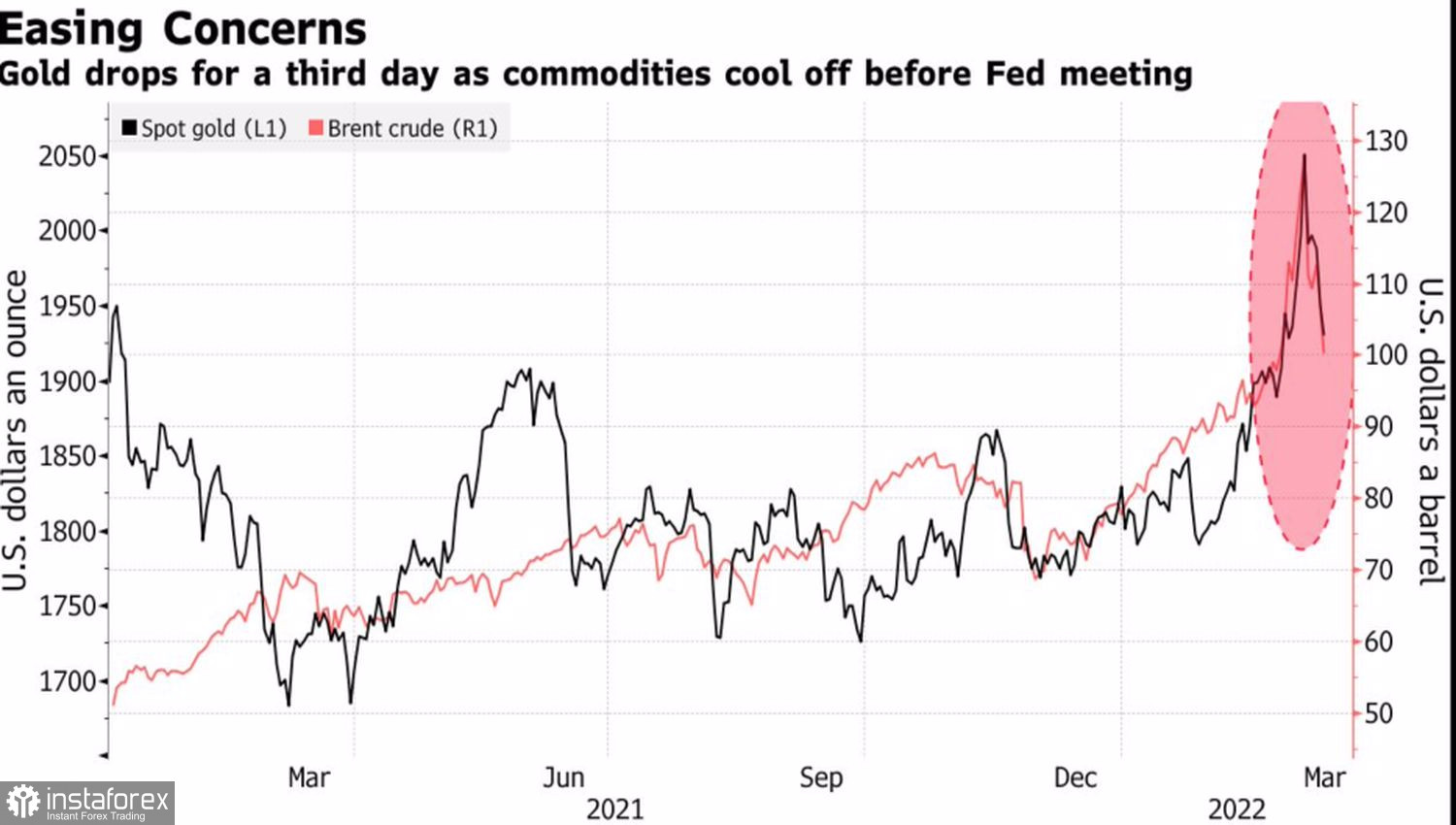

The armed conflict in Ukraine has turned oil and gold into twin brothers. Since the start of hostilities in Eastern Europe, both assets have simultaneously skyrocketed, both have collapsed no less rapidly against the backdrop of ceasefire negotiations between Moscow and Kyiv. This is what lies on the surface - the picture on the chart. An attempt to look into the depths allows us to talk about closer inter-market ties between traditional and black gold.

The precious metal is usually seen as a hedge against inflation. It is not surprising that the population of Russia, frightened by the collapse of the ruble, is actively buying up gold. Oil is an indicator of the health of the global economy. If they both accelerate upward, expect trouble. A picture of a stagflationary environment immediately emerges. In fact, Brent is to blame for what is currently happening in the markets. More precisely, the fact that many countries of the world are sitting on the Russian oil needle. The departure of barrels from this country from the market led to the rise of the North Sea variety to $130. As soon as concerns arose about a slowdown in global demand led by China due to the outbreak of COVID-19, black gold fell off the cliff and dragged XAUUSD with it.

