The cryptocurrency market is currently in a phase of recovery, but it maintains a high degree of volatility and susceptibility to external factors. Prospects will depend on the decisions made by the Federal Reserve and the overall macroeconomic environment. The recovery process is likely to take some time as fundamental economic factors continue to impact the markets.

The weakening dollar and the prospect of interest rate cuts from the Fed are contributing to the strengthening of dollar-alternative assets. Earlier expectations suggested a pause in the easing monetary policy, but recent comments from Fed officials Christopher Waller, John Williams, and Mary Daly have intensified concerns about cooling labor market conditions and inflation.

Reports that Kevin Hassett, a candidate for the position of Fed Chair and director of the National Economic Council, supports a policy of low rates have bolstered expectations for further rate cuts. The market anticipates three additional rate reductions by the end of 2026, further diminishing the dollar's attractiveness.

Published data revealed that the September producer price index decreased from 2.9% to 2.6%, while retail sales fell from 0.6% to 0.2%, signaling a decrease in inflationary pressure and increasing the need for active intervention from the central bank.

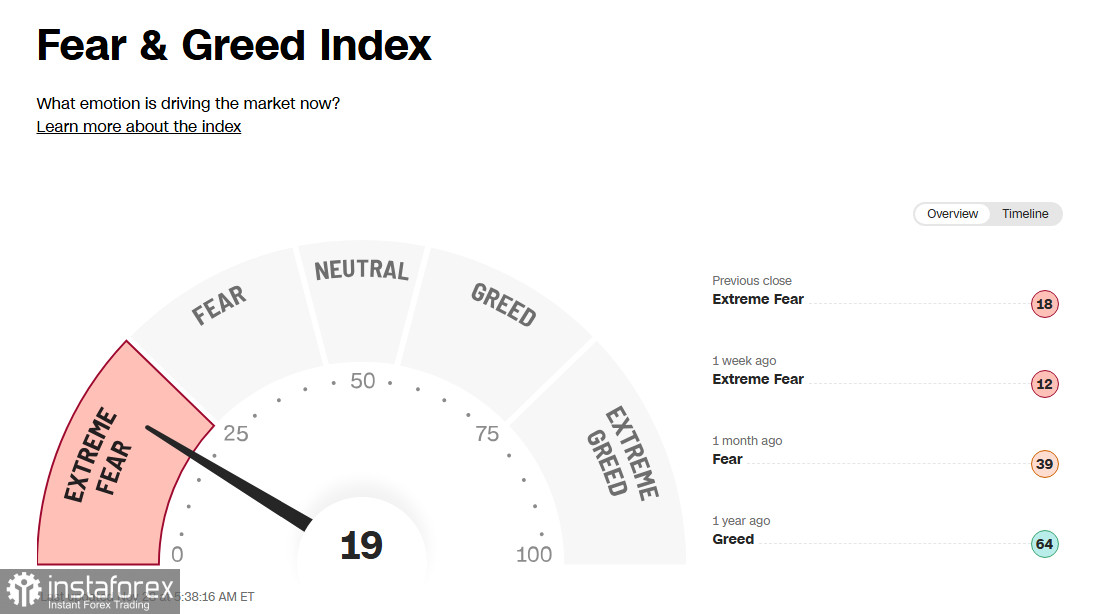

Although opinions among Fed members vary—with some advocating for employment support while others seek to limit price growth—creating uncertainty among market participants and keeping the fear and greed index in the extreme zone, the likelihood of a shift in monetary policy at the December Fed meeting has significantly increased: the CME FedWatch Tool recorded an increase in the chance of rate cuts from 30% to 84.7%.

