The EUR/USD currency pair stood in one place for most of the day on Wednesday. The pair spent some time above the moving average line, that is, it maintained an upward trend, but then it still collapsed down. At the moment, the pause in the growth of the European currency is only a couple of days. That is, if we consider the three-week growth of the euro as an independent new trend, now absolutely nothing terrible has happened. A pause for a few days is normal and no trend can do without them. Nevertheless, at this time the market has to solve a rather important issue for itself. We have already said earlier that the main factor in the growth of the European currency is technical. This can be seen even from the macroeconomic data, which have not been unequivocally in favor of the euro currency in the last three weeks and, accordingly, could not provoke the growth that the euro eventually showed.

Thus, the global upward correction can now continue, and then the euro does not need any "foundation" or "macroeconomics" at all to move in the right direction. Or the global downward trend may resume, which is still supported by fundamental, macroeconomic, and geopolitical factors. Of course, you should follow the same moving and the same linear regression channels. They will not be able to predict the future movement of the pair 100% correctly, but it should still be understood that fixing below the moving average will significantly increase the likelihood of not just a small drop in the euro currency, but the resumption of an almost 2-year downward trend, within which the pair has already fallen not so long ago to its 20-year lows. Thus, the bulls, of course, have made a good step forward, but, unfortunately, there are very few factors that could support the euro now. And there are fewer of them every day.

Hungarian leader continues to go against the whole EU

Yesterday, we already said that the European Union, after some delay related to Hungary, still imposed the sixth package of sanctions against Russia, which provides for disconnecting Sberbank from Swift, as well as an oil embargo on 2/3 of Russian oil. As we said earlier, Viktor Orban will not be able to block the initiative of the 26 EU member states. Of course, the Hungarian leader tried to bargain for the most favorable conditions for himself in exchange for approval of the rejection of Russian oil, but the European Union felt that it was easier to turn a blind eye to both Orban and Hungary. Oil supplies to Hungary are so insignificant that if 26 EU countries agree to the embargo, then nobody is interested in Hungary's opinion. Moreover, in Europe in recent weeks, criticism of Viktor Orban has been increasingly heard, although he won the recent elections in his country very confidently, at the same time his rhetoric is increasingly radically different from that of other European leaders.

Recall that the entire European Union is set to help Ukraine: financial, military, and humanitarian. And only Hungary refuses even to let cargo into Ukraine through its territory. Almost all EU countries approve of the oil embargo against Russia, but Hungary is against it again. A reasonable question arises: maybe Hungary is superfluous in the EU? It is this issue that is being discussed by the European media and individual journalists. Recall that the European Union is not just a community of 27 countries, where each country can do what it wants. There should be solidarity with other members of the Alliance, there should be a lack of material interest in approving or refusing to make certain decisions. All this is now leading to the fact that Hungary will be the first on the list for a new Brexit. Moreover, if the UK left the EU on its own, Hungary may simply be asked to leave. Recall that if all other members of the bloc vote for Hungary's withdrawal from the EU, the country will leave it. In general, Viktor Orban is now openly playing with fire, clearly forgetting that his country is far from the most significant player even within the European Union itself.

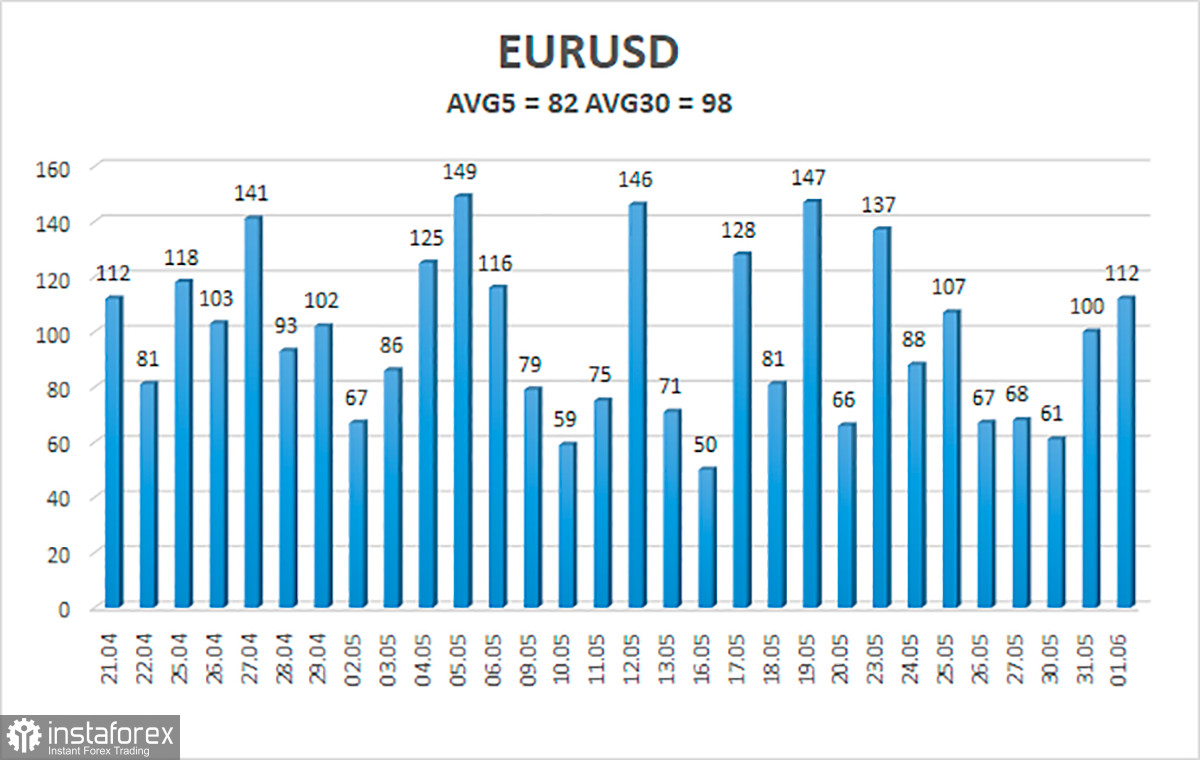

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 2 is 82 points and is characterized as average. Thus, we expect the pair to move today between the levels of 1.0560 and 1.0722. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0620;

S2 – 1.0498;

S3 – 1.0376.

Nearest resistance levels:

R1 – 1.0742;

R2 – 1.0864;

R3 – 1.0986.

Trading recommendations:

The EUR/USD pair continues to gain a foothold below the moving average and may begin forming a new downward trend. Thus, now you should stay in short positions with targets of 1.0620 and 1.0560 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.0864 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.