Trade Analysis and Recommendations for the Euro

The price test of 1.1575 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro. The second test of 1.1575 coincided with a moment when the MACD was oversold, which allowed scenario #2 for buying euros to play out. However, the pair failed to rise, resulting in closing the position with a loss.

The unexpected decline in Germany's retail sales by 0.3%, compared to the expected increase of 0.2%, caused a noticeable drop in the EUR/USD exchange rate in the first half of the day. This negative data further heightened investor concerns about slowing economic growth in the eurozone. Combined with the pause in the European Central Bank's interest rate-cutting cycle, this factor had a significant impact on the single European currency.

The absence of major economic news from the United States in the second half of the day, as well as silence from Federal Reserve representatives, gives markets a chance to offset the morning decline observed during the European trading session. Traders may take advantage of the lull in the news flow to buy back the recent drop in the euro. However, fundamental factors — such as the overall condition of the eurozone economy and expectations regarding future ECB policy — will continue to influence the dynamics of the currency pair.

As for the intraday strategy, I will rely primarily on scenarios #1 and #2.

Buy Signal

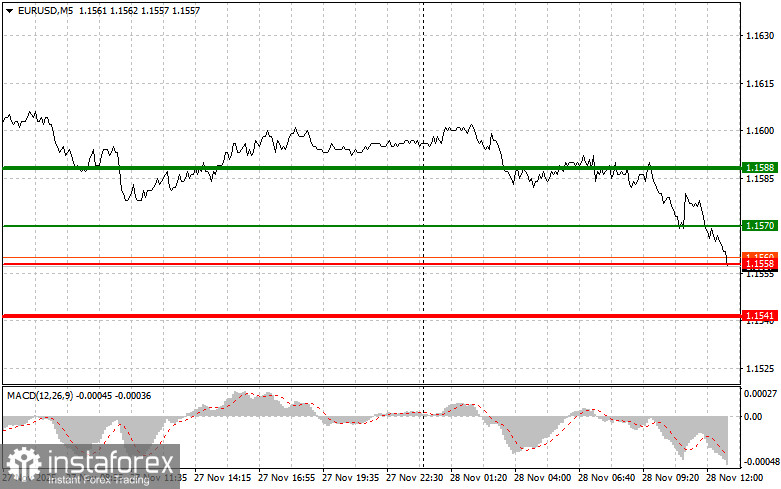

Scenario #1: Today, you can buy euros when the price reaches the level of 1.1570 (green line on the chart), aiming for growth to 1.1588. At 1.1588, I plan to exit the market, and also sell euros in the opposite direction, expecting a movement of 30–35 points from the entry level. Counting on a strong rise in the euro today is unlikely. Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy euros today if the price 1.1558 is tested twice in a row at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth to the opposing levels of 1.1570 and 1.1588 can be expected.

Sell Signal

Scenario #1: I plan to sell euros after the price reaches 1.1558 (red line on the chart). The target is 1.1541, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25-point movement back from the level). Continued pressure on the pair today is unlikely. Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell euros today if the price 1.1570 is tested twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline to the opposing levels of 1.1558 and 1.1541 can be expected.

What's on the chart:

- Thin green line – entry price at which the instrument can be bought

- Thick green line – estimated price for setting Take Profit or manually taking profit, as further growth above this level is unlikely

- Thin red line – entry price at which the instrument can be sold

- Thick red line – estimated price for setting Take Profit or manually taking profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important

Beginner Forex traders must make market-entry decisions with great caution. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit — especially if you don't use money management and trade large volumes.

And remember: successful trading requires having a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.