Dovish decisions are out of fashion now, and the new reality is forcing even the most convinced supporters of soft monetary policy to shift their stance to a hawkish one. The ECB has signaled a rate hike, but the euro is in no hurry to go higher. Monetary policy tightening makes the currency more expensive. Should we expect such a move from the euro or are market players looking at the current situation from a slightly different angle?

Rate hikes always have their negative sides. Monetary tightening aimed at fighting inflation will undermine the euro bloc's already struggling economy. According to economists at Barclays, the ECB will warn of an economic slowdown that will follow a rate hike at Thursday's meeting. This stops euro buyers from acting decisively.The first hike by 25 basis points is expected to take place at the July meeting. Rates are likely to increase by a similar amount at subsequent meetings throughout the year until December 2022. Barclays also assumes another increase in the first quarter of next year. This would bring the rate to 0.75%.

Previously, economists have written about two rate hikes of 25 basis points in 2022 and four by a similar amount in 2023.

Due to persistent inflationary pressures and impending policy tightening, Barclays revised its forecast for eurozone GDP growth this week. A moderate technical recession is expected at the end of the year and real GDP growth averages to 0.5% in 2023 from 1.8%.

There are concerns that the ECB's actions could destabilize the economic situation in the euro bloc, especially in peripheral countries. In this case, the regulator would have to take forced measures, i.e. to abruptly stop the rate hike program.

The risks of such developments will be higher if the Central Bank decides to raise the rate by 50 basis points at once. A disorderly widening of the spread between the core countries and the periphery may begin. The ECB will not only have to stop the cycle of monetary policy tightening early. The launch of a new quantitative easing program to close the spreads, for example, will come as a big surprise to markets. Such an outcome is negative for the euro.

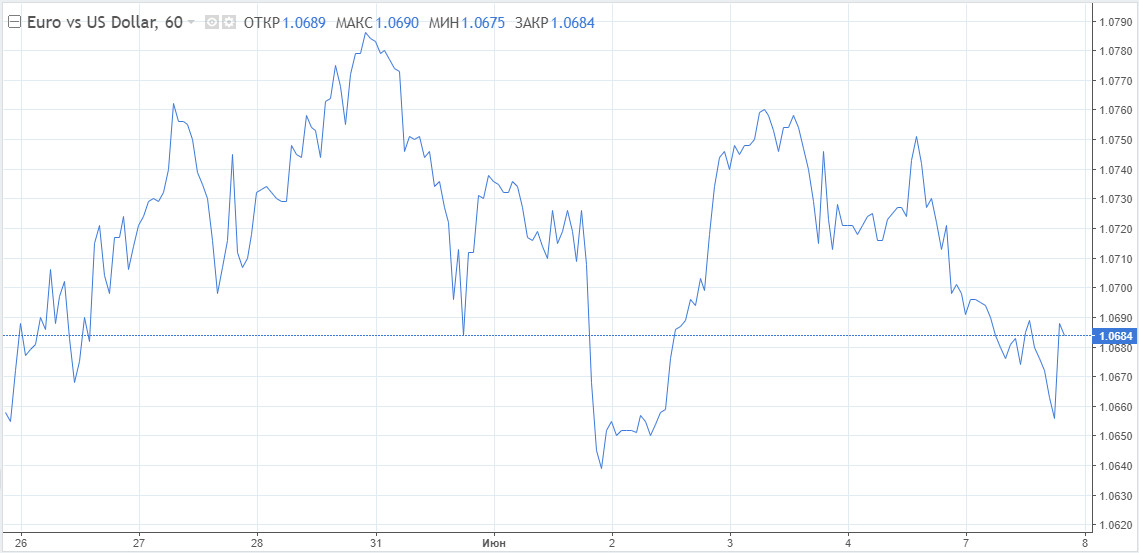

The single currency is not soaring after the signals of the ECB policy tightening. Nevertheless, it managed to bounce from the dangerous May lows. It looks like the bottom at 1,0349 was broken and the parity is not expected. These levels may well be a thing of the past if the ECB continues its steady but modest cycle of rate hikes.

The downside risk for EUR/USD would be for the ECB to end its cycle earlier than the markets are currently pricing in, leaving interest rates in the eurozone much lower than in the UK, the US, and other developed markets.

Meanwhile, Morgan Stanley is positive about the upcoming event this week and makes a recommendation to buy the pair EUR/USD.

"The upcoming ECB meeting may prove a key EUR-positive catalyst. We think the time has come to buy EUR/USD," the bank said.

Growing inflation in the eurozone may cause increased concern in the ECB and force the regulator to act wider and faster than the market currently expects, according to Morgan Stanley.

In June, the EUR/USD pair maintains a consolidation period near 1.0600 and 1.0787. This week, the ECB may open the way to 1.1000.

Clearly, it's not just about the ECB, the US dollar looks pretty strong, and it would be nice to see a weaker USD for a euro recovery.

What will it take to weaken the US dollar? Factors such as the balance of risks to global economic growth, and China's recovery from lockdowns. In addition, the Fed should soften its monetary policy due to growing worries about recession.

If the rate of Fed policy normalization slows down, and the data on the EU economy are strong enough along with the increase in rates, we can expect a rise in the EUR/USD pair to the area of 1.1400, Morgan Stanley forecasts.

Goldman Sachs economists remain positive about the medium-term outlook for the euro and expect the currency to rise to 1.1000 in the coming months.