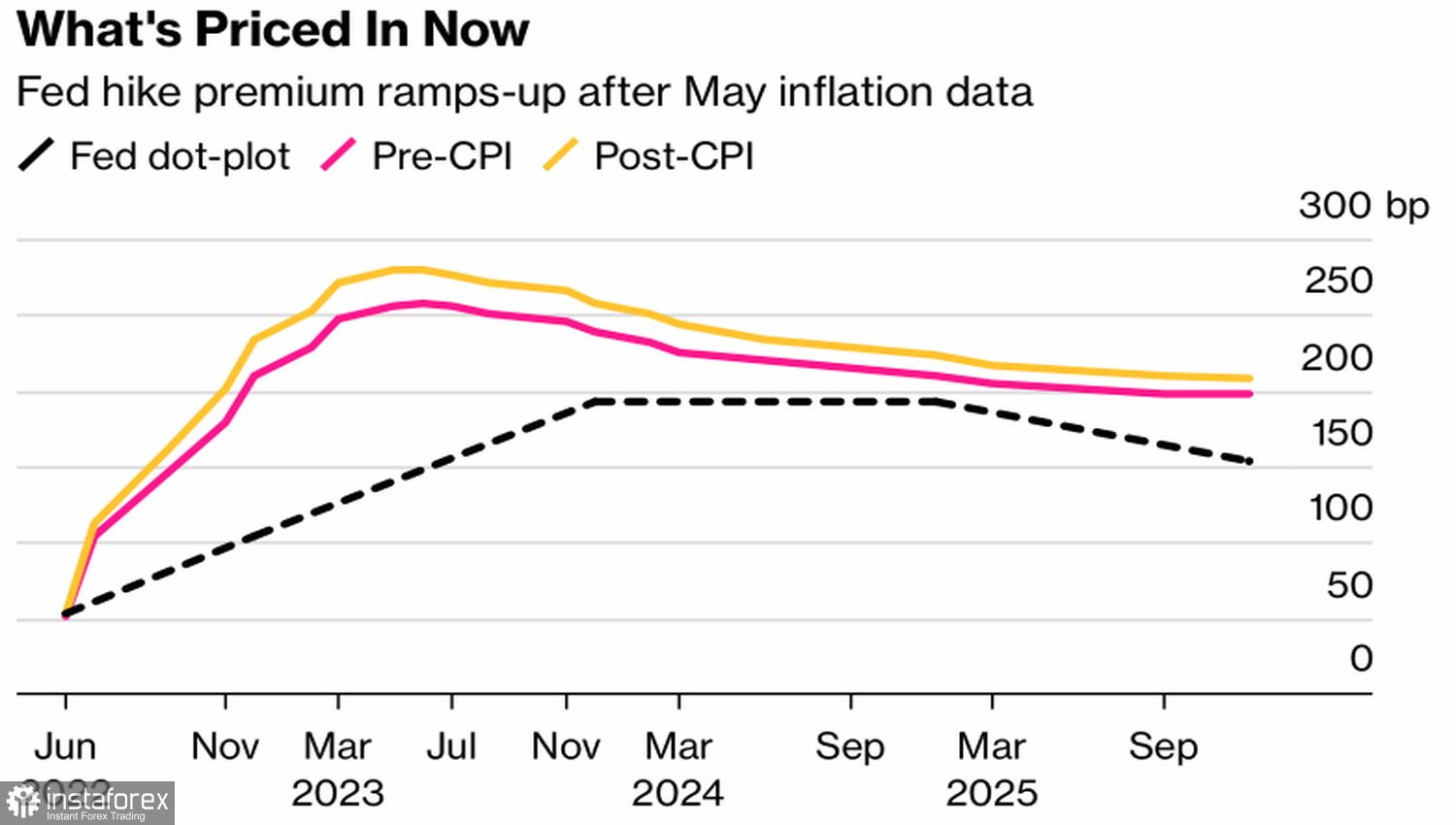

Sell everything except the US dollar! This slogan is quickly spreading through financial markets, causing stock indices to fall, bond yields to rise and EURUSD to fall below 1.05. The release of US inflation data for May was the catalyst. Consumer prices unexpectedly accelerated to 8.6%, giving central banks license to aggressively raise borrowing costs. The futures market is signaling that the federal funds rate will increase by 175 bp by the end of the third quarter, which implies a 75 bps increase at one of the FOMC meetings. In June, July, or September.

Dynamics of market expectations and Fed rate forecasts

Central banks usually act like a pack, led by the Fed. Therefore, one should not be surprised at the growing chances of higher borrowing costs, not only in the US but also in the eurozone. Investors predict that by October the ECB deposit rate will rise from -0.5% to 0.75%. We are talking about two increases of 50 bps and one 25 bps at once. Against this background, the first rise in the last decade in the yield of 2-year German bonds above 1% looks logical. It could have supported EURUSD bulls if not for a faster rally in the US and Italian debt rates.

