On Friday, the GBP/USD pair also traded higher, but the movement was almost vertical. It might seem that such a movement was triggered by important news and events, but in reality, three reports were published on Friday. The retail sales report was released in the UK, which matched forecasts. In the U.S., reports on building permits and consumer sentiment came out. We believe everyone understands that these are not the most critical indicators, and in two out of three cases, the report values did not suggest a significant decline in the dollar.

Nevertheless, the pound began to rise even at night and gained about 100 pips throughout the day. This was one of those rare cases where the opening price was the day's low, and the closing price was the day's high. In other words, the pair moved up all day without exception.

We have discussed the reasons behind the pound's unfounded rise many times before. There are a few reasons, and they are not strong enough to cause such a dramatic increase. The market recently reacted to rather mediocre U.S. inflation reports with strong selling, and on Friday, it was hard to explain why the pound was rising. As we can see, the market again uses any formal opportunity to buy the pound.

Therefore, the fundamental and macroeconomic backgrounds in the upcoming week will not be significant. What difference do the reports make if the market interprets any of them in favor of the British pound? Of course, the pound does not fall constantly; corrections do happen, but it should be the other way around! The Bank of England has started easing monetary policy, so there are more reasons for the pound to fall.

Next week in the UK, we can only highlight the business activity indexes in the manufacturing and services sectors for August and a speech by BoE Governor Andrew Bailey. These are interesting events but unlikely to influence market sentiment drastically. Only Bailey might provide new information, particularly about the central bank's willingness to lower rates for the second consecutive time in September. However, the market is only interested in the Federal Reserve's rate and it has already managed to reduce it about five times instead of the Fed.

In the U.S., there will also be a few important events. On Wednesday, the minutes of the last Fed meeting will be published, which did not involve any significant decisions. On Thursday, the business activity indexes for August will be released. On Friday, Fed Chairman Jerome Powell's speech will again be examined "under a microscope." More precisely, the market will look for any dovish hints in Powell's speech. Any phrase from the Fed chair indicating a possible rate cut in September could provoke a new decline in the American currency. The market continues to react to the same yet-to-be-realized event time after time.

