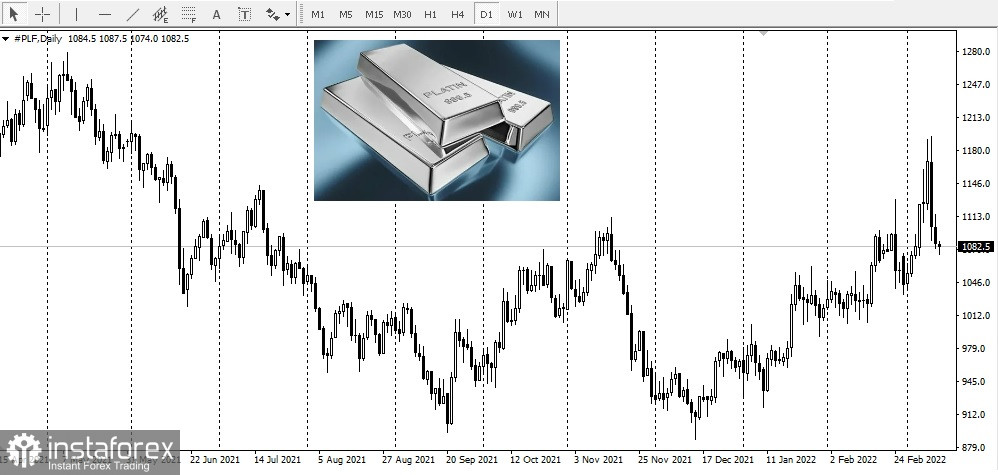

According to the World Platinum Investment Council (WPIC), platinum investors should prepare for a year of volatility as the supply and demand outlook for 2022 remains solidly volatile.

In its latest report on the platinum market, the council described the precious metal as having a challenging 2021 with strong demand but even stronger supply. The WPIC reported that the platinum market saw a supply surplus of 1.232 million ounces last year, driven by the rapid process of stockpiled ore from 2020 and significant outflows of 237,000 ounces from platinum-backed exchange-traded funds.

The increase in supply came as platinum demand grew significantly in 2021. The WPIC said that automotive demand increased by 11% last year, industrial demand rose by 27% and jewelry demand grew by 5%.

The council predicts that total demand will rise by 7% to 520,000 ounces in 2022. However, the market is still expected to register another surplus, albeit lower than in 2021. Platinum surplus is likely to be reduced by 47% to 652,000 ounces this year. Director of research at the WPIC Trevor Raymond said that while platinum's surplus was expected to remain elevated, there was still a lot of uncertainty in the market, especially with the ongoing tense geopolitical situation in Ukraine. He noted that Russia accounted for about 10% of the world's platinum supply.

Director of research at the WPIC Trevor Raymond said that while platinum's surplus was expected to remain elevated, there was still a lot of uncertainty in the market, especially with the ongoing tense geopolitical situation in Ukraine. He noted that Russia accounted for about 10% of the world's platinum supply.

Raymond added that the conflict could fuel demand for platinum.

Besides, Russia controls about 40% of the palladium market. Both metals can be used in catalytic converters, reducing harmful emissions in gasoline-powered engines.

The threat of imposing sanctions against Russia has already driven palladium prices to a new record high above $3,300 an ounce.

Despite the market's large surplus, there is a deficit in the market as precious metal prices remain high.

Despite the market's large surplus, there is a deficit in the market as precious metal prices remain high.

Raymond said that there was evidence that China was buying unprecedented amounts of platinum, which would account for perceived tightness and rising prices. He added that China's appetite for platinum in the physical market had not been captured in the latest data, which is one of the reasons for last year's massive surplus.

According to the WPIC, it will not take long to turn this year's expected surplus into a deficit or at least a balanced market.

Raymond said that the green energy transition would further support platinum.

He added that the precious metal continued to play an important role in reducing harmful greenhouse gas emissions.

Some analysts speculate that rising oil prices could lead to a faster transition to electric vehicles. However, consumers should consider not just oil prices; commodity prices from nickel to lithium have already hit record highs, which could lead to higher prices in electric car markets.

Raymond said that the cheaper option for automakers in the current environment would be to produce more hybrid vehicles that have smaller batteries and still rely on internal combustion engines.

Another factor in the green energy transition is the growing popularity of green hydrogen, which requires platinum as a catalyst. Solar or wind energy separates hydrogen and oxygen molecules in water; the hydrogen is then used as fuel for power generators.

Raymond added that higher energy prices could accelerate plans to develop hydrogen fuel cells.

As for what is holding platinum prices back, the market needs an infusion of new capital. Platinum has been one of the worst-performing assets in the precious metals sector. However, currently its discount to gold continues to rise.