No matter how hard hawkish policymakers tried, they failed to save the British pound from its steepest drop since March 2020. Three members of the Monetary Policy Committee voted to increase the policy repo rate by 50 bp at once in May, but this did not support sterling bulls. The statement of the Bank of England about the British economy slipping into recession and a rapid collapse in the US stock market a day after the FOMC meeting dragged the pound/dollar pair down.

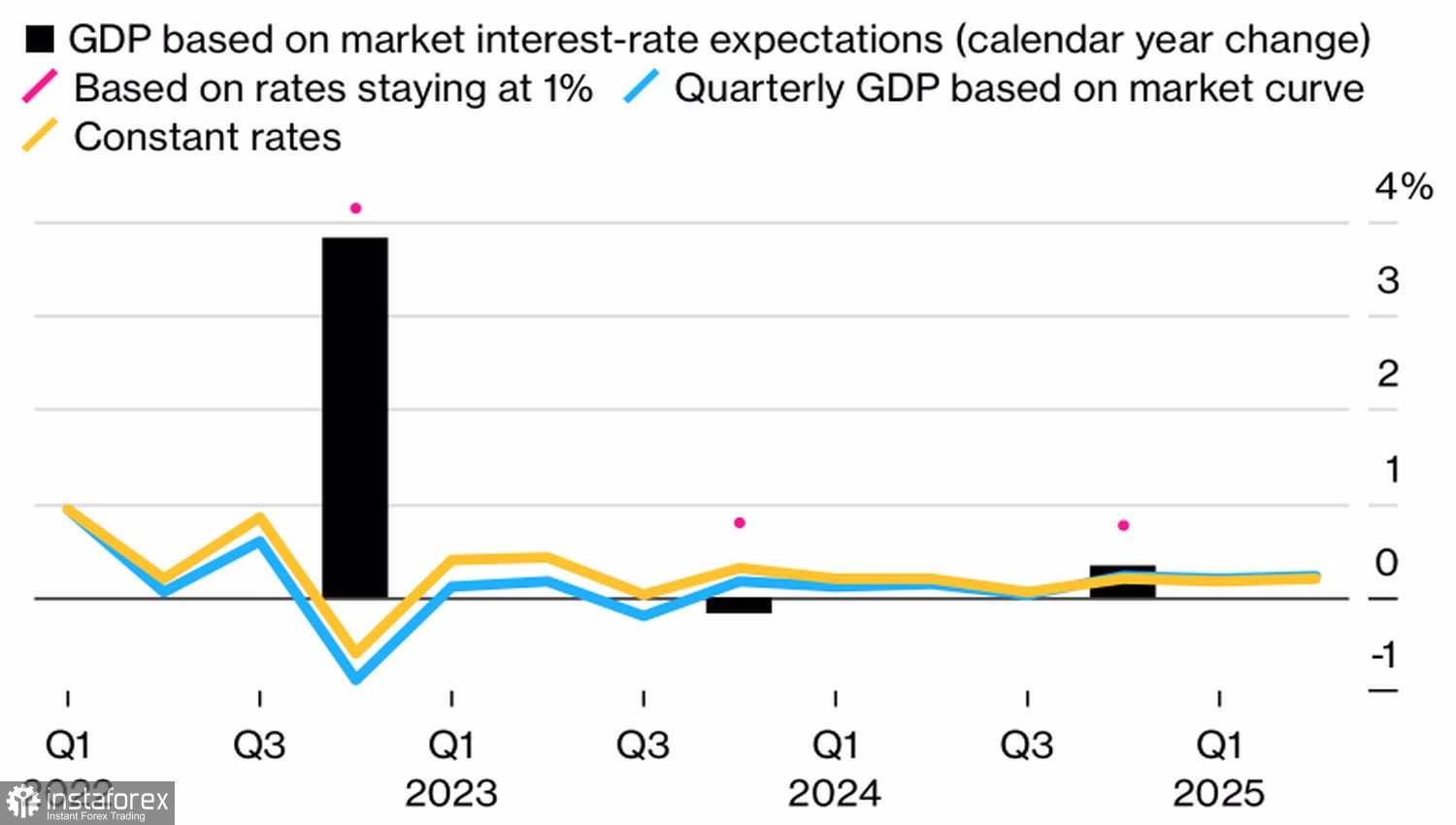

According to the central bank, the UK risks falling into recession in 2023. The regulator expects inflation to peak this year before falling back to 1.5% by 2024. The unemployment rate is forecast to rise from the current 3.8% to 5.5%. Two years of economic stagnation and almost 600,000 job losses are the price of taming UK inflation, estimates from the Bank of England indicate. According to the central bank, consumer prices will first soar above 10% in the autumn and then fall below the target of 2% in a year and a half to two years.

BoE forecasts

It is obvious that with such (the gloomiest among all the world's leading central banks) forecasts on the dynamics of key macroeconomic indicators, market expectations of an increase in the repo rate to 2.25% by the end of 2022 and to 2.6% by mid-2023 were excessive. After the MPC meeting, they fell to 2% and 2.5% respectively, which triggered a steep decline in the British pound. Three committee members who voted to raise borrowing costs by 50 basis points, failed to back up the currency as investors focused on those policymakers who had supported further tightening in monetary policy. The seven officials said that some degree of monetary tightening might be appropriate in the coming months.

