"The big decline in the yen in a short amount of time is hurting the economy," Bank of Japan Governor Haruhiko Kuroda said early in the trading day. At the same time, "as long as the moves are not too sharp, a weak yen is beneficial for Japan's economy. One could talk about a strategy to wind down the easing policy if the 2% inflation target were on the horizon, but now is not the time," Kuroda said. On these statements by Kuroda, the yen weakened sharply, and the USD/JPY pair continued to grow, which was interrupted in the previous month, which was negative for this currency pair.

Kuroda's remarks follow on from his yesterday's similar remarks about the current exchange rate of the yen and the policy of the Bank of Japan: "Our highest priority is to support the Japanese economy through continued strong monetary easing. The Bank of Japan will be unwavering in its stance to maintain monetary easing to ensure that the recent rise in inflation expectations will lead to sustained price increases."

In fact, Kuroda only confirmed his already traditional statements about the monetary policy of the central bank and the inclination of its leadership to continue the ultra-loose monetary policy.

Since January 2016, the key interest rate in Japan has become negative. During the meeting on January 26, 2016, the Bank of Japan made it negative for the first time, reducing it from 0.10% to -0.10%. And since then, at every meeting, the leaders of the Bank of Japan have declared the need to maintain a negative interest rate and the parameters of the current ultra-loose monetary policy.

And now, when many of the world's largest central banks have begun a cycle of tightening their monetary policies, the Bank of Japan does not intend to deviate from its beliefs on this matter.

"It is advisable to maintain the current strong monetary easing to support the economy. Western central banks are normalizing policies, but Japan is not in that situation given its economy and price trends," Kuroda said, commenting on the April 28 meeting of the Bank of Japan, where he reaffirmed his intention not to raise interest rates despite accelerating inflation. According to the forecast of the leaders of the bank, the core inflation in the country (in the financial year ending in March 2023) will reach 1.9%, only approaching the target level set by the central bank of 2%, and in the 2023–2024 financial year, inflation will slow down to 1.1% and will remain at this level in the following financial year.

At the same time, according to the bank's forecast, this fiscal year the Japanese economy will grow by 2.9%, and not by 3.8%, as previously thought. In 2023–2024, GDP growth is expected at 1.9%, and in the next fiscal year at 1.1%, demonstrating a slowdown.

As a result of this (April 28) meeting, the central bank also stated that it will buy 0.25% government bonds every business day to keep the yield below this level, which is also a powerful quantitative easing tool used by many central banks.

Thus, the yen will remain the most vulnerable among the world's major currencies, also supporting the growth of the DXY index (the share of the yen in the basket of the DXY index of 6 currencies is known to be approximately 14%).

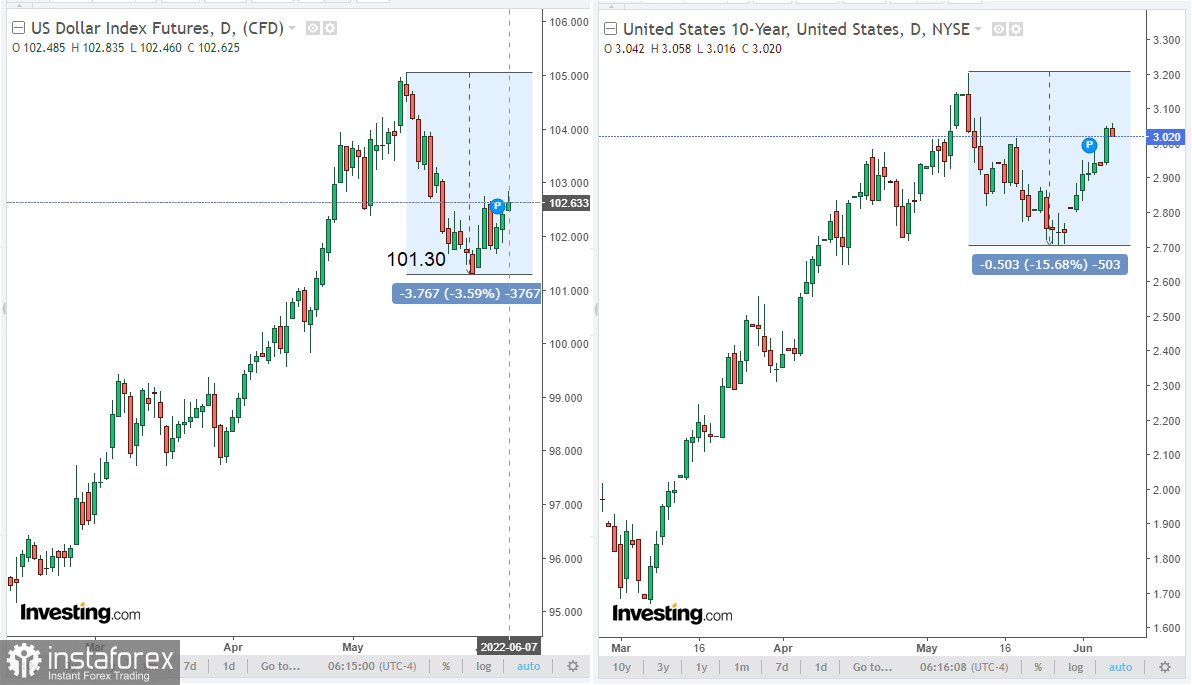

At the same time, the dollar continues to strengthen, while the dollar index (DXY) continues to rise. At the time of writing this article, DXY futures are trading near 102.63, 133 points above the local low of 101.30 hit last week.

During today's Asian trading session, USD/JPY hit a 20-year high at 133.00 and its positive momentum continues.

The dollar is also receiving support from the high yields of US government bonds. They continue to fall in price, while the yield on 10-year bonds reached 3.058% today, the highest level since May 12.

The continued positive upward trend in the yield of 10-year US bonds makes the dollar an attractive asset for investment, given the prospects for further tightening of the Fed's monetary policy. The dollar is also actively used as a defensive asset, winning over traditional defensive assets such as gold, franc, and yen.

Today, market participants who follow the dynamics of the yen and the USD/JPY pair are likely to pay attention to the publication of the report by the Japanese cabinet ministers with data on the country's GDP for the 1st quarter of 2022.

In the previous 4th quarter, the country's GDP grew by +1.1% (+4.6% in annual terms) after falling by -0.9% (-3.6% in annual terms) in the 3rd quarter, growth in the 2nd quarter by +0.5% (+1.5% in annual terms) and falling in the 1st quarter of 2021 by -1.0% (-3.7% in annual terms). The data point to the uneven recovery of the Japanese economy after its collapse due to the coronavirus pandemic in 2020.

Today's final release implies that Japan's GDP fell by -0.3% (-1.0% YoY) in Q1 2022, negative for both the yen and the Japanese stock market. The forecast assumed a decline of -0.4% (-1.8% in annual terms). Better-than-expected data is likely to help the Japanese stock market and the yen rise. An upward trend in GDP is considered positive for the national currency, while a low result is considered negative (or bearish).