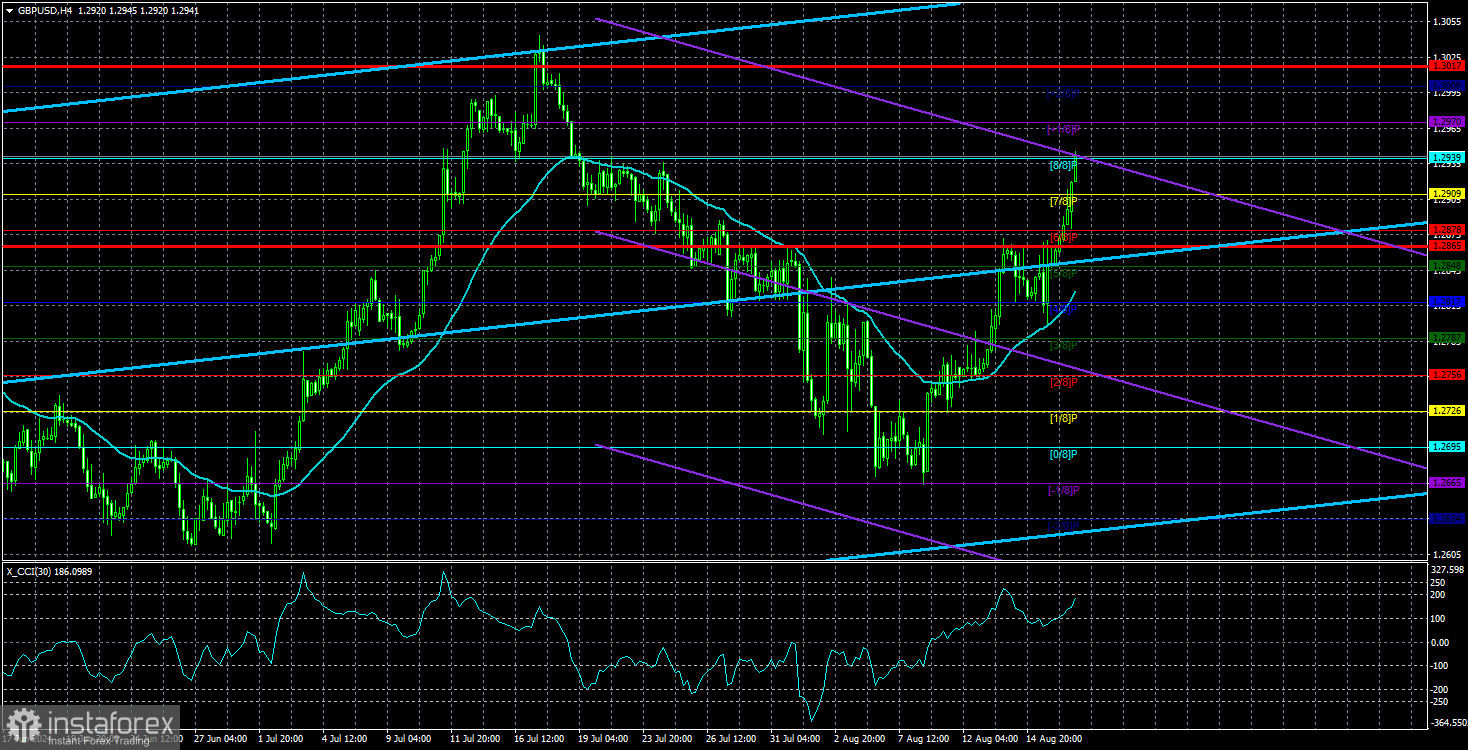

From a technical standpoint, the price is above the moving average line, so there are no grounds to expect the end of the upward movement at this time. We assume that the pound is going through a correction, as the preceding decline was more substantial. However, betting on a decline in the British currency in 2024 could be costly.

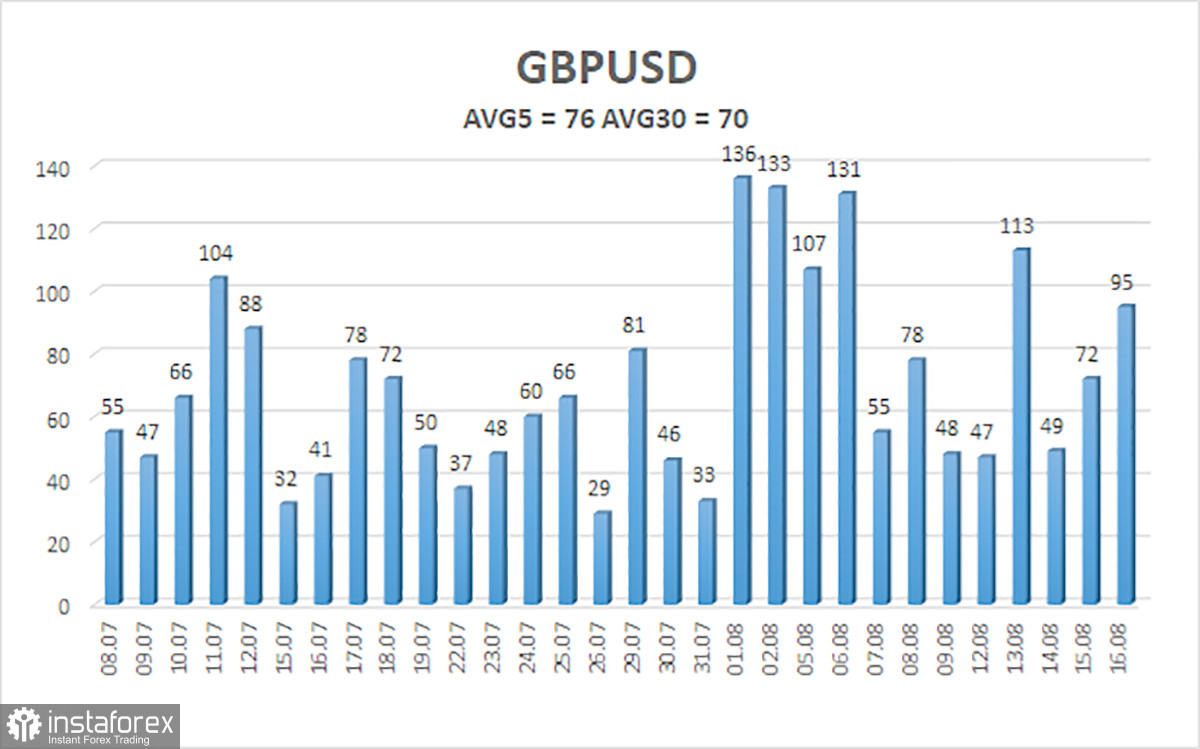

The average volatility of GBP/USD over the last five trading days is 76 pips. This is considered an average value for the pair. Therefore, on Monday, August 19, we expect movement within the range limited by 1.2865 and 1.3017. The upper channel of the linear regression is directed upward, indicating the continuation of the upward trend. The CCI indicator may soon enter the overbought zone again.

Nearest Support Levels:

- S1 – 1.2909

- S2 – 1.2878

- S3 – 1.2848

Nearest Resistance Levels:

- R1 – 1.2939

- R2 – 1.2970

- R3 – 1.3000

We recommend checking out other articles by the author:

Review of EUR/USD on August 19; Preview of the week. A boring week and the euro's final blitzkrieg

Trading Recommendations:

The GBP/USD pair continues its illogical rise but retains good chances for a resumption of the downward momentum. We are not considering long positions at this time, as we believe that the market has already addressed all the bullish factors for the British currency (which are not much) several times. Short positions could be considered at least after the price consolidates below the moving average. For now, the current rise in the pair can be viewed as a correction, which means there are prospects for the British currency to decline below the last low of 1.2665.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.