The rise of gold to $1880 per ounce after the publication of statistics on consumer prices in the United States for May might seem logical. The precious metal is traditionally perceived as a tool to hedge against inflation risks, so the CPI crackdown theoretically should have forced investors to buy it. In fact, the XAUUSD rally turned out to be a "dead cat bounce," followed by a natural collapse. Well, gold can't grow when the chances of an aggressive increase in the federal funds rate are rapidly increasing, the US dollar is strengthening, and the two-day rise in treasury bond yields is the best since the 1980s.

The Fed's generosity in stunning investors with colossal amounts of cheap liquidity to bail the economy out of recession in 2020 could not last indefinitely. The result of ultra-loose monetary policy has been a negative slide in real debt rates, fueling an unbridled appetite for risk. Everything was swept away—from bitcoins and stocks of technology companies to precious metals. Now it's time to take the money, and investors poured in. The rise in US Treasury yields is turning into a capitulation of the Nasdaq Composite and cryptocurrencies. The XAUUSD bulls are still holding on, but their days are probably numbered.

Nasdaq Composite and US Treasury yields

Over the past 60 trading days, rates on benchmark 10-year US debt have jumped by 150 bps. We are talking about the fastest rally since the start of the issuance of inflation-protected securities in 1990. It surpassed a similar rally in 2013. That is, we can say that the current panic in the market overshadows the taper tantrum on the announcement of the Fed's transition to quantitative tightening.

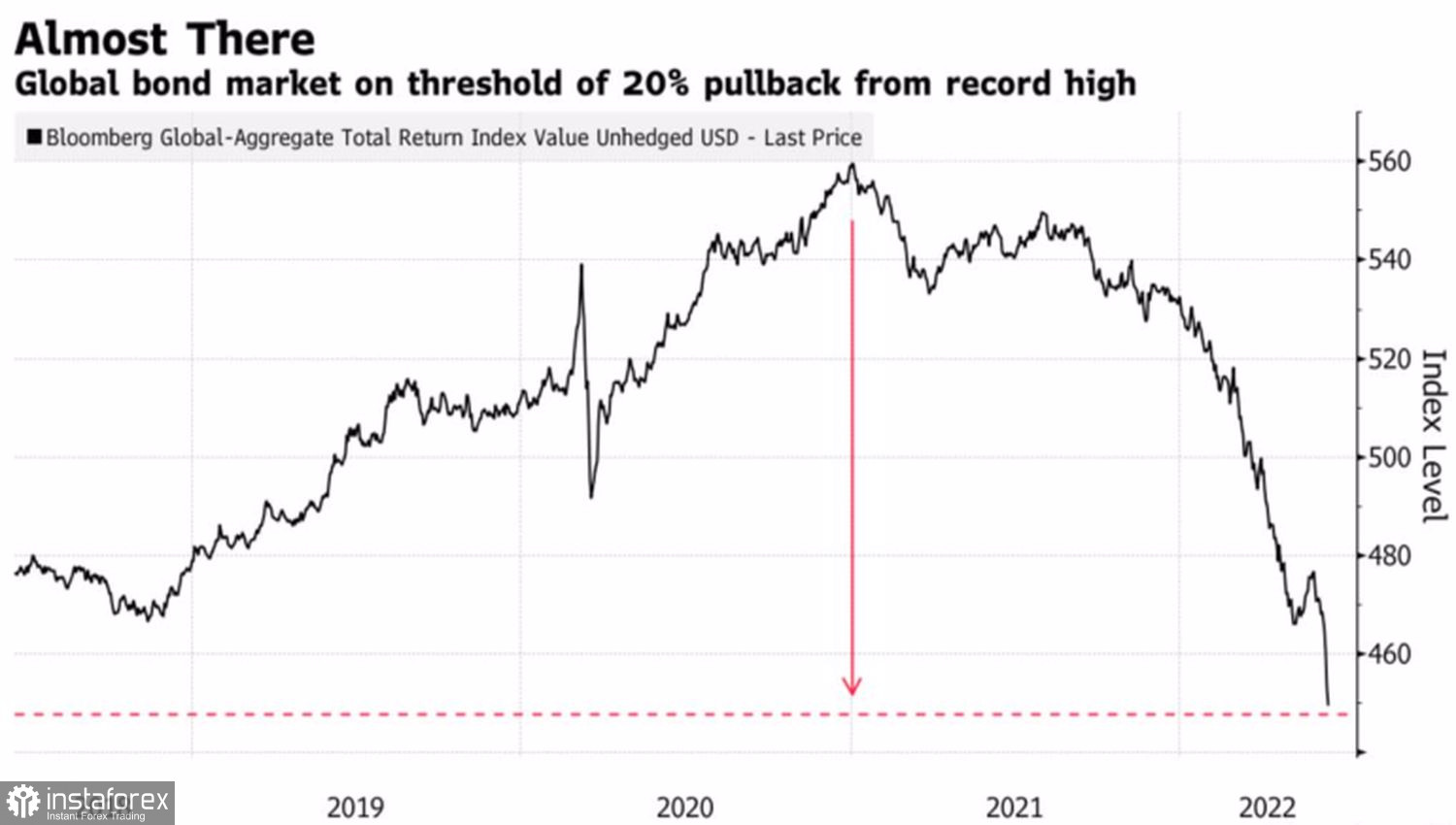

Today, the central bank's balance sheet will shrink significantly faster, and if we add to this the decline in assets on the balance sheets of the ECB, the Bank of England, and the Bank of Japan, a figure of $4 trillion will appear by the end of 2023. This is 4 times more than in 2018–2019. It is not surprising that the Bloomberg Global Aggregate Index is on the verge of moving into bearish territory. It marked the worst start to the year since 1990.

