The Bank of England's 25 bps rate increase and its words about the readiness to act decisively if high inflation takes root in the British economy was enough to push the GBPUSD quotes above 1.24. According to Capital Economics, consumer prices in the UK will rise faster than US prices, at least until mid-2023, which forces the BoE to act aggressively. The futures market expects borrowing costs to rise to 3% by the end of 2022, just short of the FOMC consensus for a federal funds rate of 3.4%.

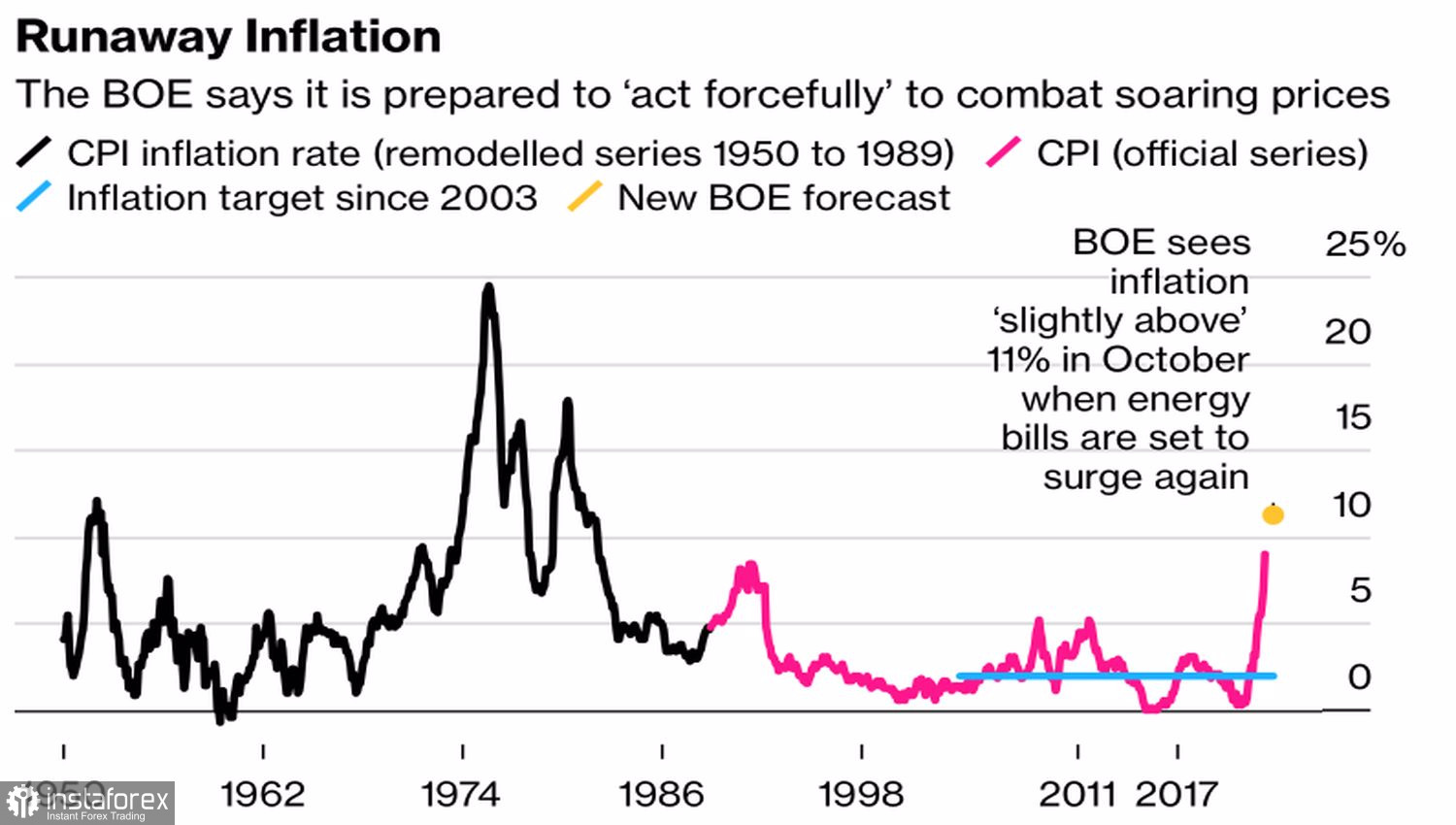

The Bank of England, like many other regulators, is between a rock and a hard place. On the one hand, according to Bloomberg experts, inflation will accelerate to 9.1% in May. At the same time, Natixis expects it to rise to 10%, while the BoE itself predicts an acceleration to 11% in 2022. According to BoE chief economist Huw Pill, if evidence continues to show that consumer prices lead to higher wages, the central bank may raise the repo rate by 50 bps.

Dynamics and forecasts of inflation in Britain

On the other hand, the UK population is facing the most severe cost of living crisis in at least two decades, and 71% of UK citizens polled by YouGov say their costs will increase significantly over the next 12 months. This is the worst result out of 18 countries participating in the survey. For comparison, in the US the figure is 48%.

