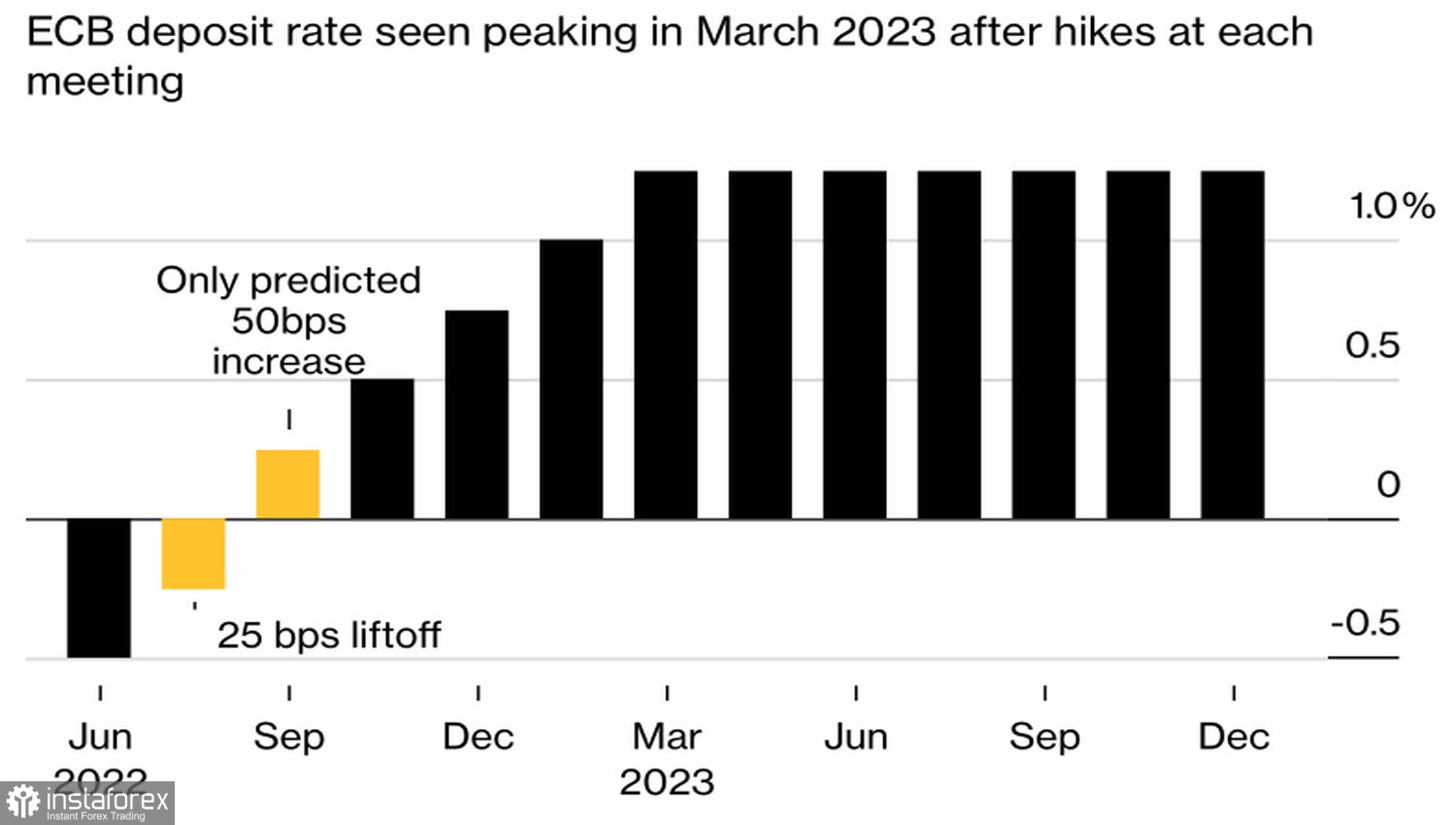

Only 4 out of 53 Bloomberg experts expect the ECB to raise the deposit rate by 50 bps in July, but as soon as an insider appears in Bloomberg that this issue is on the table of the Governing Council, the EURUSD pair soared above 1.025. The same goes for a $150 billion deal to buy October futures linked to the federal funds rate. Someone knew more than anyone else and was sure that the chances of an increase in borrowing costs by 100 bps at the upcoming FOMC meeting would drop sharply. They fell from almost 90% to 30%. And this someone earned $14 million per day.

