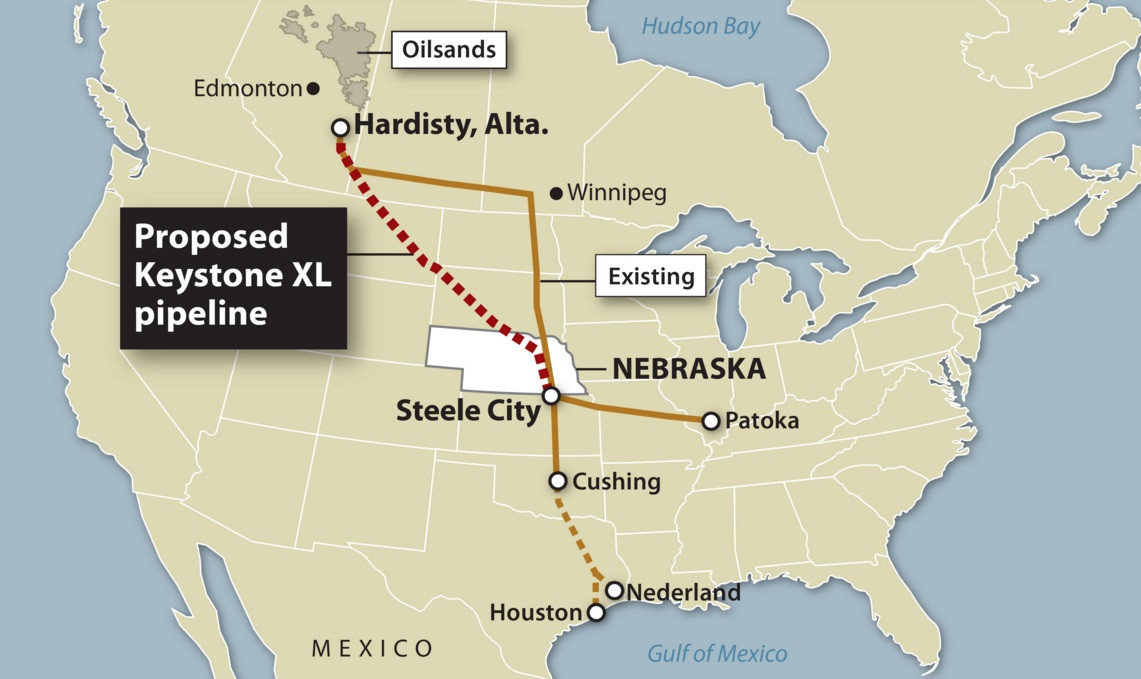

Experts are also trying to assess the possible consequences of the shutdown of the Keystone pipeline, which connects oil fields in the south of Canada and oil refineries on the Gulf coast of Mexico in the US. Canada's TC Energy suspended operation of the pipeline last week and now says it's continuing troubleshooting work, but hasn't specified when it will finally resume pumping oil. And this uncertainty undoubtedly weighs on quotes, because all 620,000 bpd have stopped coming into the US, which means that a local deficit is being created. With this in mind, prices for US WTI crude are getting tangible support.

Meanwhile, the number of active oil rigs in the US fell by 2 units to 625 last week. That is, the indicator fell for the first time in six weeks.

The EIA analysts in their latest commodities report raised their outlook on global inventories while lowering their estimate of next year's average Brent price by $3/bbl. Obviously, this does not add to the optimism. OPEC will present an updated market view on Tuesday and the IEA on Wednesday. If the forecasts turn out to be negative, a surge of sell-off sentiment will not be long in coming.