Who will stop the dollar? Even though the EURUSD bulls managed to catch on to parity and went on the counterattack, there is no talk of a full-fledged correction of the main currency pair. Investors are reinsuring themselves in case Nord Stream resumes operation, Italy avoids a political crisis, and the ECB unexpectedly raises the deposit rate by 50 bps instead of 25 bps. The euro should go up, as so much bad news has already affected its quotes. Alas, the coincidence of all three events all at the same time seems unlikely.

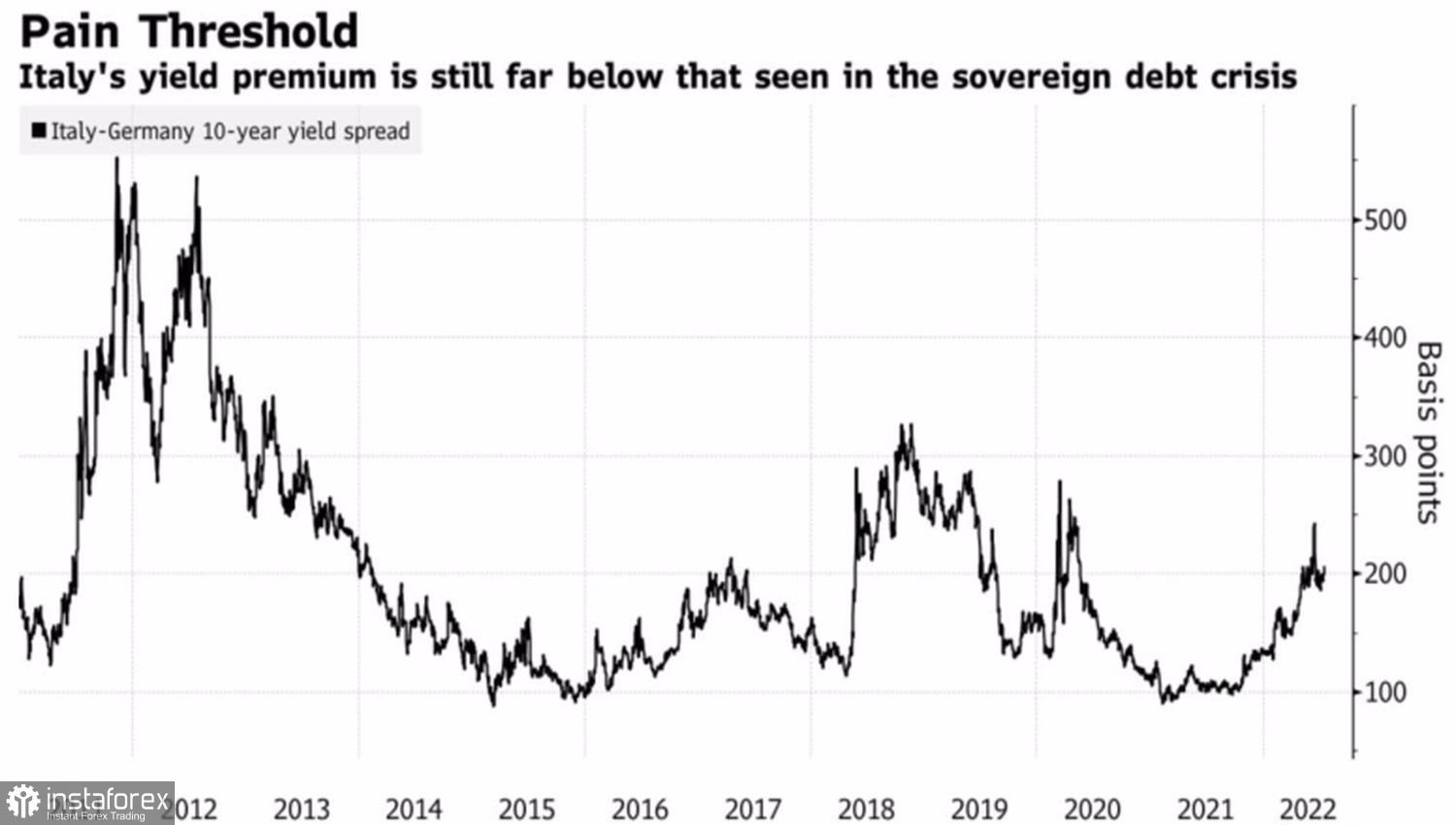

The Five Star Movement, which has so far only provoked a storm in a teacup in Italy, clearly does not want snap elections. The party's rating began to fall after joining the coalition. Mario Draghi may be able to save the country from another political crisis. This will result in a reduction in the yield spread of Italian and German bonds and untie the hands of the ECB. Curiously, almost half of the 792 investors surveyed by Pulse believe that the European Central Bank will begin to actively intervene in the life of the debt market if the key spread exceeds 450 bps. Bloomberg experts previously called a figure of 250 bps.

Dynamics of yield differential of Italian and German bonds

The idea of raising the deposit rate by 50 bps at the meeting of the European Central Bank on July 21 does not look unrealistic either. Record high inflation, the fall of EURUSD to the 20-year bottom, which makes energy products even more expensive and contributes to the crisis, as well as the desire of other regulators to keep up with the Fed play into the hands of the ECB's hawks. It is more difficult to resume the work of the Nord Stream because if Russia wants to avenge the sanctions, it is the right time.

Thus, the euro has arguments for a counterattack, but it is unlikely that this will somehow change the existing trend in EURUSD. The US dollar draws a feedback loop when its strengthening negatively affects the global economy by hitting debt-laden developing countries, high commodity prices, and worsening global trade conditions. All this increases the risks of a global recession and contributes to the growth of demand for safe-haven assets. That is, the US dollar. A vicious circle that the Fed had previously destroyed.

The Federal Reserve, looking at the negative impact of its tightening monetary policy, often began to slow down with an increase in rates. As a result, a pattern emerged according to which the US dollar strengthens on the eve of the start of the process of monetary restriction and at its beginning and then begins to weaken.

Dynamics of the US dollar and Fed rates

This template is currently not functional. If Jerome Powell and his colleagues are willing to sacrifice their labor market and economy to beat inflation, what do they care about the rest of the world?

Technically, the Three Indians pattern has worked out on the EURUSD daily chart. However, the downward trend is strong, so rebounds from resistances at 1.018, 1.022, and 1.03 should be used for selling.