According to Bloomberg Intelligence, which draws parallels to the 2000 dot-com bubble: Crypto winter 2022 is a necessary downturn to get rid of unnecessary speculation and build a stronger foundation.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said the bursting of the internet bubble was a reminder that nascent assets are highly volatile, and he sees the cryptocurrency winter of 2022 as a necessary cleansing of speculative excesses.

The crypto space is still experiencing the crash that happened last week, which wiped out $1 trillion of the total cryptocurrency market capitalization, with many cryptocurrencies falling to levels not seen since 2020.

The crash was closely linked to a sell-off in the US stock market as investors embraced risk aversion ahead of an aggressive Fed interest rate hike.

However, Bloomberg Intelligence still predicts that the cryptocurrency market will continue to grow.

According to McGlone, cryptocurrencies are poised to continue outperforming most assets. The main reason for the drop is that the total market capitalization of crypto assets listed on Coindance fell by about $1 trillion until May 13, and it is associated with a drop in global equities of about $20 trillion.

The biggest price drivers in the crypto space will be Bitcoin, Ethereum, and crypto dollars, which make up about 70% of the total crypto market capitalization.

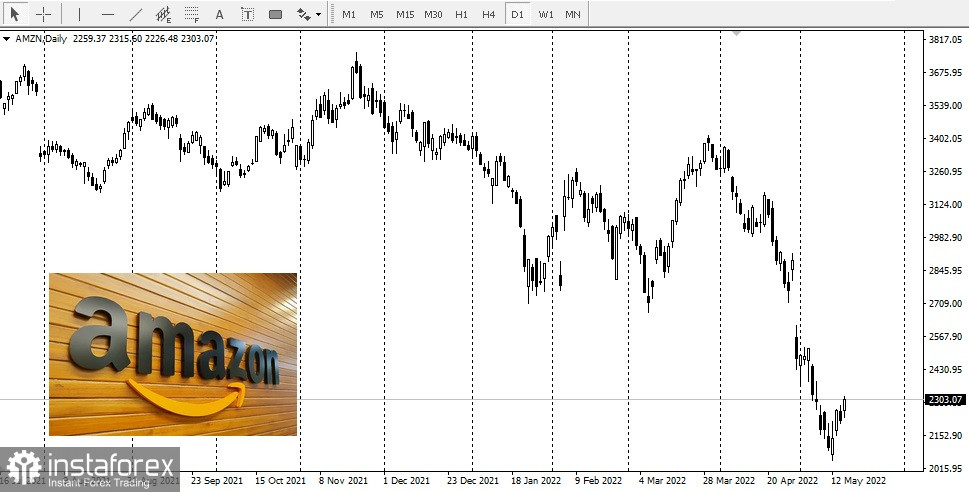

McGlone also added that Bitcoin could go down the same unstable path as tech giant Amazon.

"The crypto's 260-day volatility to May 13 is, at about 70%, nearly the same as Amazon's stock was in 2009... In a world rapidly going digital, we see the benchmark crypto well on its way to becoming collateral. Old-guard gold positions appear increasingly naked in portfolios if not paired with Bitcoin," McGlone said.