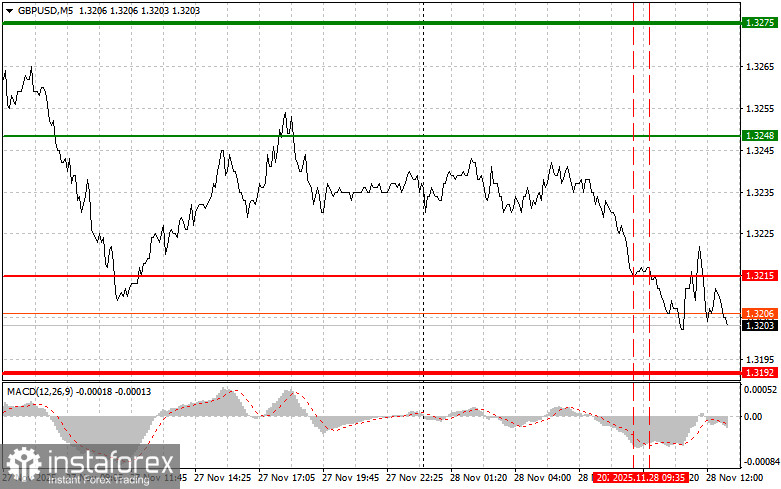

The price test of 1.3215 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound. The second test of 1.3215 coincided with a moment when the MACD was oversold, which allowed scenario #2 for buying the pound to play out. However, the pair failed to rise, resulting in closing the position with a loss.

The pound continued to decline amid the absence of U.K. statistics. After the morning pressure, the lack of internal catalysts left the British currency vulnerable to the overall negative market sentiment. Traders, lacking domestic guidance, focus on global uncertainty factors, which puts additional pressure on the pound. Considering that there are no major U.S. data releases in the second half of the day either, the GBP/USD pair could fall even further. The most likely scenario appears to be a continued decline in GBP/USD in search of new support levels. However, it is also important to consider technical factors that may limit the pair's downward potential.

As for the intraday strategy, I will rely primarily on scenarios #1 and #2.

Buy Signal

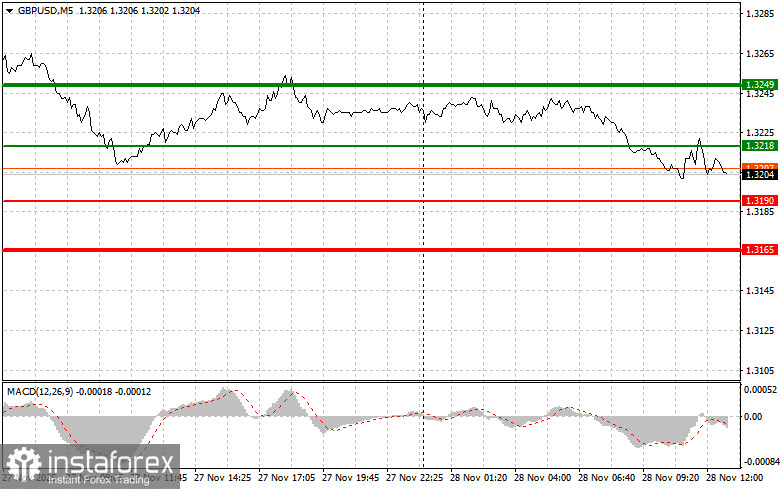

Scenario #1: Today, I plan to buy the pound when the entry point of 1.3218 (green line on the chart) is reached, aiming for growth to 1.3249 (thicker green line on the chart). Near 1.3249, I will exit long positions and open short positions in the opposite direction (expecting a 30–35-point movement back from the level). A strong rise in the pound today is unlikely. Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if the price 1.3190 is tested twice in a row at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth to the opposing levels of 1.3218 and 1.3249 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after the level 1.3190 (red line on the chart) is renewed, which will lead to a rapid decline of the pair. The key target for sellers will be 1.3165, where I will exit the short position and immediately open a buy position in the opposite direction (expecting a 20–25-point movement in the opposite direction). Continued pressure on the pound today is unlikely. Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning its downward movement from it.

Scenario #2: I also plan to sell the pound today if the price 1.3218 is tested twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline to the opposing levels of 1.3190 and 1.3165 can be expected.

What's on the chart:

- Thin green line – entry price where the trading instrument can be bought

- Thick green line – estimated price for placing Take Profit or manually taking profit, as further growth above this level is unlikely

- Thin red line – entry price where the trading instrument can be sold

- Thick red line – estimated price for placing Take Profit or manually taking profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important

Beginner Forex traders must make market-entry decisions with great caution. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit — especially if you do not use money management and trade large volumes.

And remember: for successful trading, you need to have a clear trading plan, like the one I have presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.