Since the ECB has not outlined a plan to rescue the European bond market, investors are wondering: who will buy Italy's bonds after the end of QE? Yields on 10-year bonds soared to their highest levels since 2014, while the spread with German peers widened to 233 bps, the highest level since May 2020.

Dynamics of yield differential of Italian and German bonds

The situation is no better with the sales of French securities. Opinion polls show that Emmanuel Macron's party will lose its majority in parliament next weekend, which increases political uncertainty and forces investors to flee Paris like rats from a ship. The fact that the ECB does not have a plan to stop all of this exacerbates the panic and contributes to the fall of the EURUSD.

Along with bonds, investors are rushing to get rid of stocks. Moreover, the yield curve in the US has inverted for the first time since April. The rates on 2-year bonds exceeded the rates on 10-year bonds, which signals the proximity of a recession. 70% of Financial Times experts are confident that the US will face it next year. The highest rates (38%) go to the first and second quarters. 30% of respondents expect a decline in the third or fourth. Its approach causes the S&P 500 to dive into the abyss and further fuels the demand for the US dollar as a safe-haven currency.

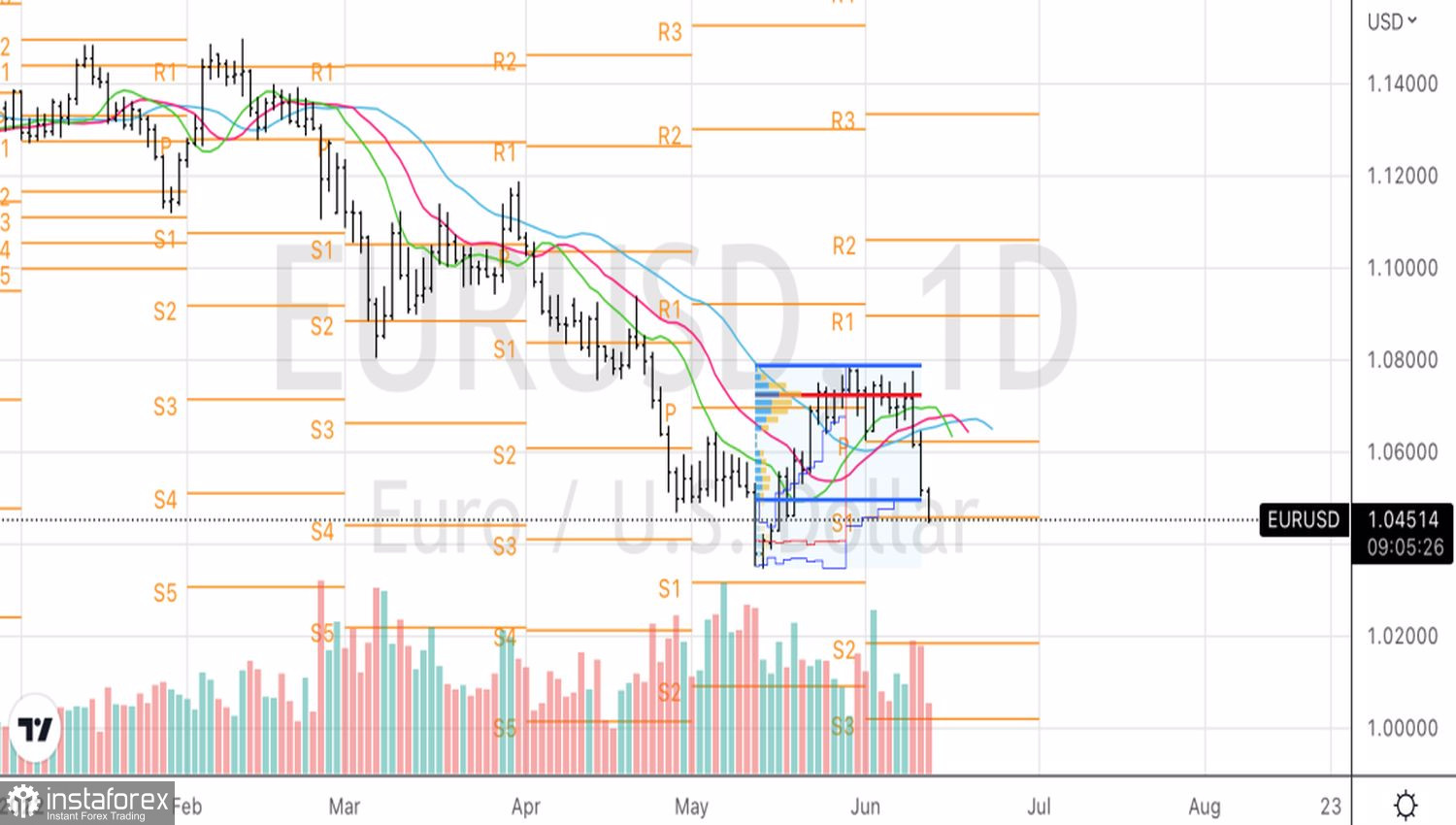

EURUSD, Daily chart

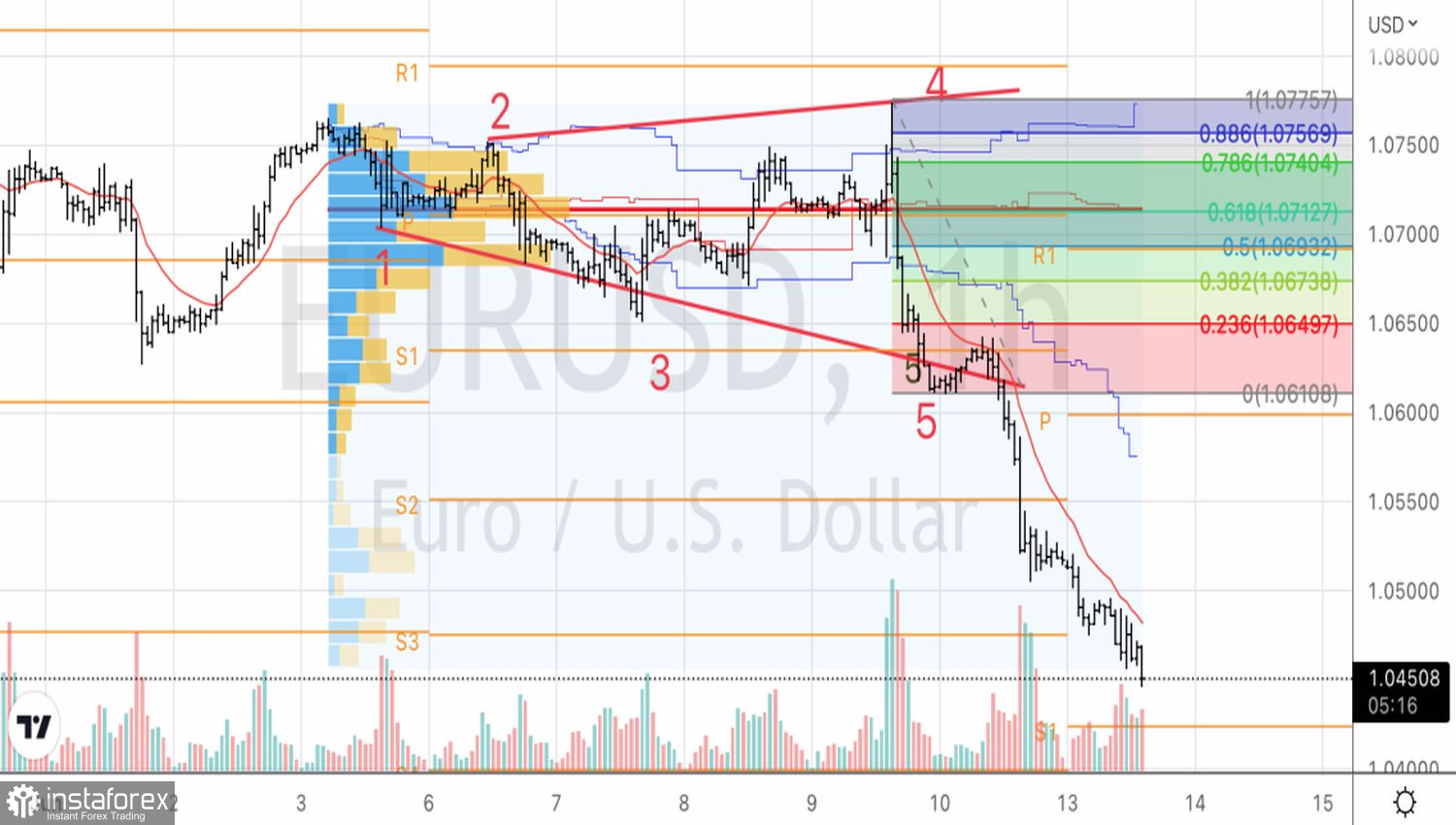

EURUSD, Hourly chart

Technically, on the EURUSD daily chart, quotes going beyond the lower limit of the fair value range of 1.05–1.079 indicates the seriousness of the bears' intentions. A break of support at 1.046 would allow shorts to build towards 1.032 and 1.022. The Broadening Wedge pattern clearly worked out on the hourly timeframe. Pullbacks should be used for selling.