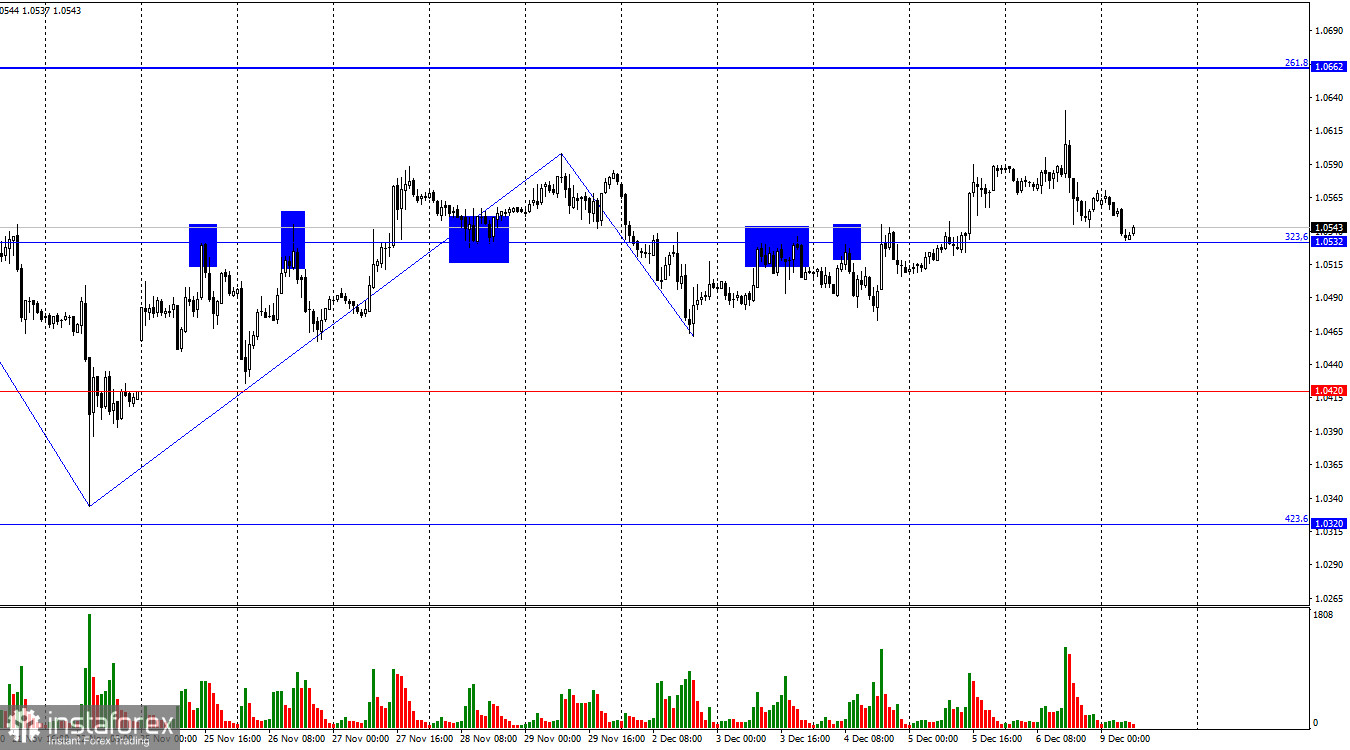

The wave structure raises no questions. The last completed downward wave did not breach the previous low, while the last upward wave broke the previous peak. This suggests the formation of a bullish trend, which, in my view, appears unconvincing—possibly a correction or manipulation. Bulls have lost market initiative and have yet to regain it. A break below 1.0461 would invalidate the bullish trend.

Friday's information background was strong, though the key reports arrived in the second half of the day. The unemployment and labor market reports provided mixed signals. While unemployment rose, the Nonfarm Payrolls figure exceeded trader expectations. The market response showed that Nonfarm Payrolls data carried more weight, as evidenced by the U.S. dollar's rally.

This increases the likelihood that the Federal Reserve might keep interest rates unchanged at its upcoming FOMC meeting. While the chances are low, hawkish expectations are gaining traction. If bears consolidate below the 1.0532 level today, it could indicate their readiness to begin a new bearish trend. However, bulls have not fully retreated, though they lack the strength for a strong trend. Any resumption of growth is unlikely to be significant. This week, the ECB meeting could drive high volatility.

