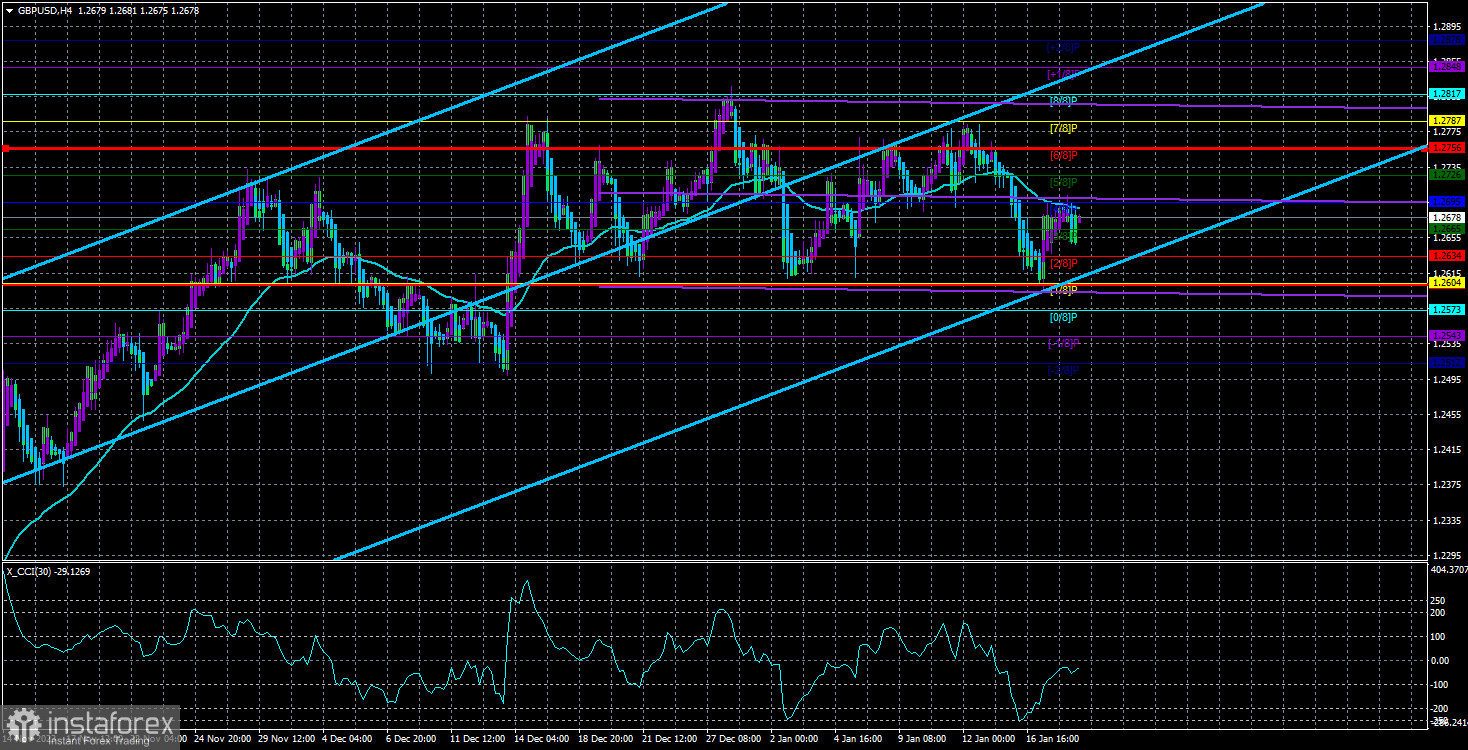

The GBP/USD currency pair continued to correct upward on Thursday, following another rebound from the level of 1.2604 seen the day before. This was the fourth or fifth rebound from this level, which acts as the lower boundary of a sideways channel that the pair has been in for over a month. Thus, the technical picture for the pound remains unchanged. The market still stubbornly refuses to sell the pound, probably anticipating a more aggressive monetary policy from the Bank of England than from the Fed. Well, there is some truth to that, but are there other reasons for the pound to remain so high? And does the pound have a future in 2024?

The fact that inflation in the UK is higher than in the US or the EU is evident. Thus, we must admit that the market does have valid reasons to refrain from selling British currency at the moment. With the current level of inflation, the Bank of England can keep the rate at its maximum for several more quarters. However, will the British economy, which has been stagnant for over a year, allow it to do so?

We believe that in the case of the Bank of England, the state of GDP is as important as the state of inflation. If the interest rate in Europe is 4.5%, then in the UK, it is 5.25%. This means that the monetary policy pressure on the economy in Britain is much stronger. And its economy has been facing serious problems since 2016 when the country decided to leave the European Union. High inflation is certainly bad, but what will happen if the economy starts to show negative values quarter after quarter?

We believe that the Bank of England will eventually be forced to ease its monetary policy, regardless of consumer price levels. When that moment will come, it's hard to say again, but we don't believe that the Fed will hypothetically cut rates five times in 2024 while the Bank of England only cuts them twice.

