The global financial markets are now hot, then cold. And in the literal sense. After numerous hot data on US inflation over the past 6 out of 7 months, a cold snap came in July. For three consecutive days, statistics on consumer prices, producer prices and import prices have convinced investors that inflation is slowing down. The S&P 500 was growing, and the US dollar was actively selling off. However, frost moved from Northern Europe to America, lowering the "bulls" on EURUSD from heaven to earth.

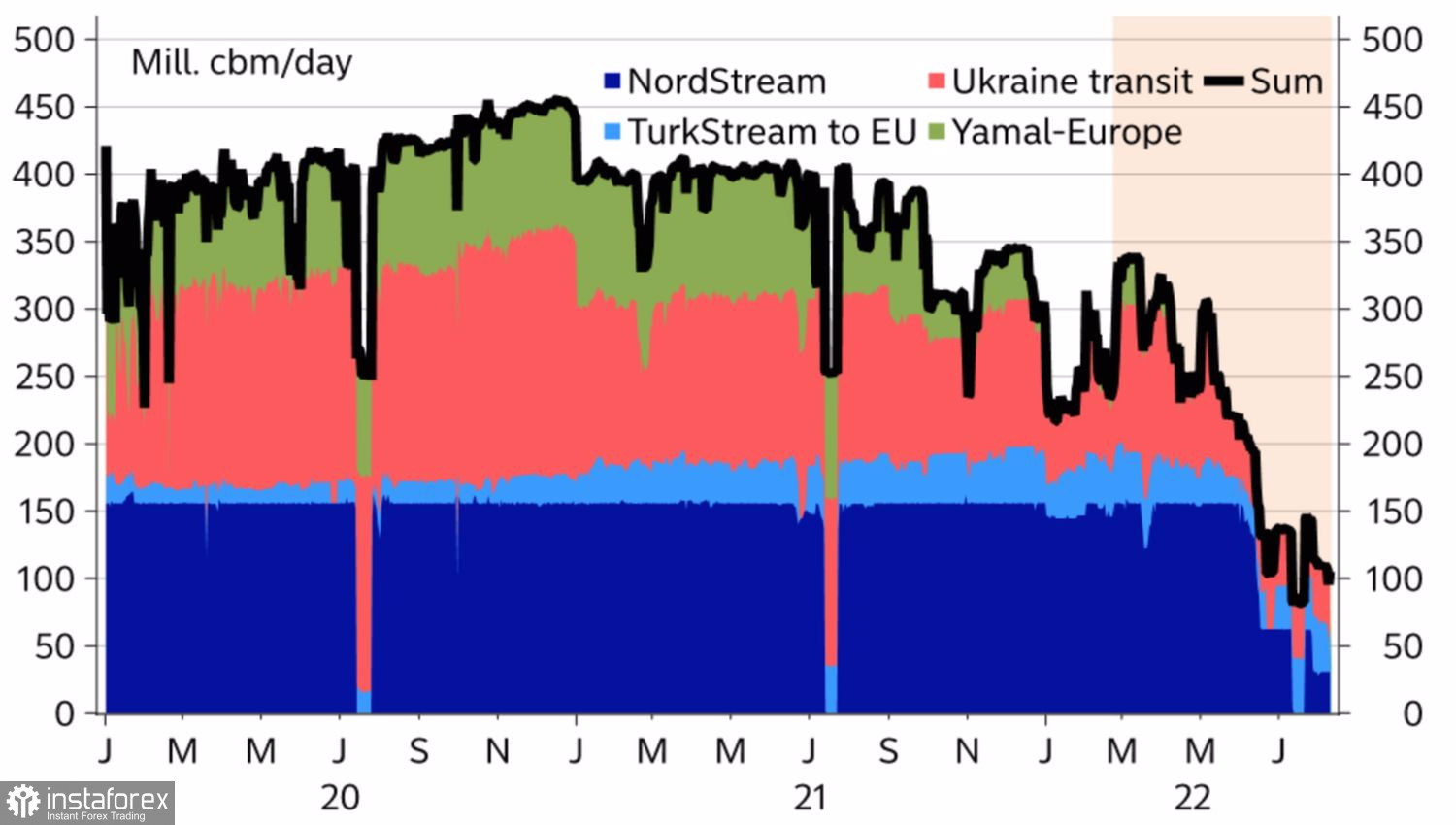

If it matters for the US currency whether hot or cold data comes in, then for the euro, it does not seem to matter. The heat in the euro area pushes up gas futures quotes in the short term. Expectations of the imminent onset of winter and frost raise them even higher in the long term. As a result, the price of blue fuel reached a record high of €475 per MWh, which is almost six times more than in August 2021. In two months, the cost of gas doubled in the face of falling supplies from Russia.

Dynamics of prices for European gas

Extraordinary measures are required from Europe in order not to drown in the ocean of the energy crisis. Germany finds them in the form of an increase in natural gas payments for households by an average of €500 per year. The situation could be even worse if the German government did not use all possible and impossible ways to fill the vaults. According to existing standards, they must be loaded by 75% by September 1, 85% by October 1 and 95% by November 1. The first target is achieved, the second is on the line.

