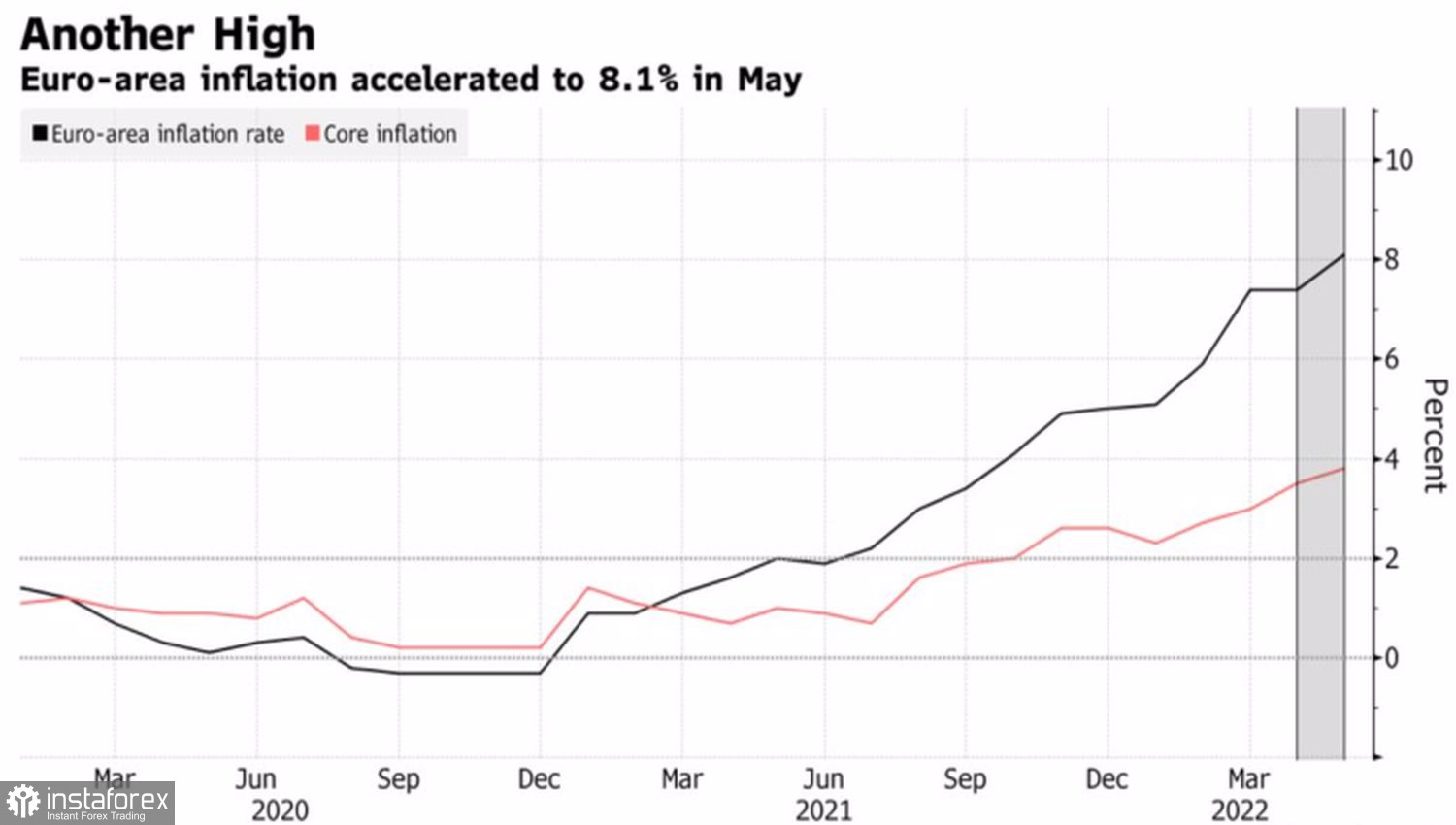

There is safety in numbers. The acceleration of European inflation to a record high of 8.1% was the last trump card of the "bulls" in EURUSD. As soon as it won back and the quotes fell below the level announced in the previous material for entering the short at 1.0735, the main currency pair went where it was supposed to. Down. No matter how much Dutch central bank chief Klaas Knot, says that a further acceleration in consumer prices in May and June is a strong argument in favor of raising the deposit rate in July, most members of the Governing Council think otherwise.

