The US dollar has surged upwards following the release of CPI data for January. The record high inflation is likely to force the Fed to adopt a more hawkish policy.

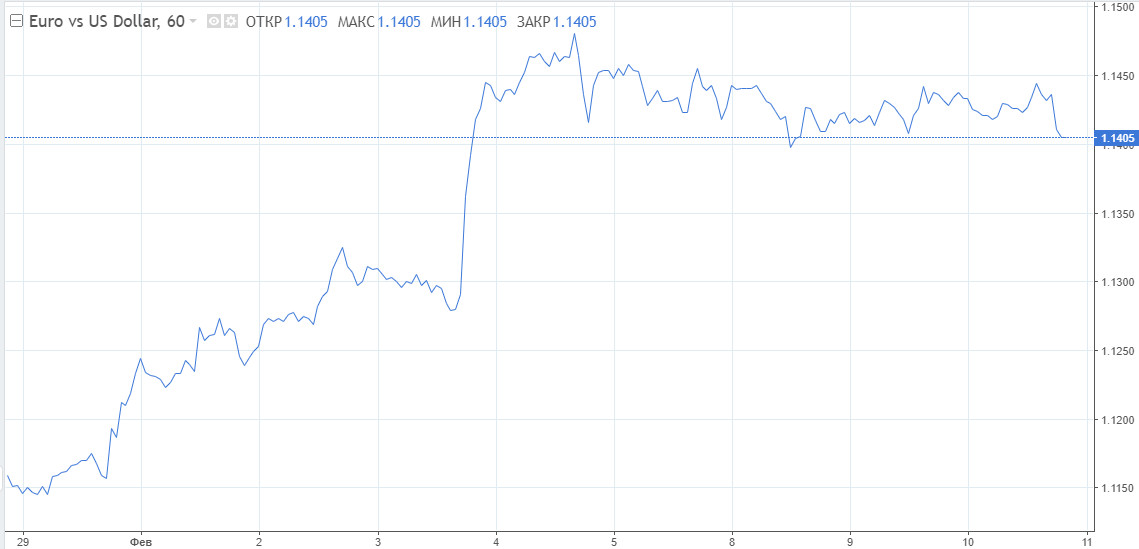

The yield of US treasury bonds has jumped upwards, and USDX has surpassed its intraday high. EUR/USD failed to settle above 1.1400 and plunged downwards.

According to today's data release, consumer prices jumped by 7.5% YoY in January, up from 7% in December. Economists expected inflation to reach 7.3%. Monthly CPI increased by 0.6% in January, beating the forecasted increase of 0.5%. Overall, US inflation has reached the highest level in 40 years.

It remains unclear how strongly the Fed would tighten its policy in March to tackle record-high inflation. It is speculated that the regulator could hike the rate by 50 basis points, which would push the yield of 10-year US treasury bonds to 2.09%.

The Fed funds swaps indicate that the market expects a 1% rate increase by July. Furthermore, the Fed Fund futures have priced in a 50% chance of a 50 basis points hike in March. If the Federal Reserve's actions do not match these expectations, the Fed would lag behind the curve on inflation. An increase of only 25 basis points would be disappointing for market players.

What does it mean for EUR?

In these conditions, a downward trajectory is the path of least resistance for EUR/USD. The ECB has made a slight shift in rhetoric, but it cannot overcome the factors driving USD. The new hawkish shift in the EU should give some support to the European currency and limit its fall.

EUR/USD would need to surpass 1.1480 to go on a steady upward trend. In this scenario, 1.5000 would become a key level, and 1.1550 would serve as the next resistance level.

The pair's support is located at 1.4000, 1.1350, and 1.1320.

EUR/USD's price dynamics have turned increasingly bearish during Thursday's session. The pair could slump to 1.1300 in the next few days.