Dynamics of Russian gas supplies to Europe

The states never dreamed of problems of this magnitude. They are net exporters of natural liquefied gas, so high prices play into the hands of their manufacturing companies and the economy as a whole. As a result, the US dollar is back on the rise thanks to American exceptionalism. After all, not only in Europe things are going badly. China's industrial production and retail sales data were disappointing, and the People's Bank of China's response to them in the form of rate cuts made it possible to say that the Chinese economy is in trouble. This circumstance paints a bleak outlook for Chinese exports and GDP.

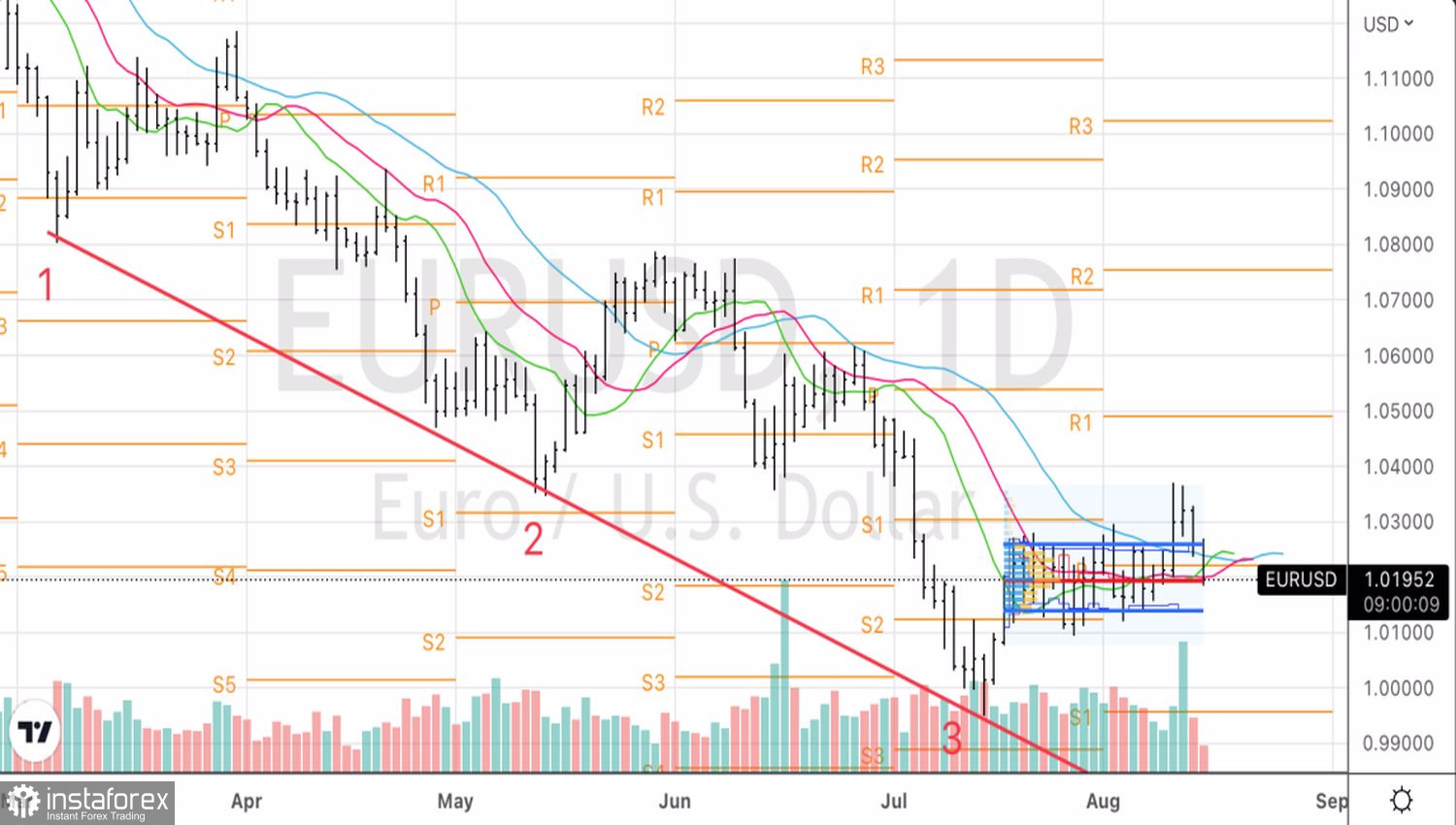

Due to the divergence in the economic growth of the US and the Eurozone, the paths of the US stock indices and EURUSD have diverged. What happens when the S&P 500 goes down? The deterioration in global risk appetite and the associated increased demand for safe-haven assets can return the main currency pair to parity.

Technically, on the EURUSD daily chart, there is a transformation of the Splash and shelf pattern into a false breakout. Euro returned to the middle of the trading range of $1.01–1.03, activating the last model. We keep the short positions formed from the level of 1.0275 and periodically increase them on pullbacks. The 1.01 and 1.00 marks still appear as targets for the downward movement.