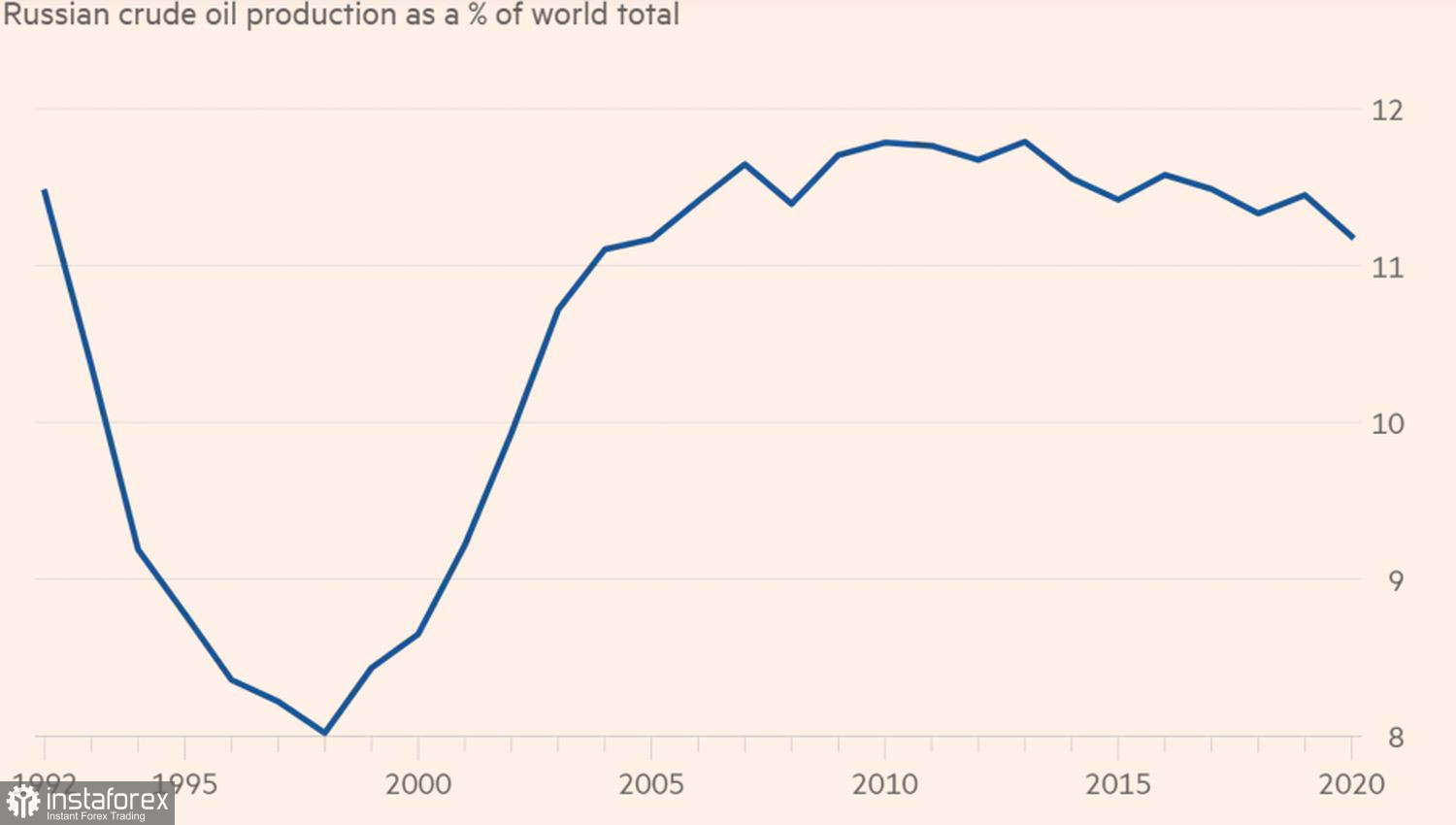

Rumors of a ban on Russian oil imports have stirred up financial markets and pushed Brent futures to their highest levels since 2008. If you refuse the services of a country that consistently supplies 10% of the global black gold supply, prices will be significantly higher. According to OPEC Secretary General Mohammad Barkindo, there is not enough capacity in the world to replace Russia's contribution to the crude oil markets. Moscow is afraid that in this scenario, the cost of the North Sea variety could soar to $300 per barrel, which will definitely lead the world economy into recession.

The fact that the sanctions do not affect the energy sector of the Russian Federation allows them to be smoothed out. The Kremlin still has the ability to get dollars for the oil and gas it supplies, so it will be bad, but it's still far from hell. And if the U.S., where the share of Russian imports of oil is a modest 8%, are ready to abandon it, then Europe, led by Germany with their 30-40%, is well aware of what the embargo can threaten. Berlin resists, and Moscow continues to put pressure on it, threatening to shut off Nord Stream 1 in response to the sanctions on Nord Stream 2. As a result, gas prices in Europe jumped by a third, to €285 per megawatt hour in a day, and then retreated slightly to €235. A year ago, it was about €9 per MWh.