Dynamics of European inflation

Bank of Italy Governor Ignazio Visco said that the ECB should not rush to tighten monetary policy, as the economic growth of the currency bloc is vulnerable to failure, and speculation in the markets can lead to negative consequences. According to his French colleague Francois Villeroy de Galhau, the dynamics of inflation require a gradual but decisive monetary restriction. ECB President Christine Lagarde believes that by the end of the third quarter, the deposit rate will come out of the negative area, and Philip Lane called it a 25 bps increase in July, and then by 25 bps in September—the reference path of the European Central Bank.

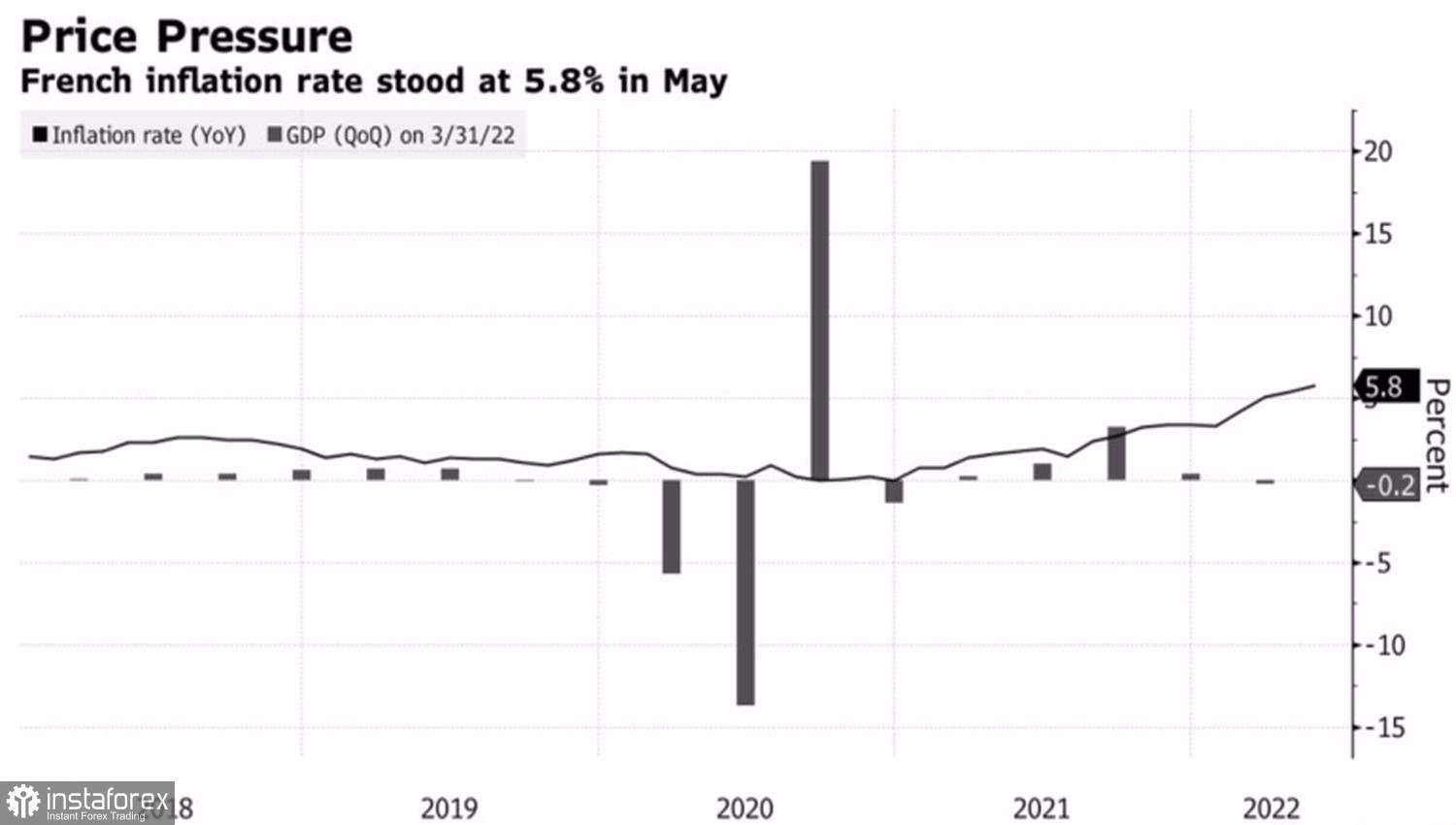

In my opinion, the benchmark is France, whose economy sank by 0.2% in the first quarter, while inflation accelerated to 5.8%. The country is facing stagflation, and the entire currency bloc will soon follow the same path. How can the euro strengthen under such conditions? That's right, it can't. The EURUSD pair has exhausted all its growth potential and will gradually lose ground.