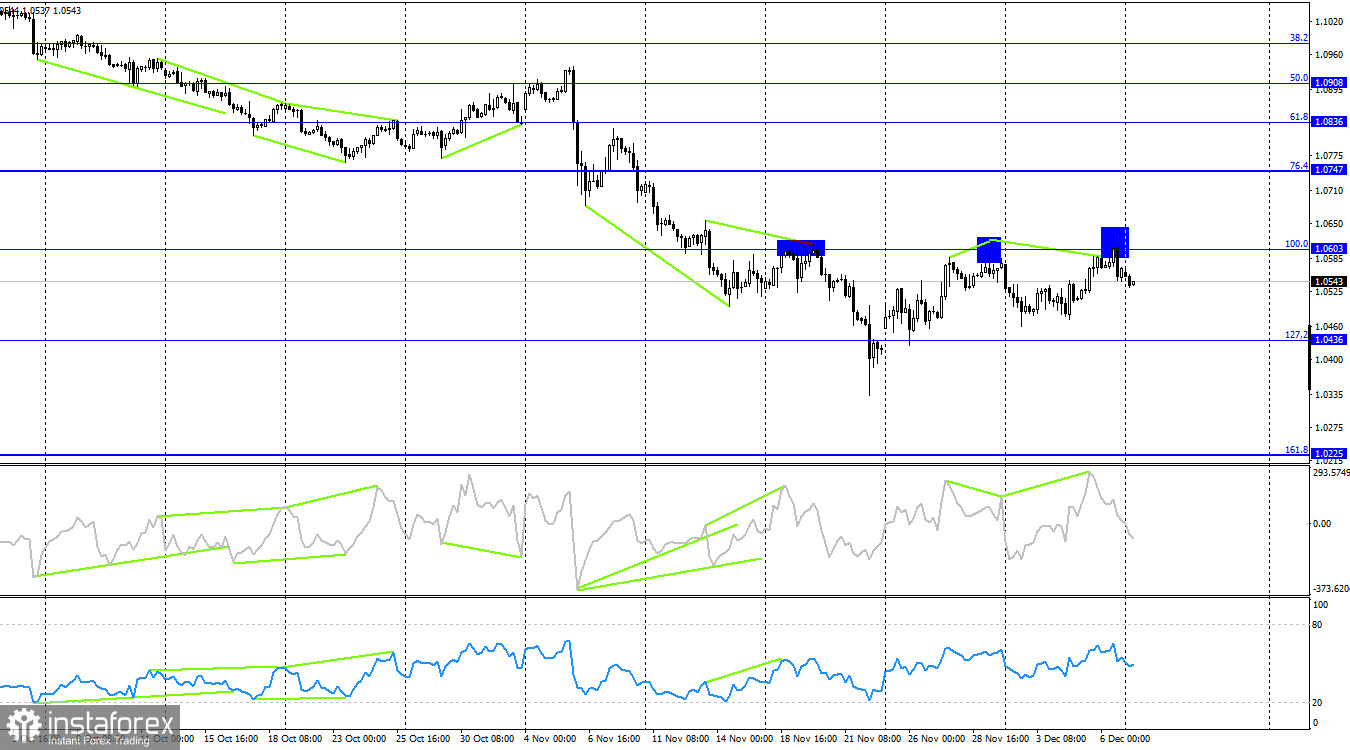

On the 4-hour chart, the pair returned to the 100.0% Fibonacci retracement level at 1.0603. A second rebound from this level favored the U.S. dollar, initiating a decline toward the 127.2% Fibonacci level at 1.0436. A bearish divergence has already formed on the CCI indicator. Consolidation above 1.0603 would suggest further growth for the euro toward the next retracement level at 76.4%, or 1.0747.