If so, then the pound is currently supported from falling by traders' optimism. Perhaps they are right in assuming that the BoE will start cutting rates later than the Fed, but what will happen when the British regulator also begins to ease? For now, the US dollar is out of favor in the market, but it cannot continue to fall on the same factor indefinitely.

When the Bank of England begins to signal its readiness to start a rate-cutting cycle, the pound will also start to decline. Otherwise, we will have to acknowledge another illogical rise of the pound, as it would imply that the market is buying the pound based on expectations of rate cuts by both the Fed and the BoE.

However, at the moment, all of this is not too important because the pound is in a sideways channel. As long as it doesn't break out of it, it doesn't matter what rhetoric the Fed or the Bank of England adopts or when the market expects the first rate cuts in the UK and the US. The fact remains that the pound may currently be trading at a high level based on all the information mentioned above, but it is unlikely to remain there for a long time. The British economy is much weaker than the American one, and the downward trend that began on July 14th of last year has not been canceled.

So, we can only wait for the GBP/USD pair to exit the sideways channel and indicate in which direction it intends to move soon. If it goes up, it will be another illogical segment of the trend. If it goes down, it will be natural.

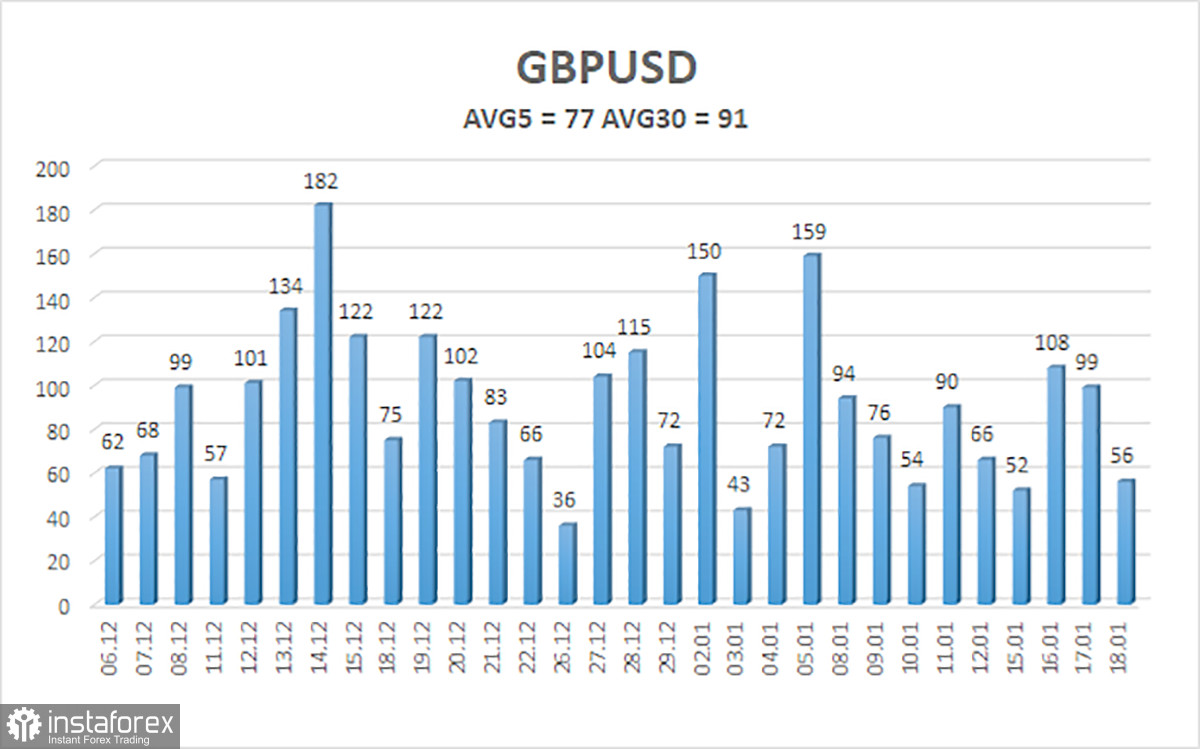

The average volatility of the GBP/USD currency pair over the last 5 trading days as of January 19th is 77 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, January 19th, we expect movement within the range between 1.2602 and 1.2756. A reversal of the Heiken Ashi indicator downward will indicate a new attempt to start a downward trend.

Nearest support levels:

S1 - 1.2665

S2 - 1.2634

S3 - 1.2604

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2726

R3 - 1.2756

Trading recommendations:

The GBP/USD currency pair remains below the moving average, so it has a chance for another return to the lower boundary of the sideways channel at 1.2610. We still find it difficult to consider buying the British pound at this time, as its rise is illogical. We believe it is more advisable to consider short positions with targets at 1.2634 and 1.2604. However, this week, the price rebounded from the infamous level of 1.2610 for the fifth time, so there are grounds to expect a rise to the level of 1.2787 (the upper boundary of the sideways channel) as well. The price is in a flat and moves accordingly.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are pointing in the same direction, it means the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel where the pair will move over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates that a trend reversal in the opposite direction is approaching.