Even though the beginning of this week turned out to be calm due to the celebration of Independence Day in the USA on Monday (American banks and exchanges were closed), Tuesday turned out to be very volatile and successful for dollar buyers. Yesterday, the dollar index (DXY) rose by 1.34%, adding 141 points, and confidently fixed in the zone above 106.00. As of this writing, DXY futures are trading near 106.55, close to yesterday's trading day high. As you can see, there is very little left before the next round mark of 107.00, and it will most likely be overcome soon.

The dollar continues to dominate the market. Risk aversion and the Fed's monetary policy, which remains by far the tightest among the policies of the world's major central banks, are the main drivers of the dollar's growth.

At the beginning of this week, the euro probably suffered the most tangible losses against the dollar. On Tuesday, the EUR/USD pair lost more than 150 points, falling to 1.0265, the lowest level since January 2003. The month has just started, and EUR/USD has already lost 2.5%.

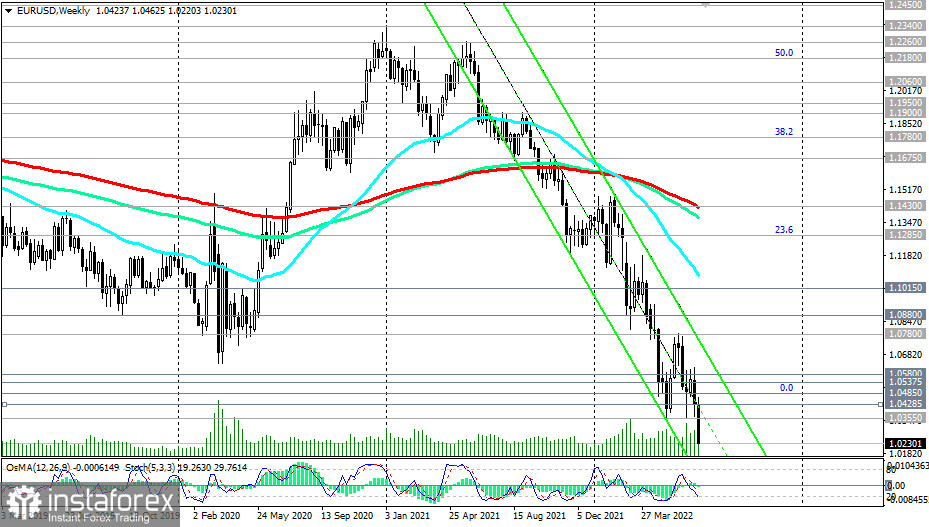

Today, the EUR/USD decline resumed at the beginning of the European trading session. As of this writing, EUR/USD is trading near the 1.0228 mark, moving deep into the descending channel on the weekly chart, the lower limit of which is currently passing near the 1.0100 mark. Taking into account the average daily volatility of the pair of 70–90 points, this distance can be covered in 2–3 days, and there, as they say, the parity of the euro with the dollar is at hand.

There is an acute shortage of energy resources in the world right now, and it's no secret. But it is most acutely felt now in Europe, where significantly increased gas prices have increased the risks of recession and, possibly, stagflation—this is when, with high inflation, the economy is not growing or even shrinking, unemployment is also, as a rule, growing.

At the same time, investor sentiment in the euro area is deteriorating. Thus, the Sentix investor confidence index published on Monday fell to -26.4 in July against the forecast of -19.9 and against the value of -15.8 in May.

Of the other economic data released on Tuesday, the PMIs (from S&P Global Services) for June in Spain, Italy, France, and Germany. Most indicators fell short of expectations and point to an accelerating slowdown in the economy. The Eurozone S&P Manufacturing Composite PMI stood at 52 in June, while the similar PMI for the services sector stood at 53 in June. The euro did not react to these weak positive data in any way, and the data published this morning indicated a weak growth in retail sales in the eurozone (they increased by +0.2% in May against the forecast growth of +0.4% and -1.4% in April. On an annualized basis, retail sales grew only by +0.2% in May against +4.0% in April, and the forecast of +5.4%).

Today, the volatility in the quotes of the euro and the EUR/USD pair will increase at 14:00 with the publication of the PMI index of business activity (from ISM) in the US services sector and at 18:00 (GMT), when the minutes from the June meeting of the Fed will be published. The publication of the minutes is extremely important for determining the course of the current policy of the Fed and the prospects for raising interest rates in the US. Following the meeting, which ended on March 15–16, the leaders of the central bank raised the interest rate by 0.25% (for the first time since 2018) and announced their intention to raise interest rates another 6 times in 2022, also allowing for the possibility of a tougher decision. The mild tone of the protocol will have a positive impact on stock indices and negatively on the US dollar. The harsh rhetoric of the Fed regarding the prospects for monetary policy will push the dollar to further growth, including against the euro.