Đánh giá mới nhất về vàng cho thấy tại Wall Street, tâm lý gấu đang có một chút ưu thế giữa các nhà phân tích. Và nhà đầu tư bán lẻ vẫn giữ được sự lạc quan đáng kể. Tâm lý trộn lẫn đã xuất hiện do thị trường vàng kết thúc tuần trước trên mức 2000 đô la mỗi ounce, nhưng đồng thời giảm mạnh so với đỉnh lịch sử của nó.

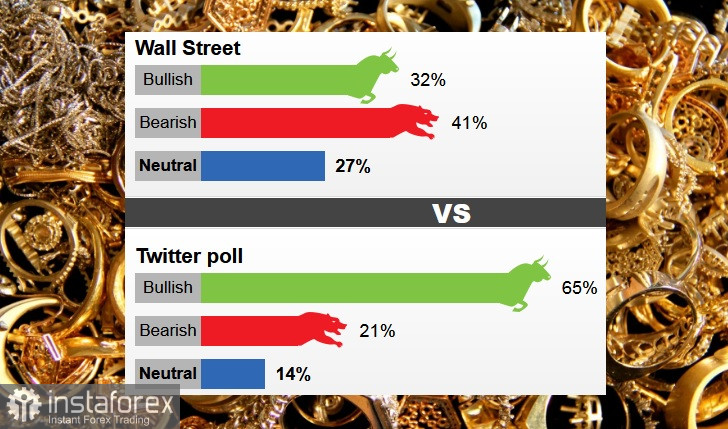

The market continues to react to volatile expectations of interest rates, according to analysts. After the Federal Reserve raised interest rates by 25 basis points, it shifted its monetary policy to a more neutral position. And the markets began to take into account the possibility of a rate cut in July. On Friday, good employment data was released ahead of the weekend, with 253,000 jobs created and wages rising by 5%. Gold prices fell, dropping more than 2% in a day. Rising wages indicate increased inflation, which will force the Federal Reserve to maintain a hawkish monetary policy stance. In the near future, gold may face difficulties, as it is unlikely that the Federal Reserve will cut interest rates in the summer. Nevertheless, such volatility creates good conditions for investors seeking to build a long-term position. Last Friday, 22 Wall Street analysts participated in a gold survey. Among the participants, seven, or 32%, were optimistic about the near-term outlook. At the same time, nine analysts, or 41%, predicted bearish sentiment, while six, or 27%, believe prices are trading in a sideways range. In online polls, 774 votes were cast. Of these, 500 respondents, or 65%, expect gold prices to rise. 163 voters, or 21%, said the price would fall, while 111 participants, or 14%, expressed neutrality.

Các nhà đầu tư bán lẻ cũng mong đợi sự phục hồi mạnh mẽ của giá vàng, dự đoán rằng vào cuối tuần giá sẽ đạt khoảng 2060 đô la.

The opinion of some analysts is that despite Friday's sell-off, as prices held at $2,000 per ounce, such a price may attract investors this week. Moreover, the longer the debt ceiling debates continue, the closer the US gets to default. Such uncertainty will continue to support gold prices, much like it did in 2011.