Dynamics of Russia's share in world oil supplies

The Eurozone is already facing the fastest rise in inflation in its history, with a third of the CPI increase attributable to energy prices. That is, with a proposal that will not be affected by the ECB's monetary policy. An increase in household spending is fraught with a serious slowdown in GDP, that is, stagflation. Or stagflation at the same time as a recession, which is even worse. The future of millions of Europeans is at stake, which is why Germany is not yet going along with the U.S. proposal for an embargo on Russian oil. The markets are well aware that it is one thing to remove the supply for 400,000 bpd, another for 5 million bpd. If China and India participate in this, we will talk about a much larger amount.

However, an unofficial embargo is already in place. Despite the huge discount with which Moscow offers the Urals in relation to Brent, it is not easy to find buyers. Shell Plc's recent purchase of Russian oil has drawn strong condemnation from the global community, with TotalEnergies SE saying it will no longer purchase black gold from the country.

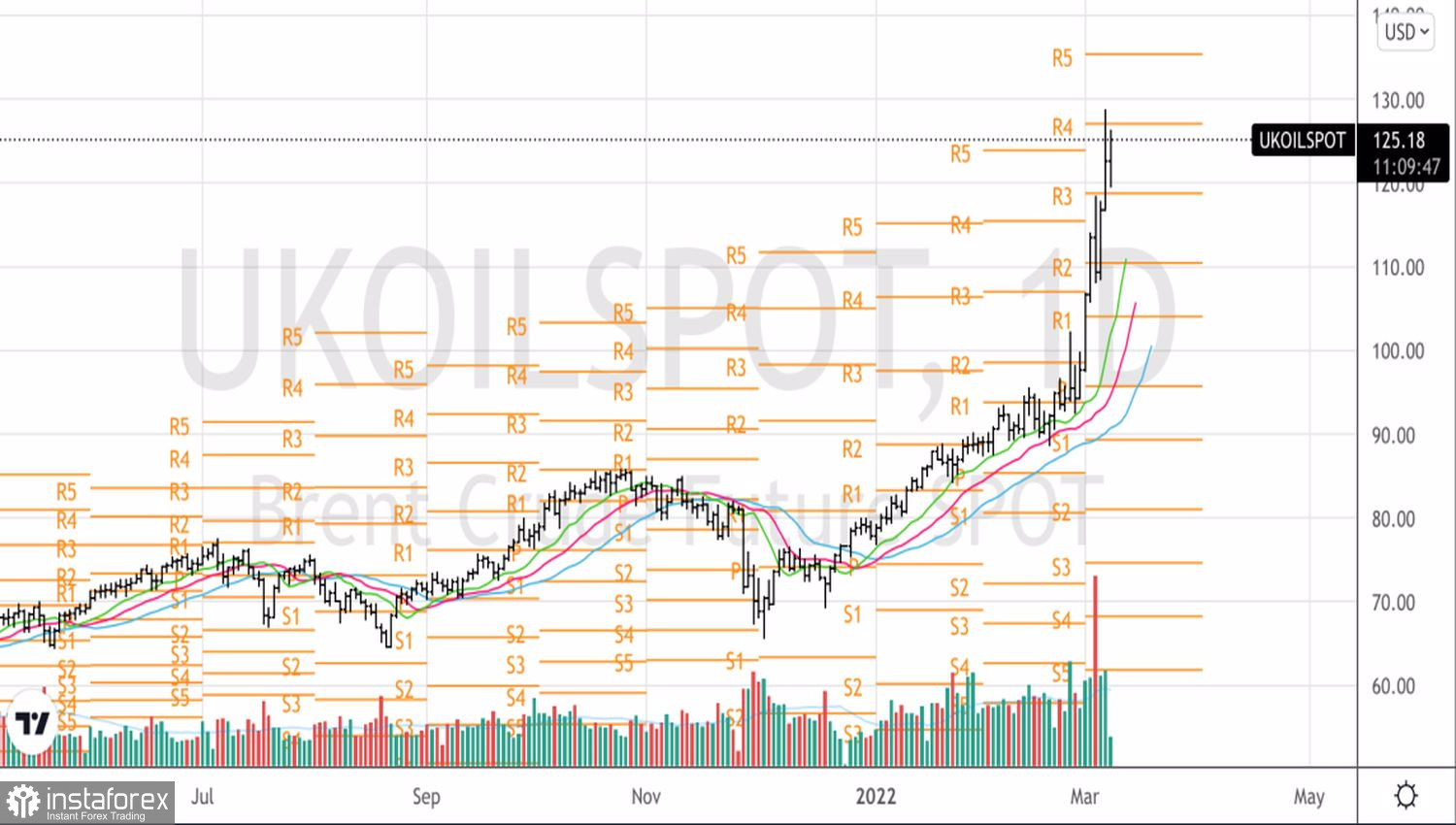

Supply issues and fears of a ban on oil imports from the Russian Federation are fueling the continuation of the North Sea rally and widening the differential between the spot and futures market to record highs. Backwardation has never been so strong, and people say: "sell me now as much as you have, and I will buy as much as I can." In such a situation, one can only guess when demand will begin to decline due to excessively high prices, and manufacturers will increase the number of drilling rigs.

Technically, the upward trend is so strong that going against it is suicide. We are increasing the longs formed from the levels of $102 and $104 per barrel in the expectation of price growth to $135 and $150.

Brent, Daily chart