The first decline in US Treasury yields in the last eight days allowed gold to move beyond the $1890–1965 per ounce consolidation range. A slowdown in core inflation to 0.3 m/m, a decline in gasoline and used car prices in April, and an improvement in supply chains suggest that consumer prices hit a ceiling in March. And if so, the Fed will have no reason for aggressive monetary restriction. Good news for the XAUUSD bulls.

It is generally accepted that the market value of the precious metal depends on the US dollar and real rates on US bonds. The USD index received preferences in April due to the hawkish rhetoric of FOMC members and the escalation of the armed conflict in Ukraine. Moscow believes that negotiations with Kyiv have reached an impasse, and is concentrating forces on the Donbas, where bloody battles are planned. As a result, the demand for safe-haven assets is growing, which is used not only by the US dollar, but also by gold.

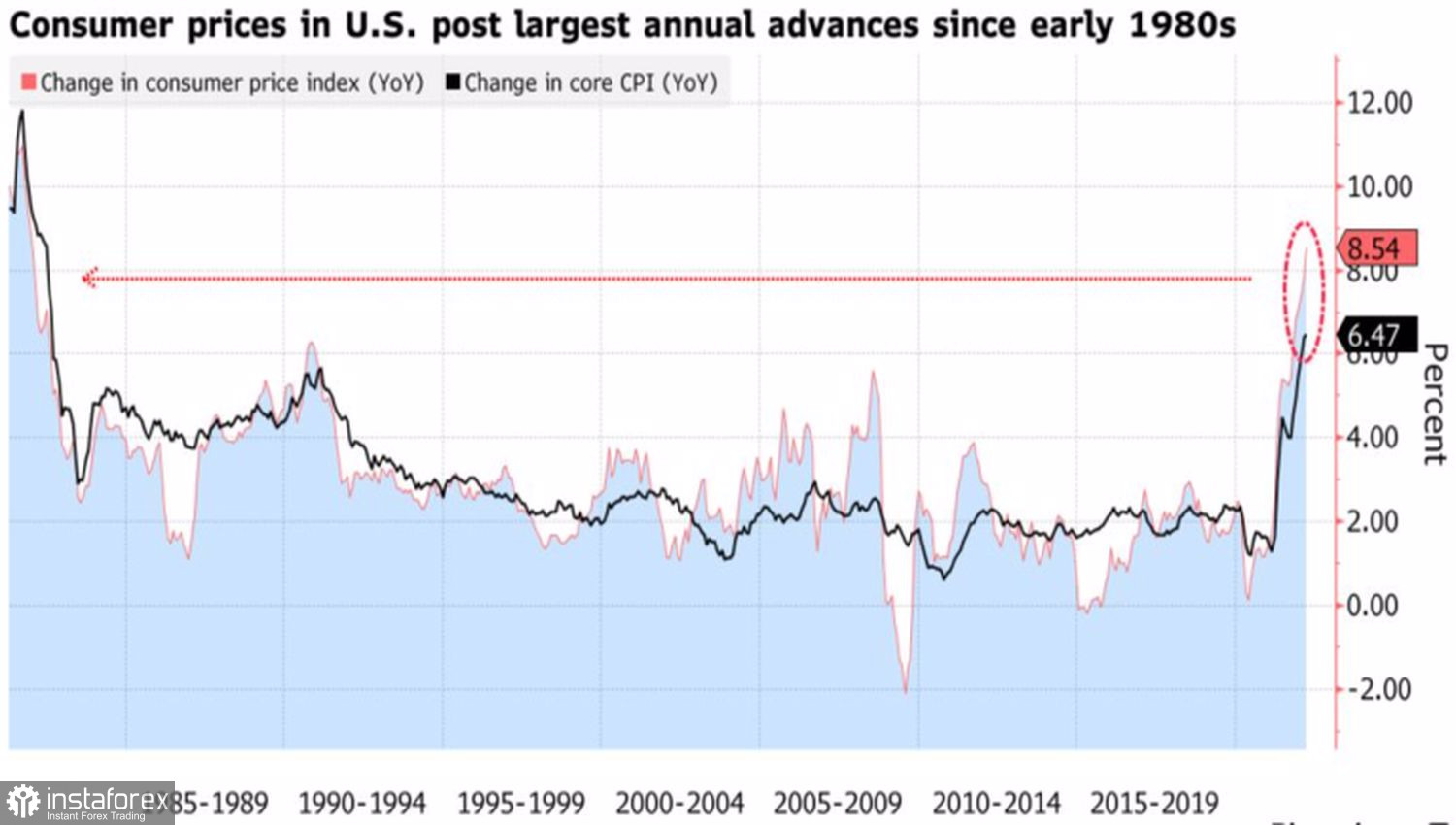

The precious metal does not lose to the US currency in the field of monetary policy. Yes, the derivatives market expects three 50 basis points restriction acts, each in 2022. Yes, FOMC officials expect to quickly bring the federal funds rate to a neutral level of 2.25-2.5%. Yes, the yield on 10-year US Treasury bonds reached its highest level since 2018. Nevertheless, consumer prices in the United States accelerated to 8.5%, the highest level since 1981, annual inflation expectations from the New York Fed accelerated to 6.6%, and this means that the real yield of treasuries continues to remain in the negative zone. This creates a tailwind for XAUUSD.

