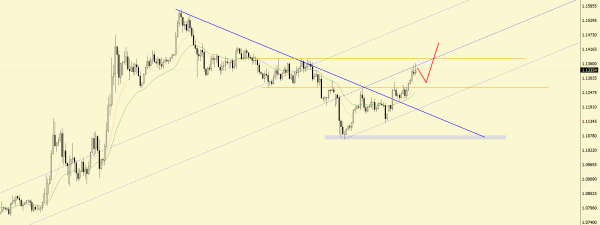

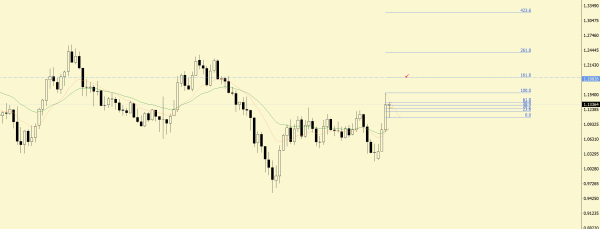

**EURUSD** Hello to those interested in the EURUSD pair. I was expecting a northward recovery, the last southward push was last Monday on the news of a freeze on tariffs between the US and China for 90 days. Probably expecting southward movement based on this information, that is, strengthening of the dollar, many continued to sell the pair, allowing large players to continue their expected deals to get rid of the dollar. The US dollar is under pressure due to loss of confidence, Trump is still at the helm, and what he will do tomorrow is unknown, big money is looking for a reliable instrument to preserve and grow capital. Previously, in times of crisis, the dollar was a safe haven currency, now gold is becoming a safe haven. And the trend will not end so quickly. Various indices indicate a loss of confidence, it's an interesting situation now, the Fed continues to hold the rate and the first rate cut is possible in September according to expectations, while the ECB is already approaching the target rate, and in this situation, before Trump, the dollar would have risen. But now everything has changed. Even with a negative swap, a risky asset like the euro is rising. And judging from the technical analysis of the weekly and monthly charts, further growth is quite realistic and above the recent high. I recall the forecast from "Goldman Sachs" about levels around 1.20 for this pair within the year. Weekly chart: Monthly chart: The rating agency "Moodys", lowering the credit rating to AA1, gave confidence to the bulls. The expected tax project from Trump will increase the national debt by 3-5 trillion dollars, which will continue to put pressure on the dollar until its adoption. I think by the end of the month, the pair may return to the levels of 1.14, whether the price will break through the maximum or take a pause until the 3rd quarter is unclear, that's what positions in the futures market are saying, further northward movement is expected, but after a pause towards the end of the 3rd quarter. Currently, there is a slow growth without sudden bearish sell-offs, allowing the pair to continue rising without significant pullbacks. The candle on the monthly range is once again bullish, continuing to break the long-term trend line that has been in place for several years. Perhaps the confidence in the euro is also boosted by the movement towards ending the war in Europe, despite the disagreement at the European top level. From a technical standpoint, breaking through the maximum based on Fibonacci levels could lead to levels around 1.18. Keeping today's sentiments in mind, such a scenario should be considered. And if the Fed starts reducing interest rates, which will have to be done sooner or later, the fall of the dollar will only accelerate.