Investors' active purchase of a hedge against geopolitical risk has pushed gold futures quotes above $1,900 per ounce for the first time since June. The question is whether speculators will get rid of the precious metal amid a decrease in the likelihood of an escalation of the conflict in Eastern Europe. Russia sent troops into Ukraine, recognized the republics that broke away from the neighboring state as independent, and the West responded with sanctions. Is the conflict settled?

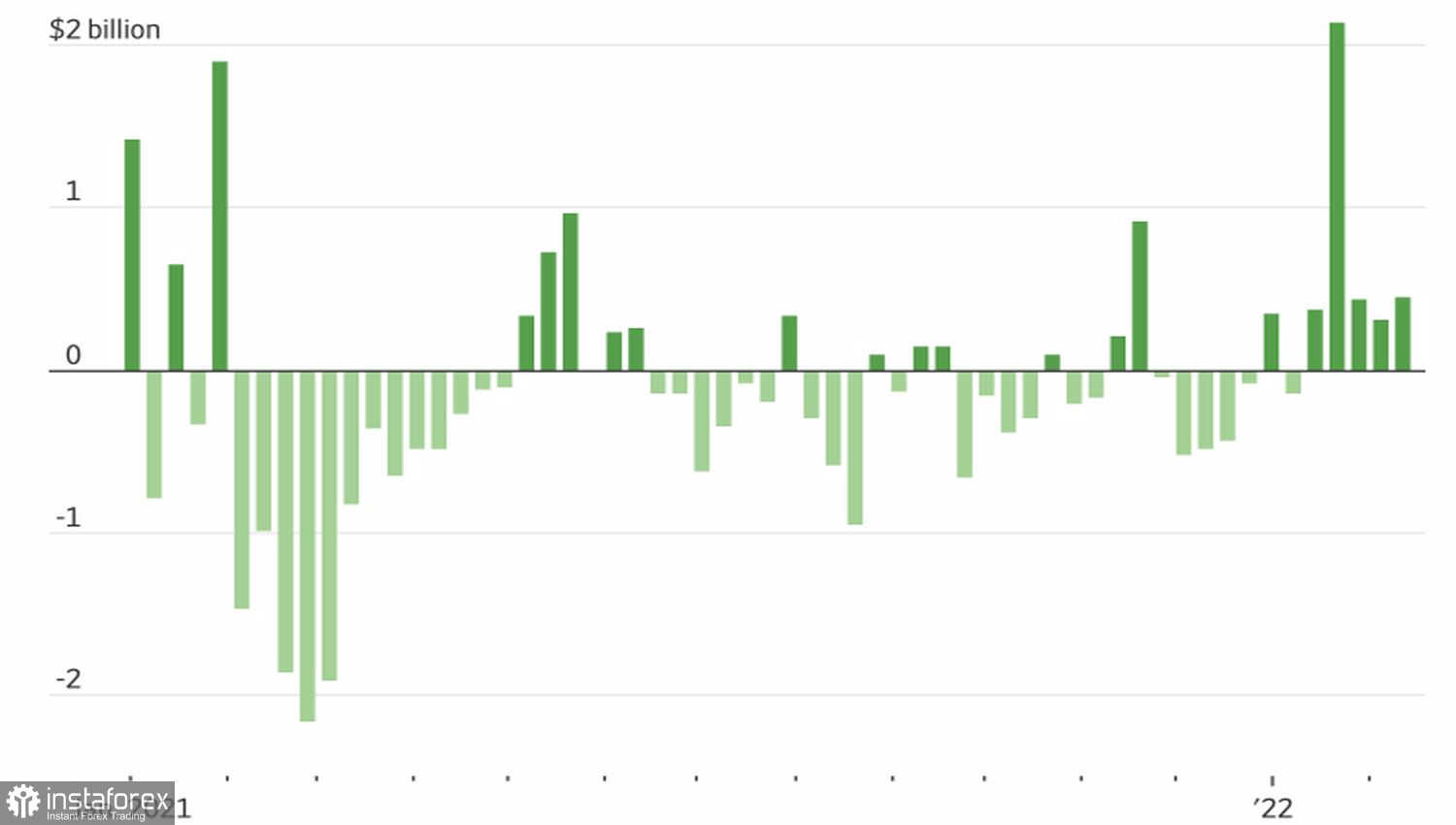

Even though gold finished 2021 and entered 2022 in an extremely pessimistic mood, the start of this year turned out to be very encouraging for it. Hedge funds are increasing long positions with enviable constancy, and stocks of specialized exchange-traded funds have been growing for five consecutive weeks, increasing by 57.3 tons since the beginning of 2022. We are talking about the longest winning streak since August 2020. At the same time, Goldman Sachs believes that the inflow of capital into ETFs may amount to 600 tons, which is equivalent to the indicators of 2016, 2019, and 2020, when the markets were concerned about the topic of recession.