Dynamics of inflation in France

It should be noted that the futures market is setting expectations for a 110 bps increase in the deposit rate until the end of 2022, while the forecast for the federal funds rate for the same period is 250 bps. In my opinion, in a pronounced stagflationary environment, the ECB will do less than is expected of it. The Fed, by contrast, is ready to do more. FOMC member Christopher Waller intends to vote for a 50 bps increase in borrowing costs at each Committee meeting until US inflation slows to 2%.

US President Joe Biden calls the task of combating it a priority and argues that due to the tightening of monetary policy by the Fed, the increase in employment outside the US agricultural sector could be reduced from more than 500,000 to 150,000 per month. It seems that investors have clearly overestimated the chances of a pause in the Fed's monetary restriction process and will soon begin to return to the US dollar.

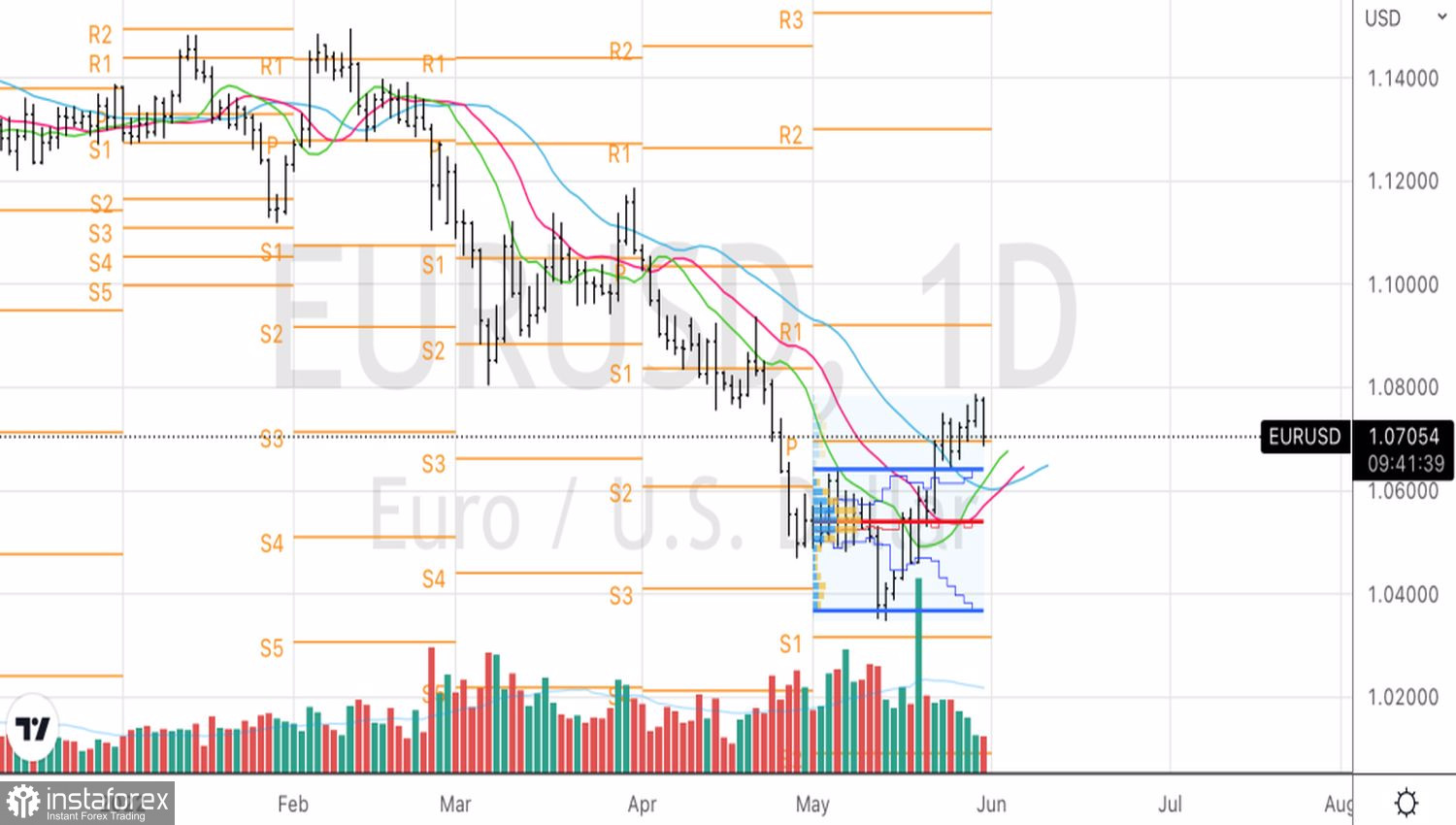

Technically, on the daily chart, EURUSD bears are testing an important pivot point at 1.07. The pair may continue to fall towards the upper limit of the fair value range of 1.037–1.064. On the hourly timeframe, the Three Indians pattern, identified in the previous article, clearly plays out. A successful assault on the support at 1.0685 will allow increasing the shorts formed from the level of 1.0735.