Dynamics of the Global Debt Market Index

Gold is not able to compete with interest-bearing bonds, so the increase in the yield of the latter brings new sellers of XAUUSD to the market. Moreover, the increase in real rates on 10-year US debt from -1.25% seven months ago to 0.88% is hurting the currencies of developing countries. It results in an increase in the cost of borrowing, the closure of positions within the carry trade, and the strengthening of the US dollar.

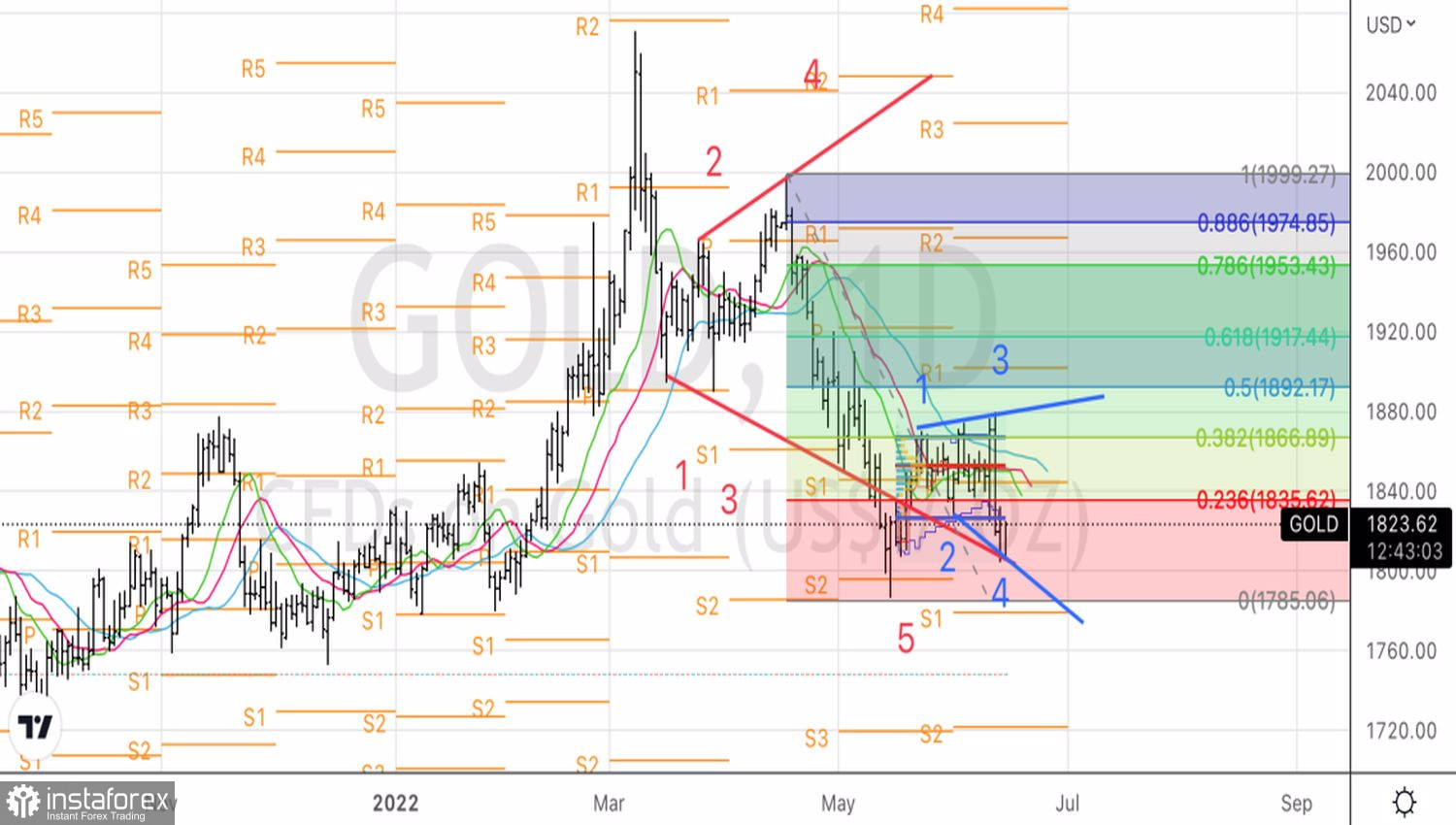

Gold, Daily chart

Technically, as long as gold quotes are below the pivot point of $1845 and the fair value of $1850, bears dominate the market. Rebound from the $1845–1850 convergence zone is a reason to sell. On the contrary, growth above it will increase the risks of the formation of a child pattern of a broadening wedge.