The final trading session of November was far from calm: a failure at CME Group disrupted trading across key futures—from commodities to currencies and bonds. This occurred just as American participants were set to return to the market after Thanksgiving Day. Liquidity hit minimal levels, and trading systems were suddenly paralyzed. Against the backdrop of an already unstable month, this episode became a symbol of November 2025: anxious and unpredictable.

At first glance, the markets appeared surprisingly resilient. The European STOXX 600 ended the day almost unchanged and even gained 0.5% for the month, albeit with the weakest increase in six months.

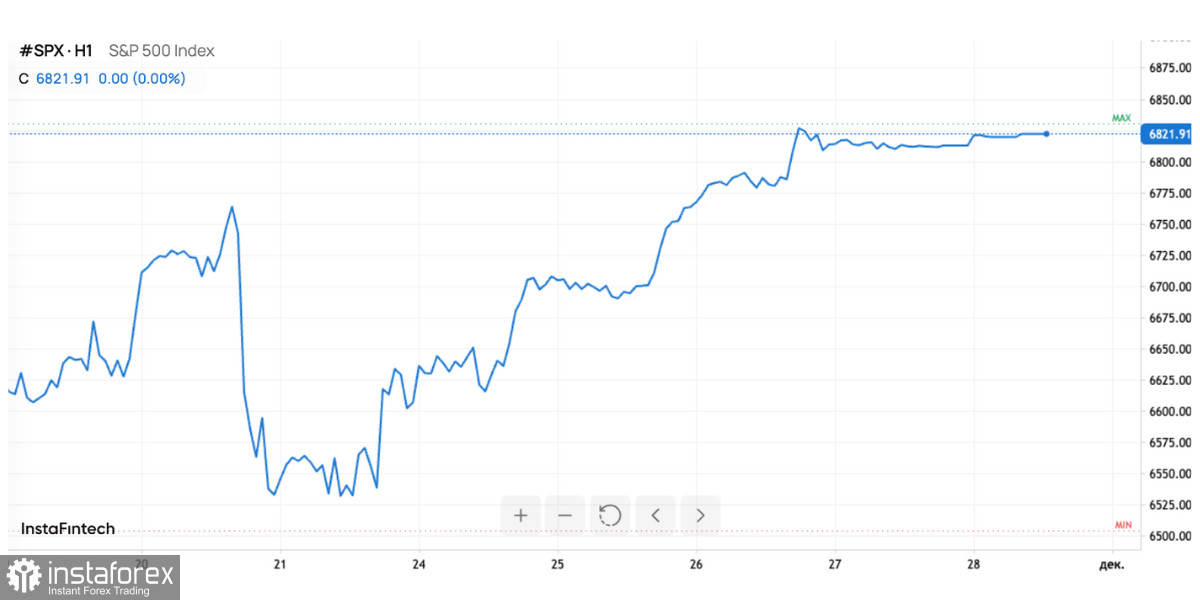

The S&P 500 was down moderately, decreasing by 0.4% in November, but compared to the two-month low the index touched a week ago, this looks almost like a victory. At one point, the decline had reached 5% since the beginning of the month—making today's partial recovery all the more significant.

However, beneath this surface stability lies a much more complex picture, characterized by significant fluctuations in the tech sector, steep declines in cryptocurrencies, interest rate expectations, currency movements, and commodity spikes.

Usually, markets prepare for heightened volatility in September and October, but this time, the main shocks occurred in November. Tech giants broke records only to fall sharply. The U.S. government was partially shut down for a record 43 days, which paralyzed the publication of crucial economic data and plunged the market into a "blind flight" situation.

The absence of statistics compelled the Federal Reserve to act particularly cautiously. Investors were unclear about the state of consumer demand, inflation dynamics, or the resilience of the labor market—all at a time when the global economy is undergoing a transition after a long cycle of tight rates.

Still, it was the Fed that became the key factor aiding market stabilization. Comments from Christopher Waller and John Williams came as an unexpected gift to investors: both supported a rate cut next month. This dramatically shifted the risk appetite—from cautious avoidance of stocks to a gradual return to the market.

The probability of a rate cut soared from 30% to over 80% in just a week. Such a sharp shift in expectations immediately fueled stock indices, aiding recovery in the final days of the month.

Currency markets

The currency market was also turbulent. The US dollar, despite attempts to strengthen in the last days, ended the week nearly unchanged and even risks showing its largest weekly decline since July.

Amid this, the Japanese yen particularly stood out, regaining attention. After falling to a 10-month low, it managed to bounce back—as the market increasingly believes the Bank of Japan is preparing to raise rates in December. The growth of core inflation in Tokyo to 2.8% has only reinforced these expectations.

For the first time in years, the Bank of Japan has the opportunity to exit its ultra-loose policy, which is already priced into the market by about a third. If such a decision follows, currency pairs with the yen could experience significant movements, one of the key events in December.

Meanwhile, the Australian and New Zealand dollars are rising steadily. Investors believe the rate hike cycles in these countries are nearing their end, making the yields on Oceania bonds attractive once again. The euro is behaving more calmly, adding 0.3% for the month—a nearly symbolic increase reflecting the lack of aggressive actions from the ECB.

Commodities

The commodities market is also showing mixed signals. Brent crude oil rose to $63.55; however, the asset is ending the month down more than 2%, extending a series of declines for the fourth consecutive month. Prices are being pressured by expectations of increased global supply and the US's efforts to promote a peace initiative concerning Ukraine.

The potential normalization of Russian energy trading could sharply increase available oil volumes in the market—and the market is preemptively pricing this in.

Conversely, gold appears strong. Its price has risen to $4,166 per ounce, reflecting an increase of nearly 5% for the month.

The metal benefits from a combination of:

- A weak dollar,

- Expectations of rate cuts in the US,

- Nervousness due to data disruptions and political risks.

Although gold did not reach its record high of $4,381, its resilient performance amid such turbulence indicates that demand for safe-haven assets remains strong and is even growing.

US, European, and Asian Markets

The final week of November provided relief for the Asian markets. After several weeks of turbulence, stocks and bonds managed to recoup some losses.

The reason is simple: weak economic data from the US increased the likelihood of a Fed rate cut. For many Asian economies, this means:

- Improved financing conditions,

- Inflows of capital,

- Reduced pressure on local currencies,

- Stabilization of debt costs.

In Europe, however, the situation is more complex. The STOXX 600, while remaining near record levels, has clearly lost its momentum. Investors are beginning to doubt whether European companies can continue growing at previous rates amid weak consumption and a lack of stimulus from the ECB.

In the US, the picture is also mixed: the technology sector, which has propelled the market upward all year, has become overloaded with expectations and has seen significant corrections. However, thanks to the Fed's pivot, indices have managed to recover some of the losses.

Markets enter December with hopes, but also caution

This November has shown that markets do not always follow their seasonal patterns. Turbulence arrived when it was least expected, and recovery was made possible through just a few comments from Fed representatives.

The glitch at CME Group became a symbolic end to the month: the financial system today is so fragile that technical failures can impact liquidity just as much as macroeconomic news.

As December begins, important expectations loom:

- A rate cut in the US is almost certain,

- The Bank of Japan may raise rates for the first time in a long while,

- The dollar may continue to weaken,

- Gold will maintain support,

- Oil will remain under pressure due to rising supply.

Markets are entering a new month with cautious optimism—and an understanding that the traditionally calm December may also prove to be an exception this year.