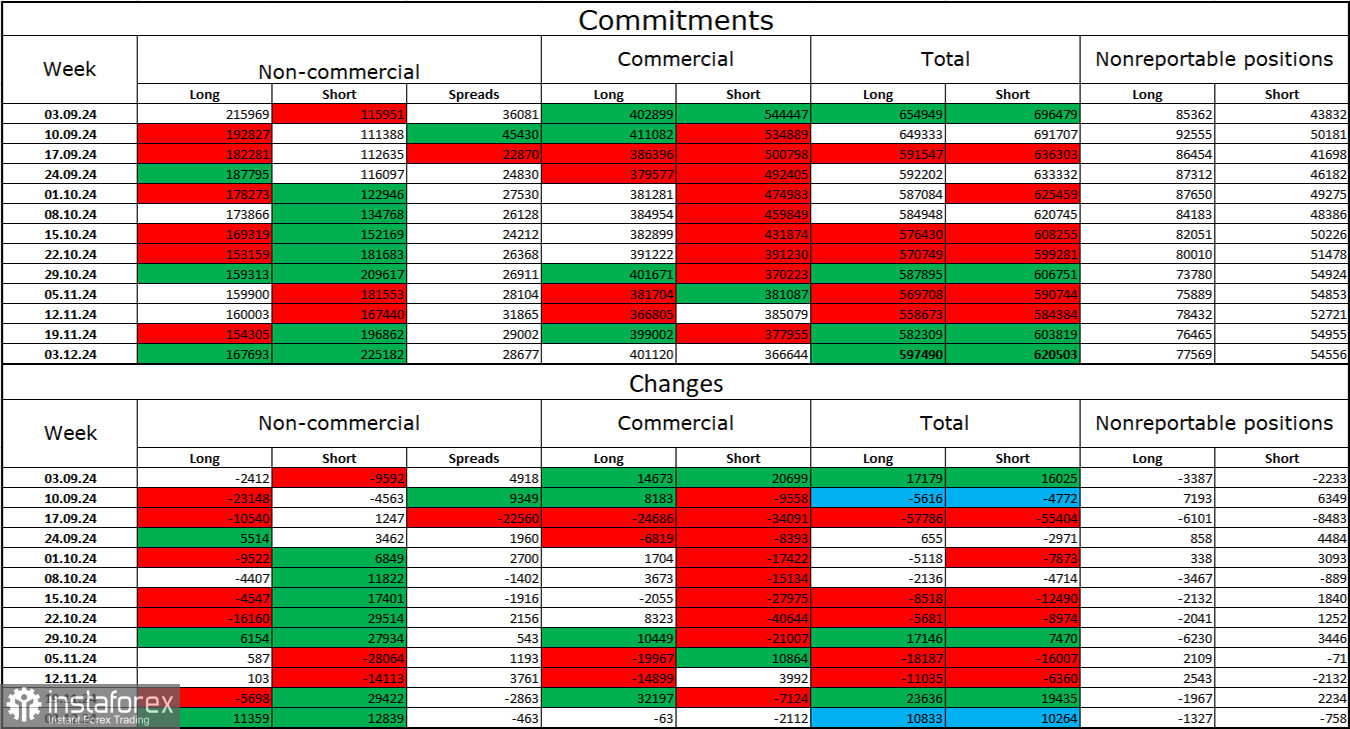

Commitments of Traders (COT) Report

During the last reporting week, speculators opened 11,359 long positions and 12,839 short positions. The sentiment among the "Non-commercial" group remains bearish, suggesting further decline for the pair. The total number of long positions held by speculators is now 168,000, while short positions total 225,000.

For twelve consecutive weeks, major players have been reducing their exposure to the euro. This indicates the formation of a new bearish trend. The key driver for the dollar's decline—expectations of FOMC monetary policy easing—has already played out. The market no longer has compelling reasons to sell off the dollar massively, though new factors could emerge over time. For now, the dollar's strength remains the more likely scenario. Graphical analysis also supports the onset of a long-term bearish trend, suggesting a prolonged decline for the EUR/USD pair.

Economic Calendar for the U.S. and EurozoneOn December 9, the economic calendar lacks any notable entries. The information background will have no significant impact on market sentiment today.

Forecast and Trading Tips for EUR/USDNew short positions could have been opened after a rebound from the 1.0603 level on the 4-hour chart, targeting 1.0420 and 1.0320. These positions can now be held, awaiting a close below the 1.0532 level on the hourly chart. Long positions may be considered after a rebound from the 1.0532 level on the hourly chart, accompanied by closing short positions.

Fibonacci levels are plotted from 1.1003 to 1.1214 on the hourly chart and from 1.0603 to 1.1214 on the 4-hour chart.