Dynamics of oil and gold

According to OPEC, the armed conflict in Ukraine will lead to an acceleration of inflation and, ultimately, to a slowdown in world GDP and global demand for oil. This could not but affect the prices, which by that time looked clearly overpriced. The fall in Brent increases the likelihood of a slowdown in inflation, which reduces the need for the precious metal as a tool to hedge the risks associated with it. At the same time, the correction of the North Sea variety contributes to the S&P 500 rally, as concerns about the Fed's aggressive monetary restriction also fade into the background. The growth of the U.S. stock market is bad news for safe-haven assets, including gold.

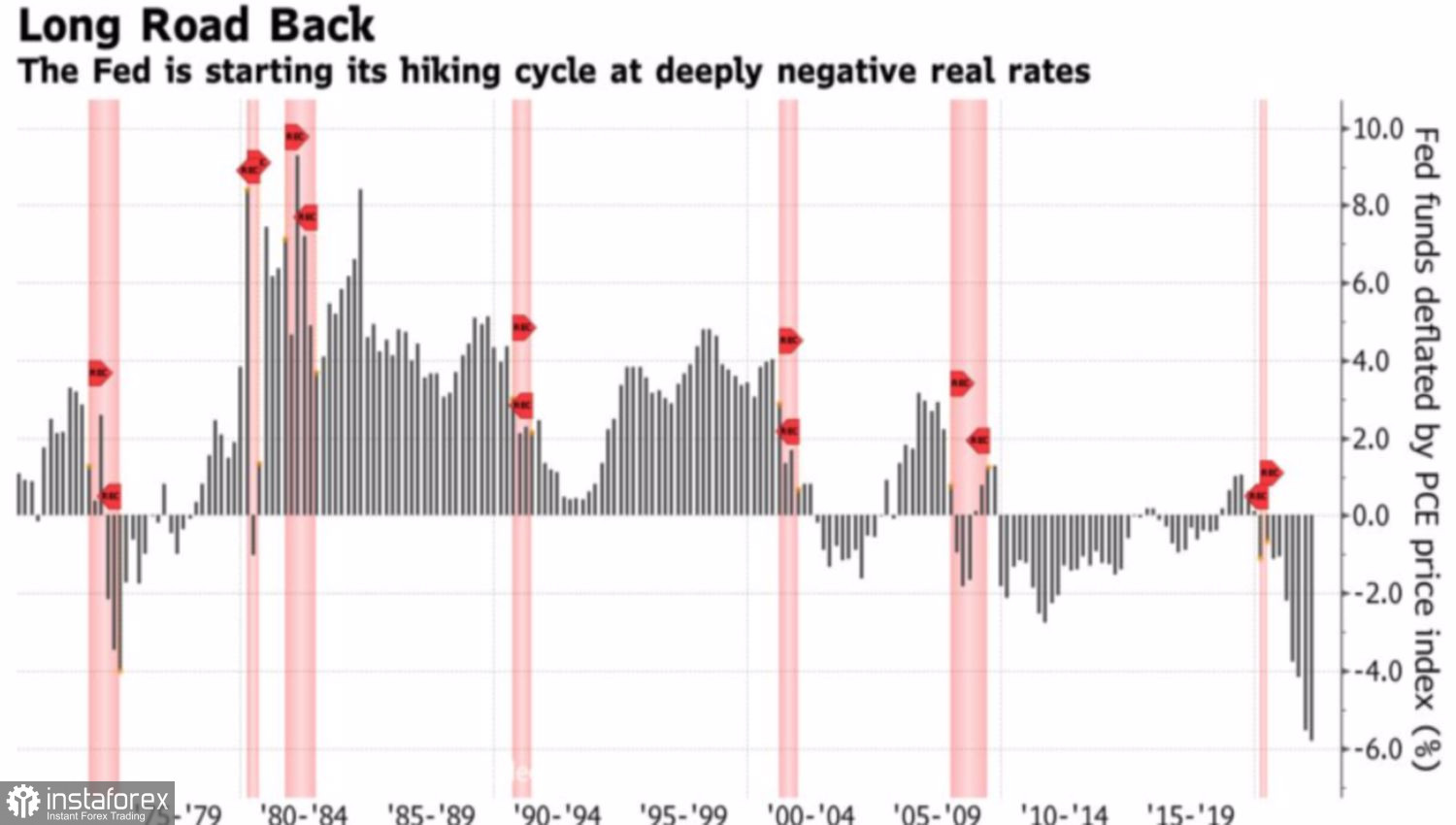

Let's not forget that the Fed is starting its monetary tightening cycle with the lowest real yield on Treasury bonds since the 1970s. It keeps gold above $1,900 an ounce. However, if the rise in nominal borrowing rates continues to outpace inflation, real yields will rise and XAUUSD will resume its march downward.