I have repeatedly stressed that the main drivers of the EURUSD collapse to parity were the contrasts between a determined Fed and a leisurely ECB, an energy crisis poised to plunge the eurozone into recession, and a political storm in Italy. If, after lowering inflation expectations from the University of Michigan, the Fed abandons the idea of raising the federal funds rate by 100 bps in July, while the European Central Bank, on the contrary, will discuss the possibility of starting from 50 bps, the difference no longer looks serious. The pair's quotes take into account a large amount, so it's time to close the shorts. It is this circumstance, against the likelihood of raising the deposit rate to zero at the next meeting of the Governing Council from 20% to 50%, allowed the "bulls" to disperse their attacks.

ECB Rate Forecasts

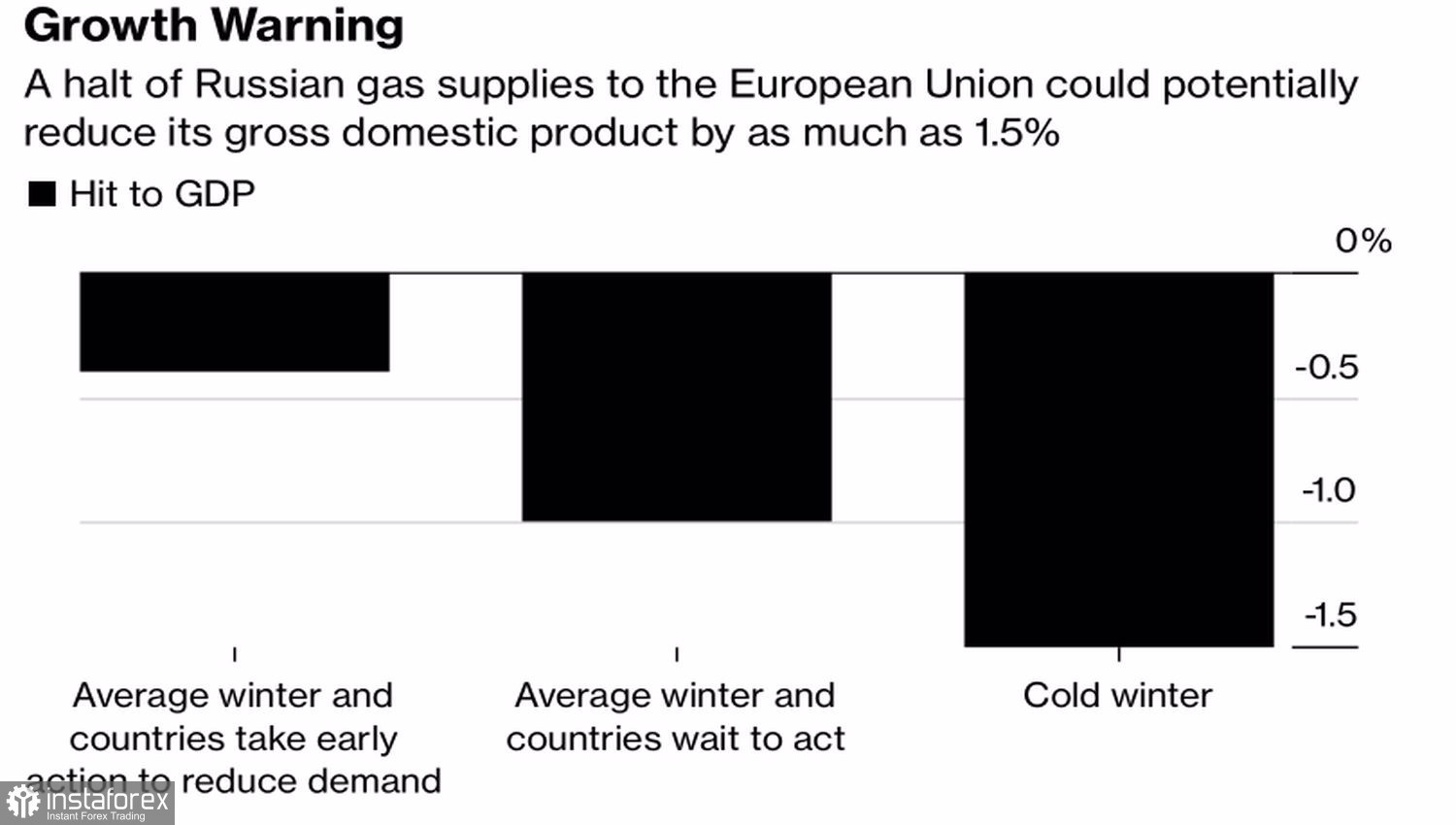

Not everything looks so bad with the energy crisis. Yes, gas prices are going through the roof, but whoever is warned is armed. The European Commission said it was already working on a baseline scenario in which Russia would not resume gas supplies from July 21. According to the forecasts of the European Commission, this will cost the EU economy 1.5 percentage points in severe winter and 0.6–1 percentage points in case of a moderate one. If all the planned actions get implemented, the figure will drop to 0.4 percentage points altogether. It is far from the 9% that some German institutions used to scare the German economy.

