At the end of 2021, crypto investors were disappointed, as Bitcoin not only failed to reach $100,000 but also fell in price. However, as data shows, large market participants wasted no time and bought back the flagship cryptocurrency at a lower price. This leaves chances for growth.

Bitcoin mega whales buy 1% of BTC volume

Crypto analytics firm Santiment notes in its report that big whales have been accumulating Bitcoin since late 2021.

Santiment notes on Twitter that mega whales' addresses containing 1,000 or more BTC have added a total of 220,000 Bitcoins. That's more than 1% of the total BTC volume in the seven weeks since December 23.

The analytics company notes that this is the largest level of bitcoin accumulation by mega whales since September 2019.

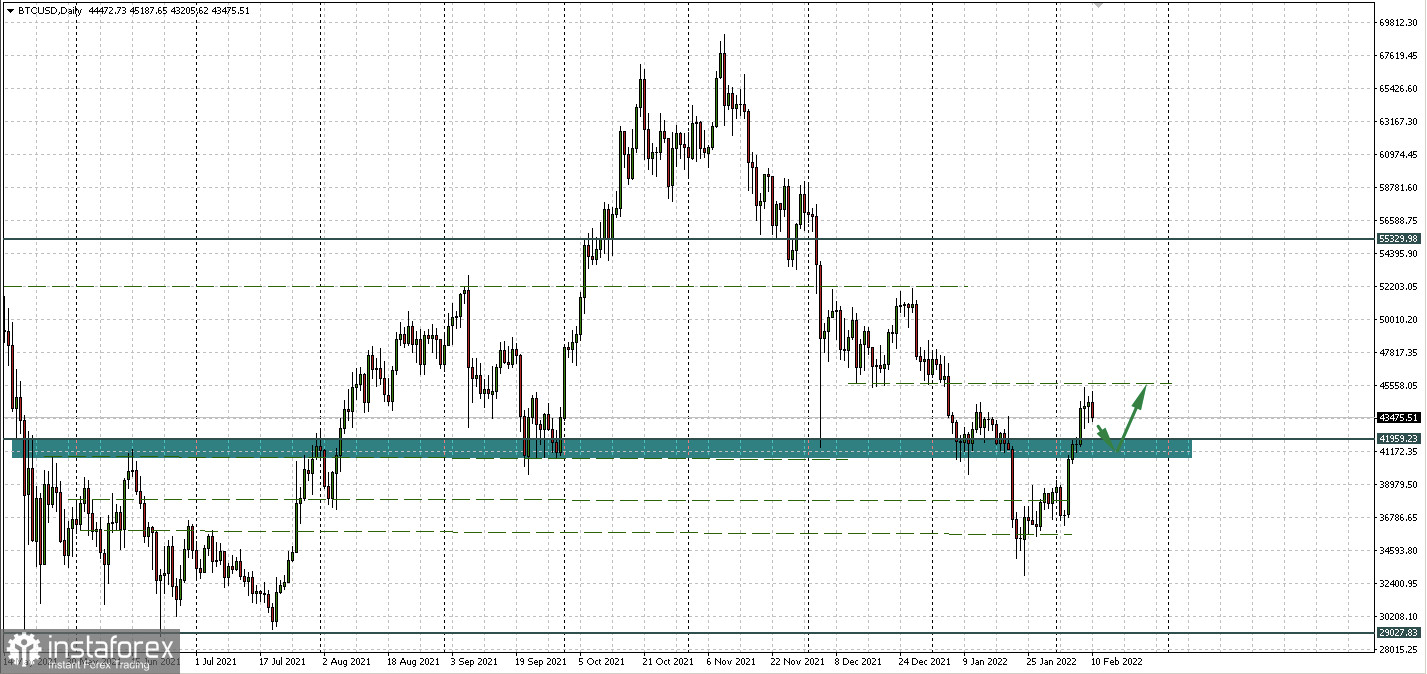

Two bullish indicators for BTC/USD

Meanwhile, market sentiment is improving and Bitcoin has gained 18.5% over the past seven days.

Santiment notes that concerns about the coronavirus pandemic have had a negative impact on the Bitcoin price over the past two years. Now, however, the firm says those concerns are starting to reduce, which is already improving the overall fundamental backdrop.

It was also noted yesterday that the analyst firm sees another sign that the major cryptocurrency will soon return to growth. Stablecoin Tether (USDT) has been reducing its network activity lately, which is another potentially bullish indicator for BTC/USD.

"The number of daily active addresses on the Tether network has dropped to its lowest level in two years. It has fallen rapidly since bitcoin hit a record high in mid-November last year. This may mean Bitcoin's price is about to rise. Historically, when stablecoin transactions decrease, Bitcoin prices tend to increase."

New requests for regulation

Meanwhile, global regulators continue attempting to take control of the crypto industry.

In the US, Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam called on Congress to allow his agency to take responsibility for regulating spot cryptocurrency markets.

The CFTC is monitoring the derivatives markets, including tracking cryptocurrency futures. The debate over whether digital assets should be treated as commodities or securities has been going on for quite some time.

Some crypto firms have called for the CFTC to regulate the industry. However, major exchange Coinbase has called for a new regulator to deal with the regulation of digital assets.

Thus, Behnam referred to the need to draw clear boundaries between digital assets that are considered securities and those that are not.

Specific regulatory measures, if taken, could be a headwind for the cryptocurrency market. In the meantime, reactions to them, depending on the potential threat, can only shape expectations.