Recessions in the U.S. economy and dynamics of real yields of Treasury bonds

Thus, the fall in oil prices, the associated expectations of a slowdown in inflation, and the intention of the Fed to raise the federal funds rate at least at 5-6 FOMC meetings in 2022 create an ideal environment for selling the precious metal. At the same time, I do not expect Brent to develop a correction, rather, the North Sea variety will stabilize in the range of $95-115 per barrel. And the Fed may not actually be as aggressive as it says. As a result, gold will continue to fall, but with serious upward pullbacks.

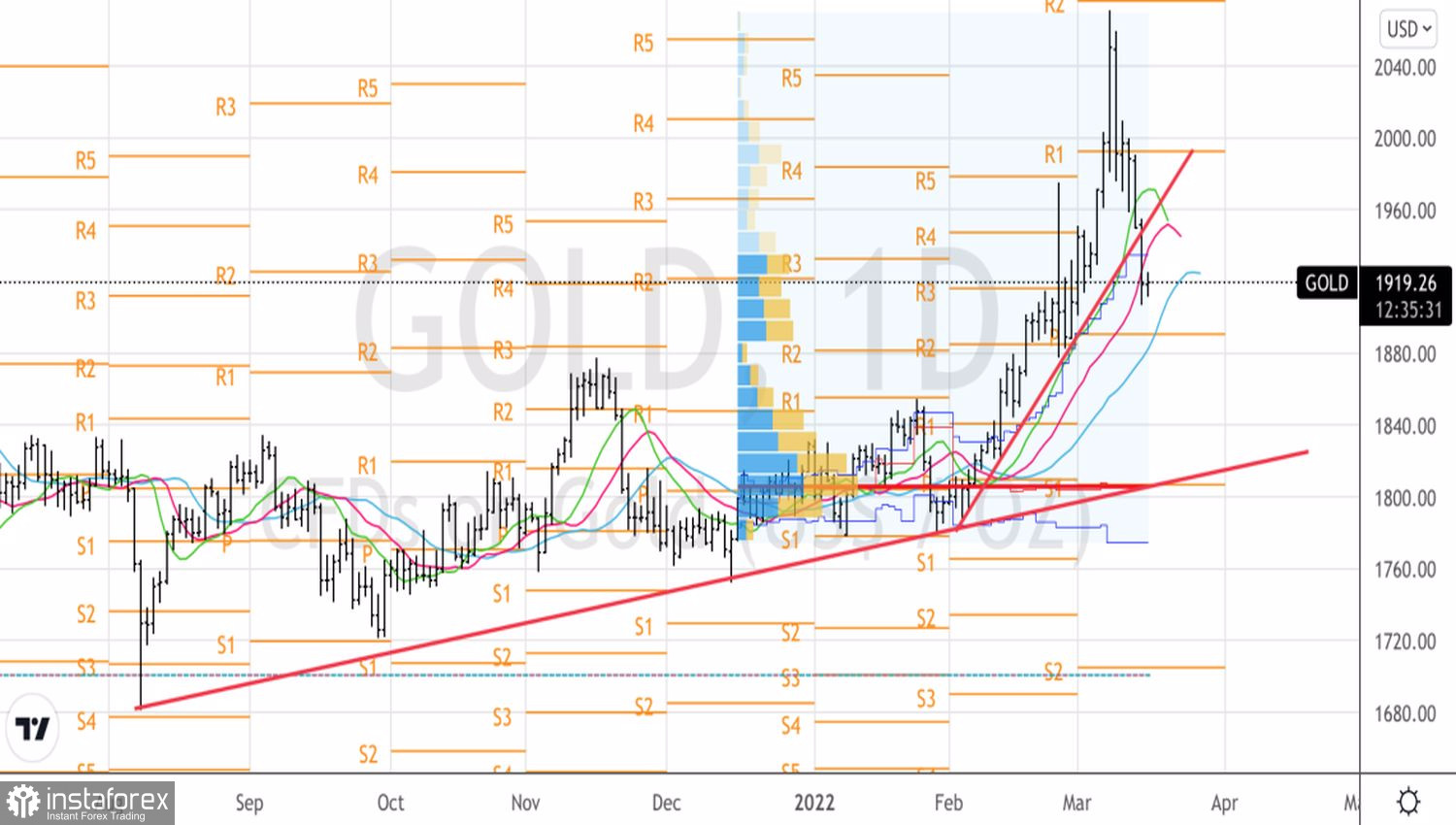

Technically, on the daily chart of the precious metal, there is a "surge and reversal with acceleration" pattern. A rebound from resistance at $1,930 and $1,950 per ounce or an update of the local lows at $1,907 should be used to form short positions in the direction of $1,880 and $1,840 per ounce.

Gold, daily chart