Dynamics of real wages in Britain

In this regard, the publication of statistics on retail sales and business activity in Britain, which, most likely, will continue to slow down, can play a cruel joke on the sterling. Capital Economics believes that the UK economy is unlikely to grow in the next three years, which is a serious obstacle to the BoE monetary restriction.

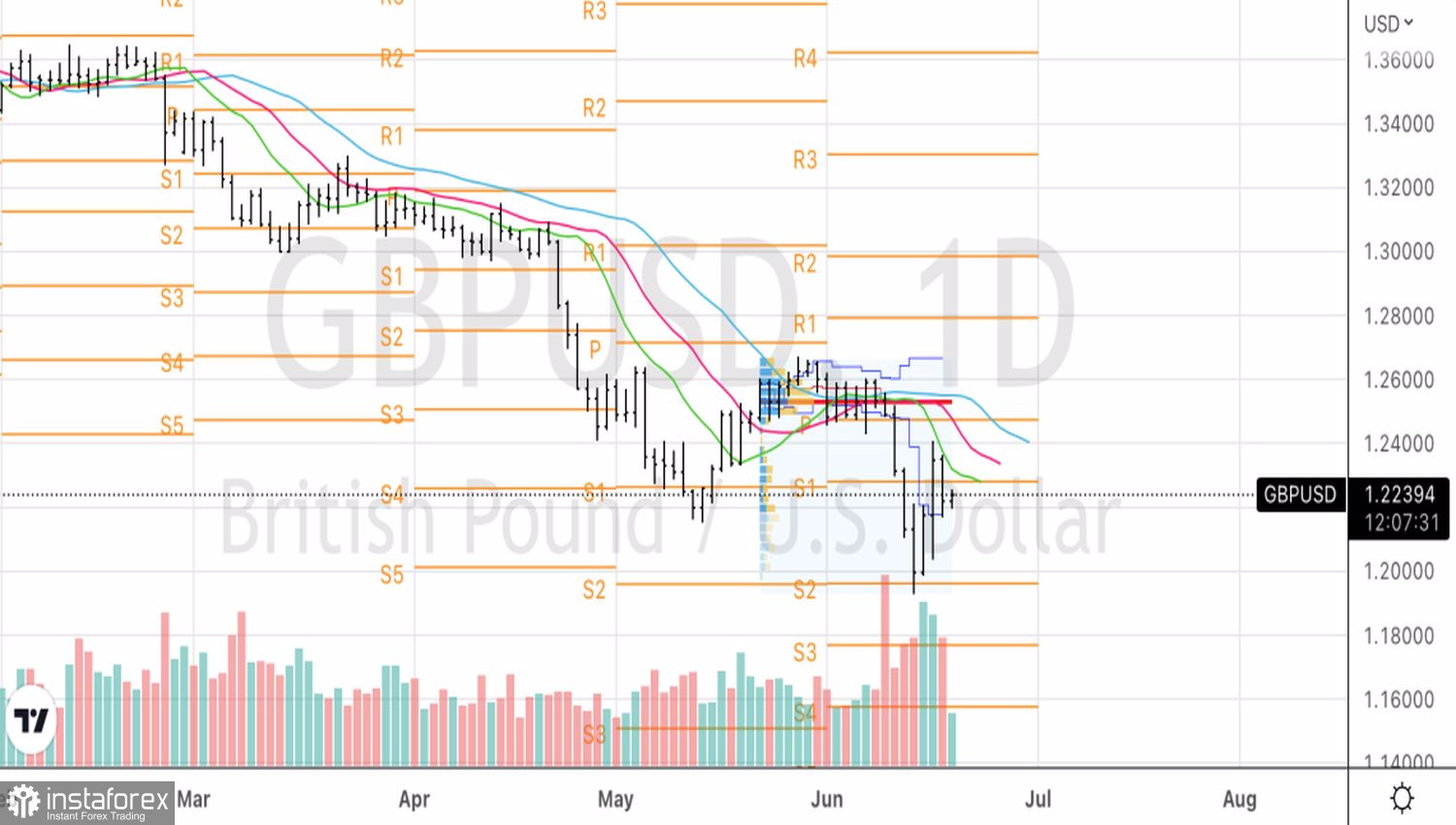

Thus, the economic calendar in the week leading up to June 24 looks very busy for the pound. Releases of data on inflation, retail sales, as well as purchasing managers' indices promise increased volatility in the GBPUSD pair. Based on the input data, investors will weigh whether the BoE will join the "all for 50" club or continue to increase borrowing costs gradually, as it has done before. In addition, the deterioration of macro statistics can provoke talk about a pause in the process of monetary restriction, which is bad news for the pound.

GBPUSD, Daily chart

Technically, there is a pronounced downward trend on the GBPUSD daily chart with a pullback in the direction of dynamic resistances – moving averages, which are part of the Williams Alligator indicator. The inability to overcome the first line of defense of the "bears" in the form of EMA and the pivot point at 1.228 indicates the weakness of the "bulls." As a result, there is an opportunity to implement Linda Raschke's "Holy Grail" strategy and form shorts on a break of support at 1.2165.