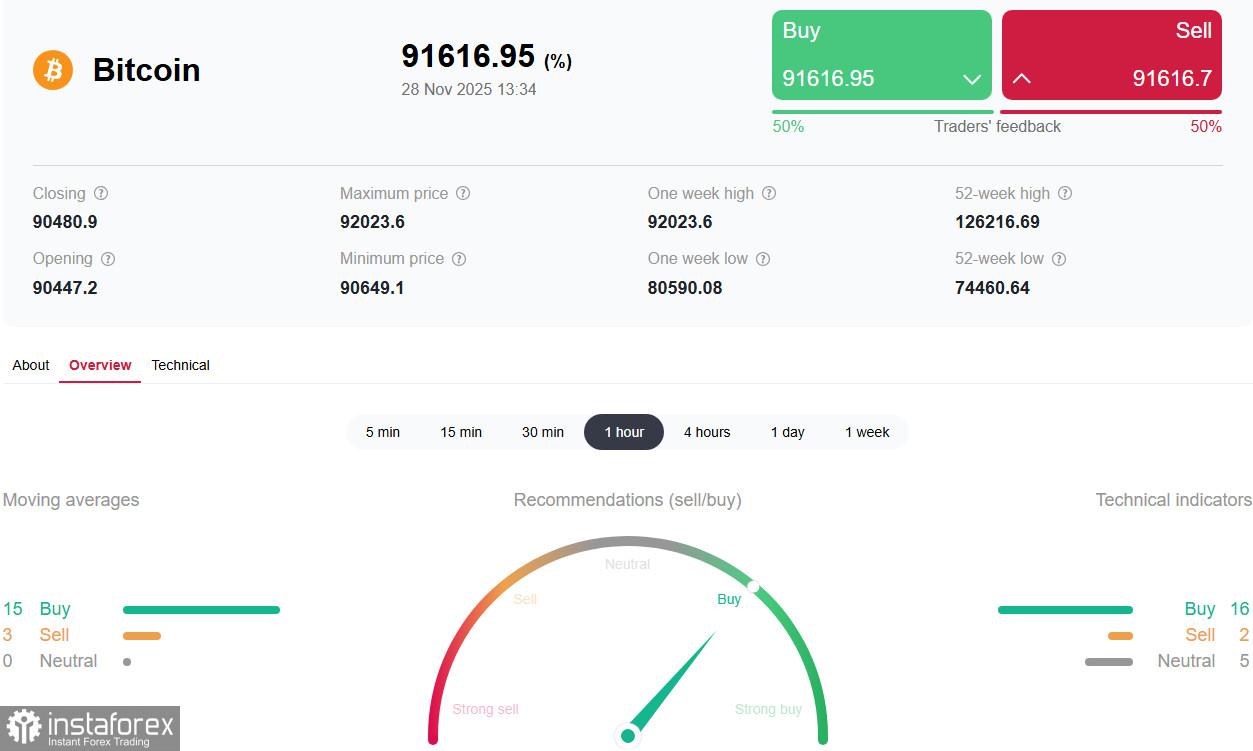

Over the past week, the cryptocurrency market demonstrated moderately positive dynamics, recovering some of its previously lost positions. Currently, Bitcoin (BTC) has stabilized near the level of 91,000.00, having gained +3.2%, while Ethereum (ETH) rose to 3,027.00, showing an increase of +5.6%. Other key cryptocurrencies also recorded strong gains: the XRP token strengthened by +6.3%, trading near 2.2000, and Solana (SOL) added +5.2% compared to last week's closing price, trading around the 140.00 mark against the dollar. The total market capitalization reached $3.08 trillion, up 0.08% from yesterday, according to TradingView. Bitcoin's dominance stood at around 60%.

At the same time, despite the positive signals, the market continues to feel the negative impact of adverse news, including another major hack of the South Korean cryptocurrency exchange Upbit, which occurred in November 2025. Hackers stole approximately $37 million, temporarily freezing operations on the exchange and emphasizing the risks of investing in digital assets.

Overall, the market sentiment remains cautious. The so-called "Fear and Greed" index continues to sit in the "extreme fear" zone at a level of 19 out of 100, signaling high risks of further volatility and the possibility of a new wave of cryptocurrency sell-offs.

Regarding Bitcoin, various sources indicate that large institutional investors have begun actively accumulating coins, especially holders of wallets containing between 1,000 to 10,000 BTC, which increases the likelihood of a trend reversal toward a bull market (for more on BTC dynamics, see our review "BTC/USD: Dynamics Scenarios for 11.28.2025").

Conclusion

In summary, the cryptocurrency market is in a phase of recovery but continues to exhibit a high degree of volatility and exposure to external factors. Future prospects will hinge on the Fed's decisions and the overall macroeconomic environment. The recovery process is likely to take some time as fundamental economic factors continue to influence the markets. Investors should exercise caution when dealing with high-risk assets like cryptocurrencies.