Dynamics of American inflation

Investors are beginning to see signs of a split within the Fed, which will make it harder for the central bank to move towards neutral rates. Governor Lael Brainard believes that the Fed will be able to cope with high inflation, while Richmond Fed President Thomas Barkin believes that its bursts will become common in the coming years. Chicago Fed President Charles Evans is poised to go all out to fight skyrocketing prices, while Governor Christopher Waller argues that the regulator needs to do everything it can to avoid collateral damage from rate hikes, a brute-force tool that can act as a hammer on the economy.

It is clear that the excessive aggression of the Fed will increase the risks of a recession, as evidenced by the inversion of the yield curve. Research firm Wood Mackenzie cut its global GDP growth forecast for 2023 from 2.5% to 0.9%, citing the consequences of the armed conflict between Russia and Ukraine. The economic slowdown is good news for XAUUSD as, however, the periods of high inflation. History shows that during such times, the annual return of US stocks is -7%, while commodity market assets return +14%.

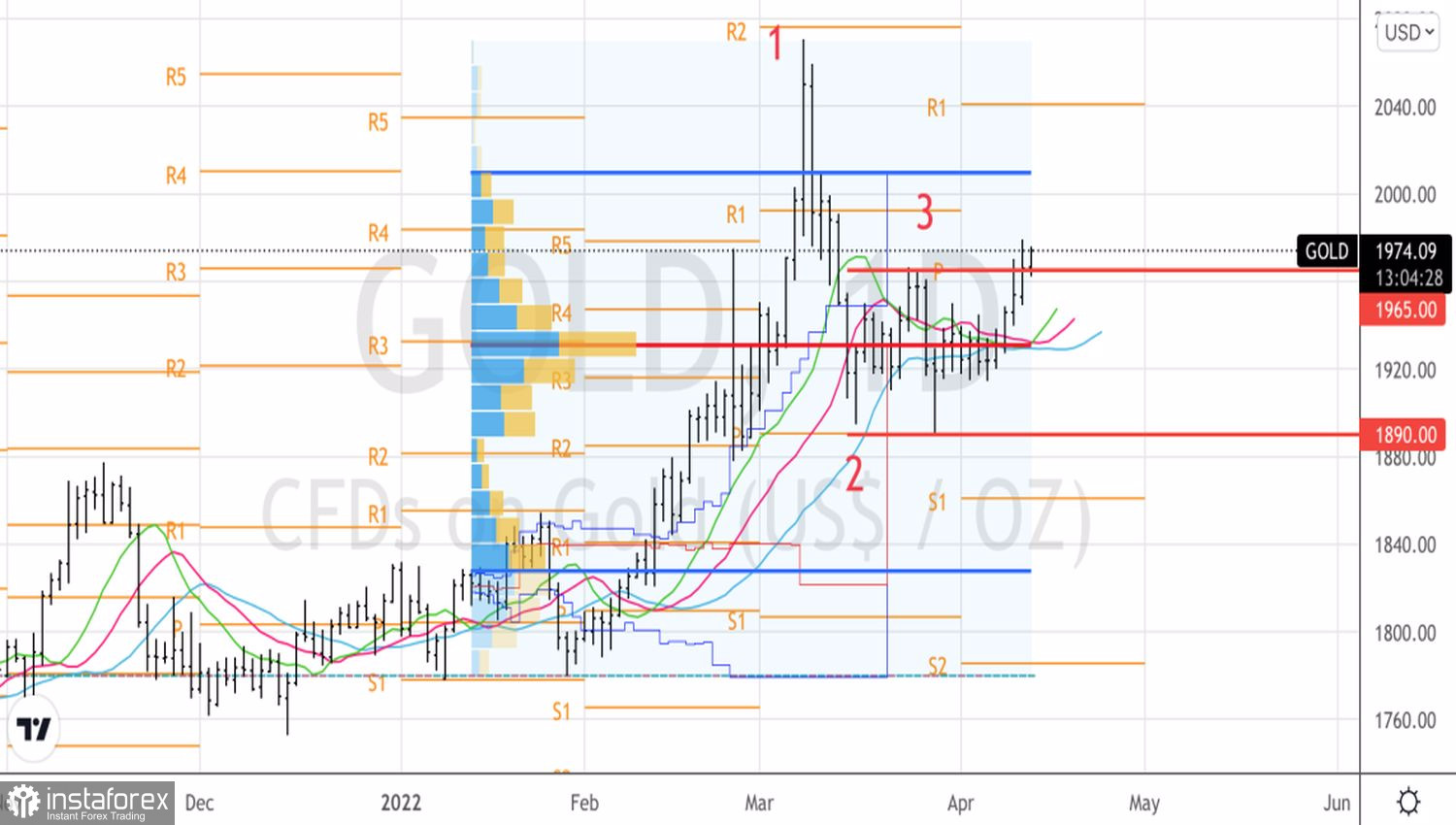

Technically, the exit of gold beyond the "shelf" – the consolidation range of $1890-1965 per ounce, formed as part of the "Splash and shelf" pattern, is a "bullish" sign. A retest of support at $1965 or a break of resistance at $1980 is a reason to buy the precious metal. Let's remember about sales in case of its return to $1935.

Gold, Daily chart