EURUSD, Daily chart

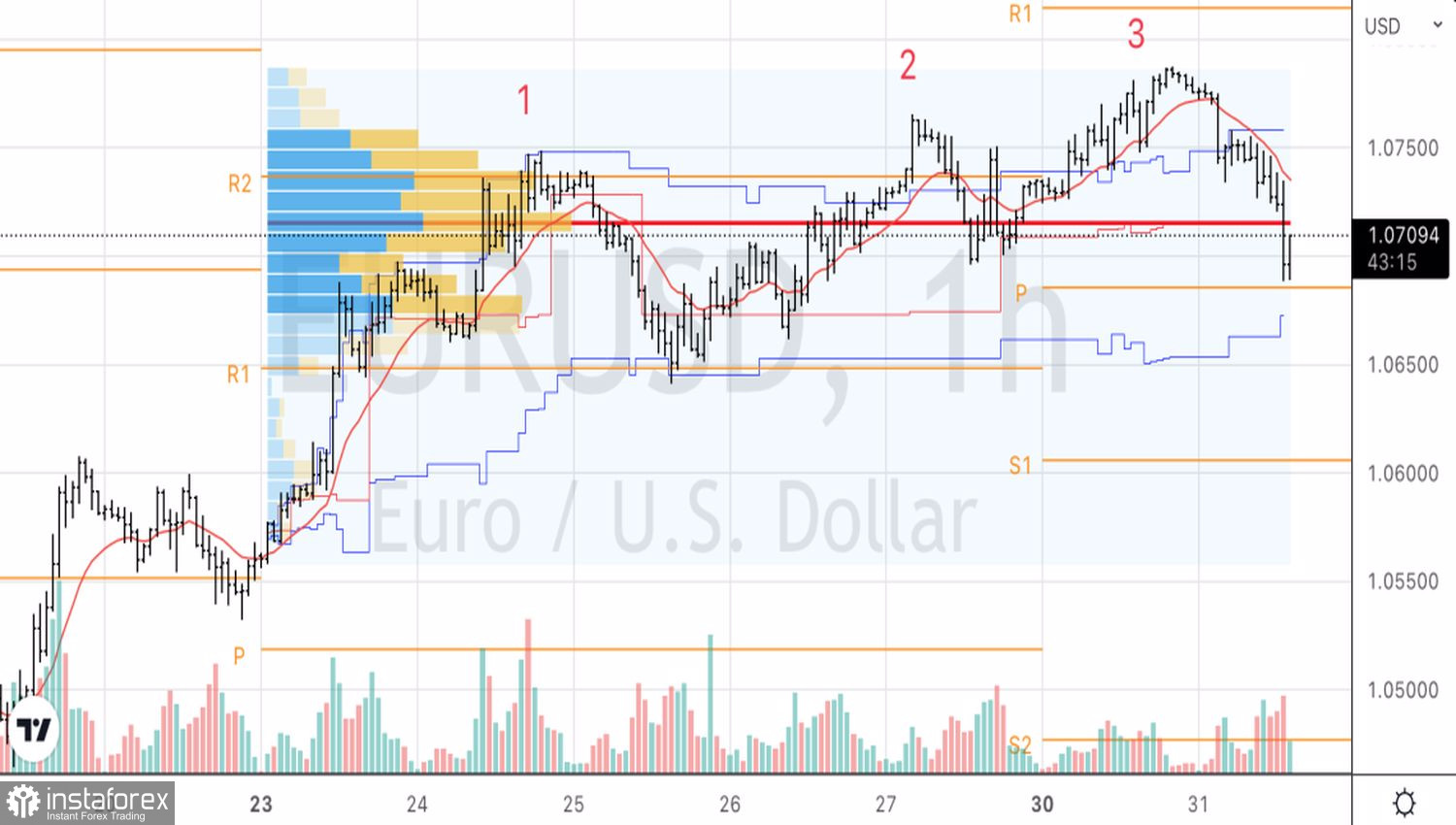

EURUSD, Hourly chart