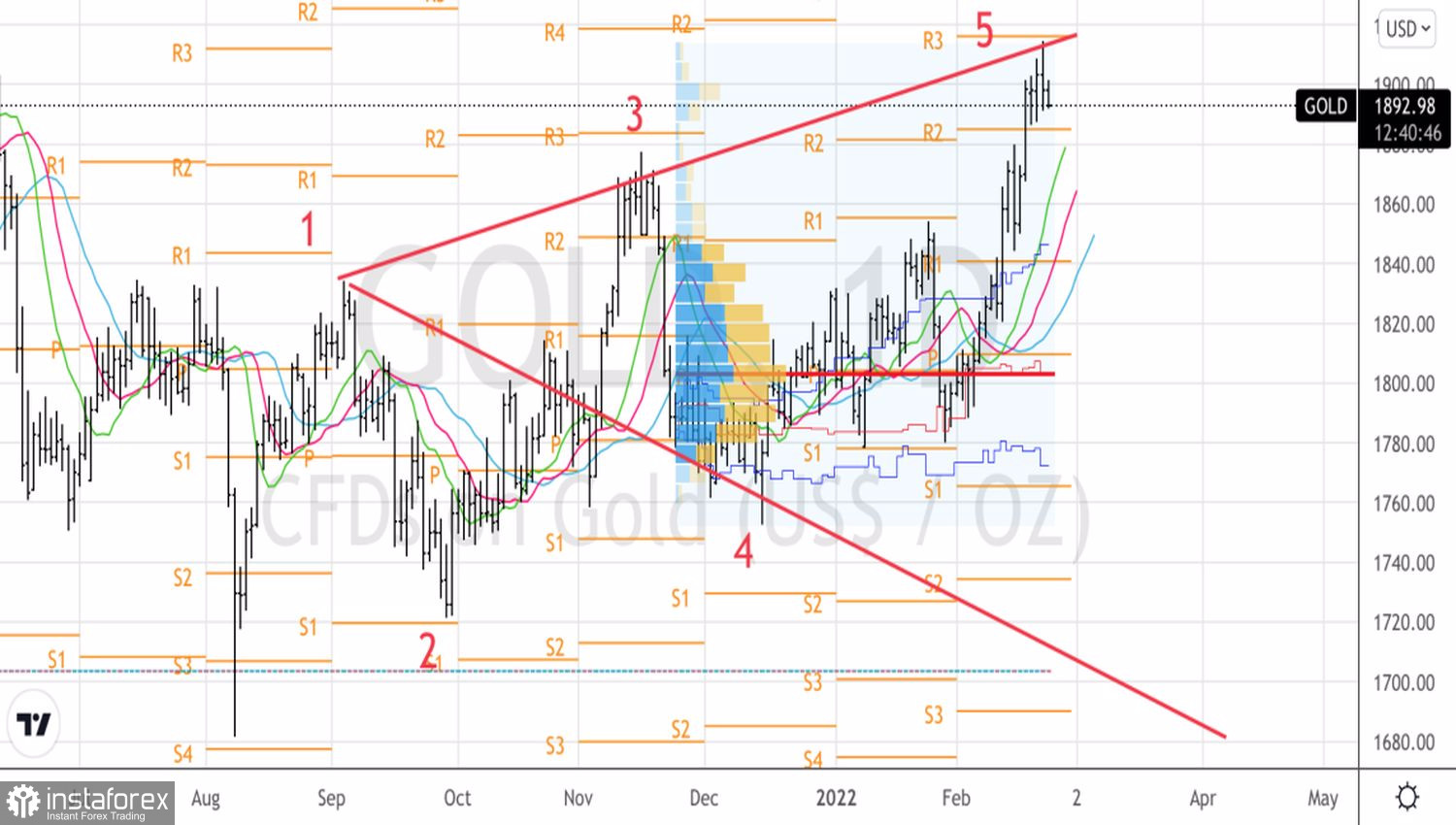

Dynamics of capital flows in ETFs

The spurt of gold in February meant that there is no shortage of bullish forecasts at present. Citigroup believes the precious metal will reach $1,950 an ounce due to heightened risks of a political misstep by the Fed and a growing possibility of a recession. Goldman Sachs even predicts that gold will be able to exceed the level of $2,000 per ounce and even aim at a new record. According to the bank, the link between it and the real yield of U.S. Treasuries is now broken due to the new inflationary regime a la 1070s and the deteriorating health of the U.S. economy. Historically, an increase in U.S. debt rates leads to a fall in XAUUSD quotes, which is not currently observed.

It cannot be said that the market is exclusively bullish. According to DailyFX, the worst of the crisis in Eastern Europe, at least in terms of uncertainty, is already over. The main catalyst for the change in futures quotes for the analyzed asset in the near future will be a reduction in the risk of escalation of the conflict, which will contribute to the fall of the precious metal in the direction of $1,750, and then $1,700 per ounce over the next 6 months.

In my opinion, the truth is somewhere nearby. Of course, the main reason for the gold rally in February was geopolitics. Its relegation into the background will contribute to the implementation of the principle of "buy the rumor, sell the news." In the end, Russia's invasion of Ukraine has already happened, Western sanctions have been announced. These factors have already been taken into account in XAUUSD quotes, it's time for the bulls to know the honor. Profit-taking on long positions is fraught with a serious correction.

Technically, there is an inverted pattern of Wolfe Waves on the daily chart of the precious metal. Currently, the quotes have reached point 5, which increases the risks of a pullback. The development of the correction requires a confident assault of support at $1,880-$1,885 per ounce. It will also become a strong argument in favor of forming short positions on gold in the direction of $1,855 and $1,840.

Gold, Daily chart