European Commission forecasts for a recession in the EU

The European Commission expects gas storage facilities to be 65–71% full by the end of October, below the 80% target level, but not by much.

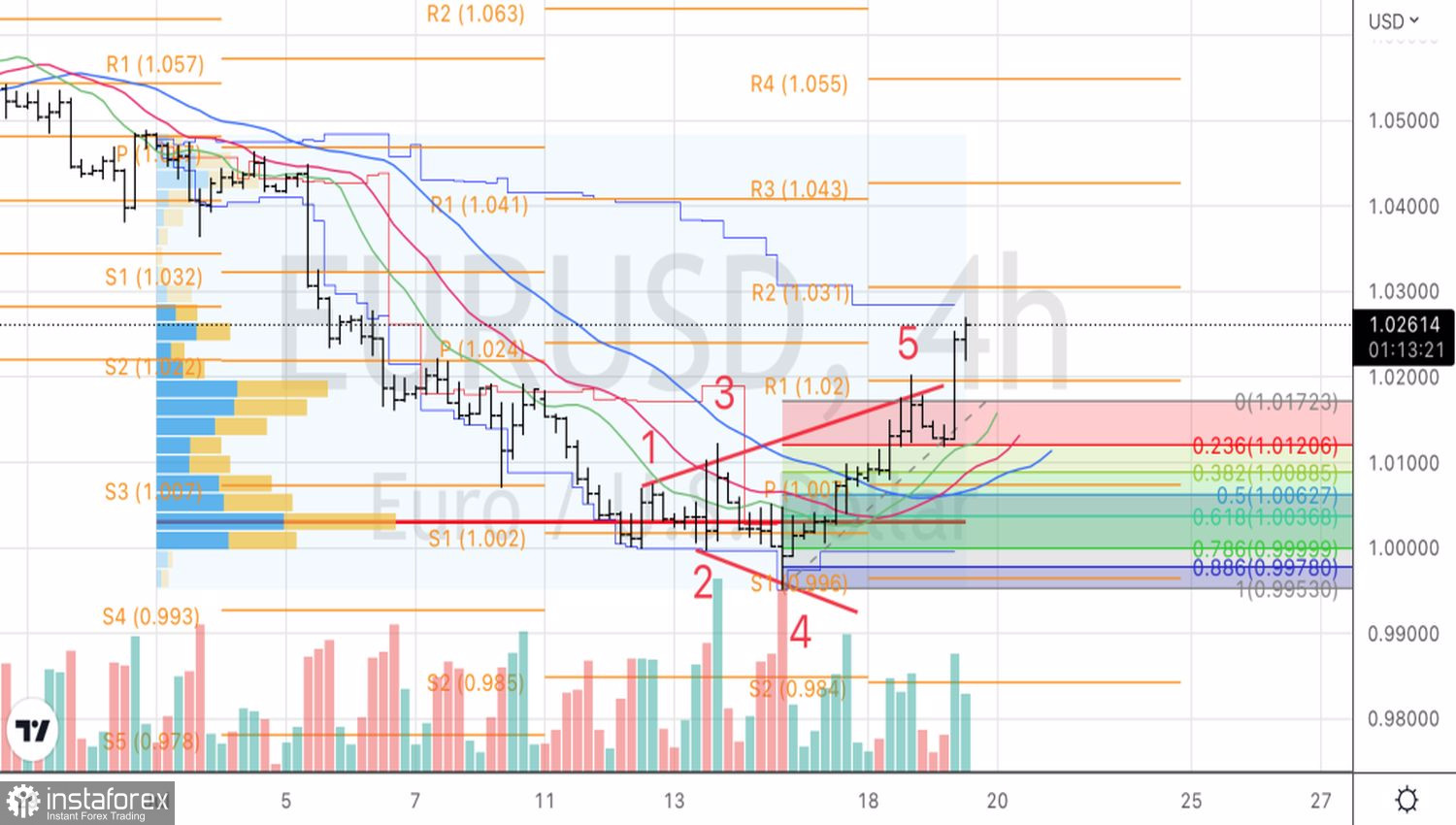

Thus, a more decisive ECB than expected, the effective work of the EU, and a messiah for Italy in the image of Mario Draghi can significantly change the balance of power in EURUSD. Draghi already has the experience of saving the euro; why won't he do the hat trick again, averting a political crisis in the country? All this together sets the fans of the euro in a major way. The correction may turn out to be deeper than expected.

Technically, the Broadening Wedge pattern has been implemented on the EURUSD 4-hour chart. Long positions formed on the breakout of 1.012 should be held until the next bar closes below the pivot point at 1.019. Partial profit-taking on longs is possible in the area of 1.03–1.032. If the euro manages to pass it, the risks of continuing the rally to $1.041 will increase.