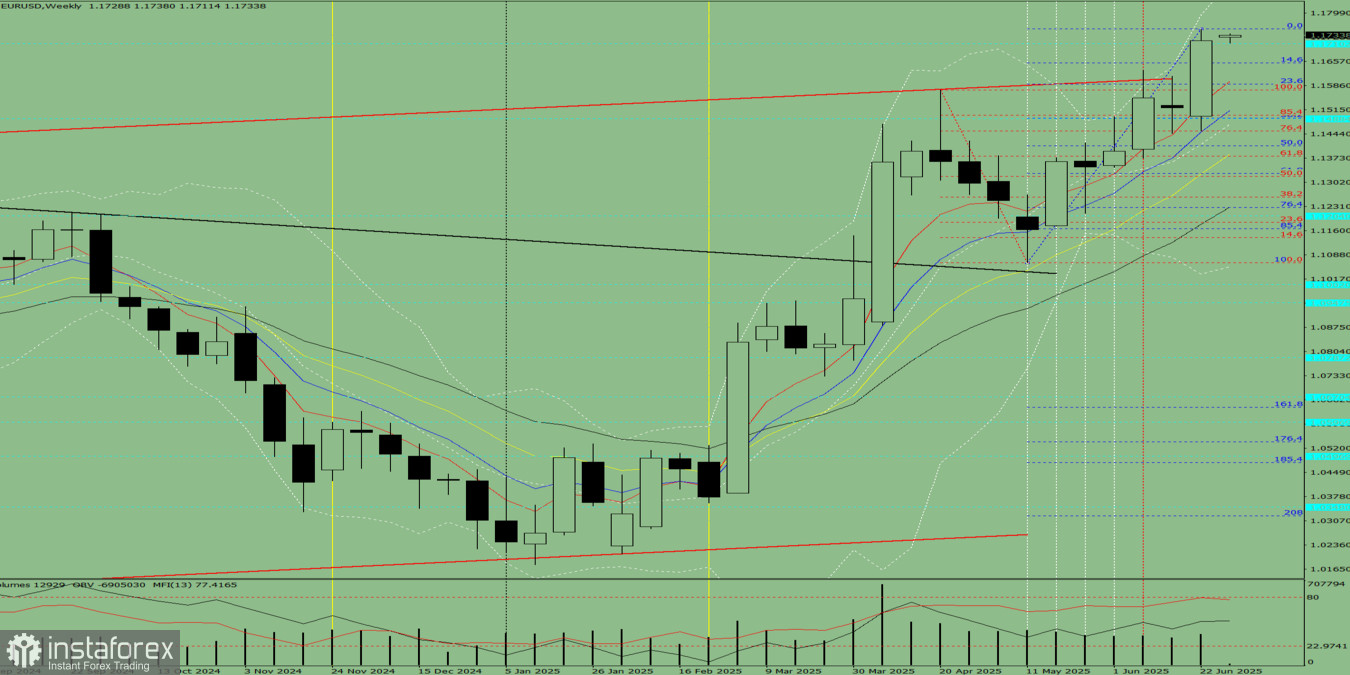

Trend Analysis (Fig. 1)

This week, the market may start declining from the 1.1718 level (the closing of the last weekly candle), targeting 1.1652 — the 14.6% retracement level (blue dashed line). Upon testing this level, the price may reverse upward toward 1.1709 — the historical resistance level (blue dashed line).

Fig. 1 (Weekly Chart)

Comprehensive Analysis:

- Indicator analysis – downward

- Fibonacci levels – downward

- Volume – downward

- Candlestick analysis – downward

- Trend analysis – downward

- Bollinger Bands – downward

- Monthly chart – downward

Conclusion based on comprehensive analysis: downward movement

Overall Weekly Candle Outlook for EUR/USD (Weekly Chart):

The price is most likely to exhibit a bearish trend throughout the week, with no upper shadow on the weekly black candle (indicating downward movement on Monday), and a lower shadow appearing by Friday (indicating a potential upward move at the end of the week).

Alternative Scenario:

From the 1.1718 level (closing of the last weekly candle), the pair may begin a downward movement toward 1.1590 — the 23.6% retracement level (blue dashed line). Upon testing this level, the price may rebound upward toward 1.1652 — the 14.6% retracement level (blue dashed line).