While the Bank of England warns that the economy could slide into recession, Fed Chairman Jerome Powell is confident that the US economy will be able to withstand a series of aggressive interest rate hikes. While the BoE may pause after four consecutive monetary tightening cycles, the Fed intends to make one or two big steps by raising rates by 50 bp at the next FOMC meetings. The US regulator plans to actively shrink its balance sheet, while Andrew Bailey and his colleagues will decide on this issue only in August. These divergences in economic growth and monetary policy are the reason the pound/dollar pair is trading downwards, approaching the level of 1.2.

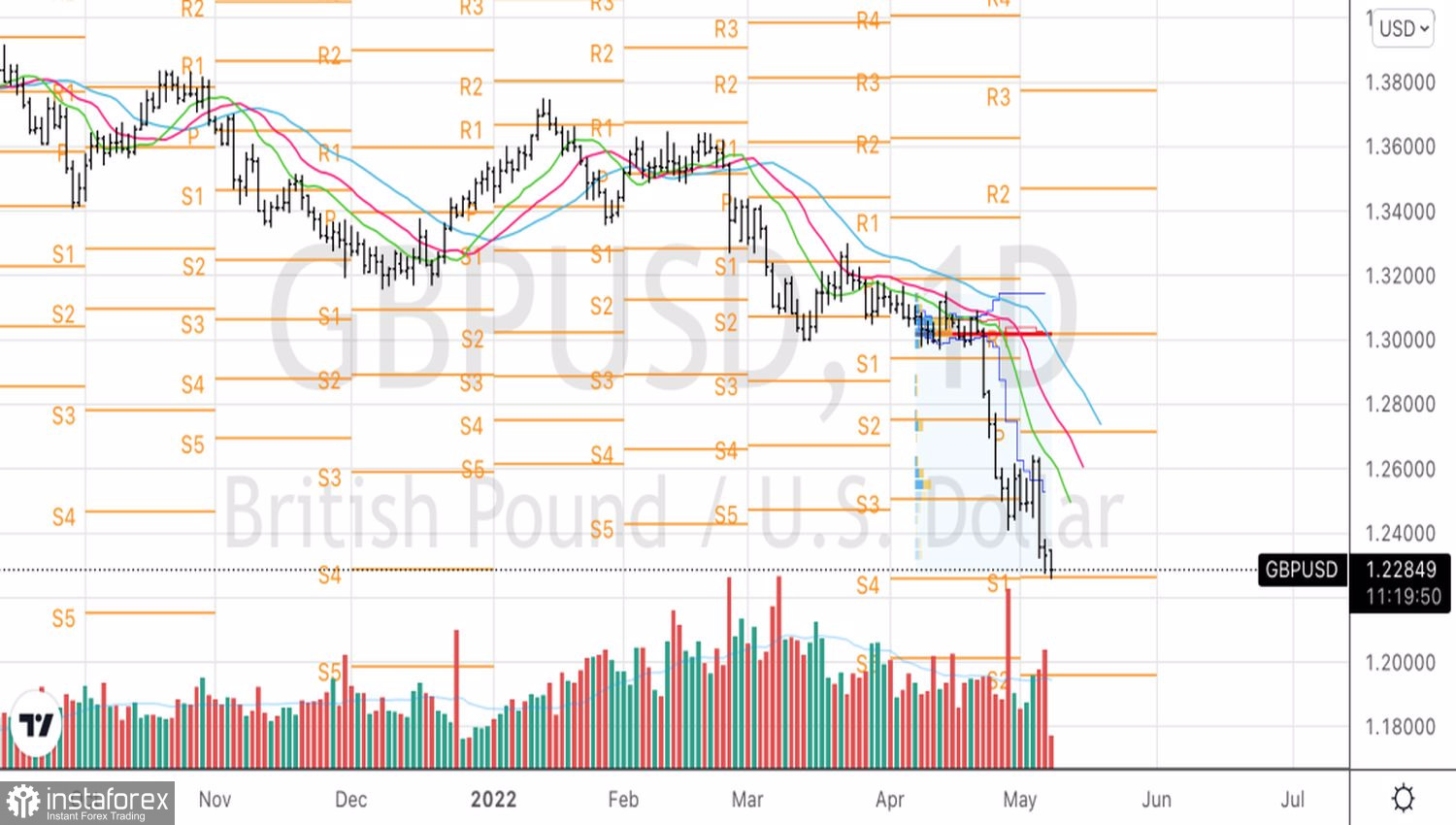

While a drop in US stock indices supports the greenback, the related decline in global risk appetite is a negative factor for the pound sterling. As long as investors adhere to the "sell shares on growth" strategy, the pound/dollar pair is unable to enter a correction. Even the fact that Bloomberg experts see the US inflation rate easing from 8.5% to 8.1% in April is unlikely to have a severe adverse impact on the US dollar. If one of the GBP/USD bears decides to close their short positions and lock in profits, others will come to take their place.From a technical point of view, the downtrend is strong. As long as the quotes are below the pivot point of 1.243, the best way to make a profit is to sell the pair with a view to reaching the 1.2 mark. The signal may come after the price breaks through the support level of 1.226.

GBP/USD, daily chart