The pound-dollar currency pair remains under pressure, despite a record increase in March inflation in the UK. All components of today's data were released in the green zone, reflecting another inflationary spurt. This fact increased the likelihood of an interest rate hike at the May meeting, but traders mostly reacted phlegmatically to such prospects. After a short-term price increase of 50 points, the pound fell under a wave of sales, and the GBP/USD pair, respectively, returned to the base of the 30th figure.

On the other hand, thanks to today's publication, buyers were able to keep the pair above the 1.3000 mark. Bears have been besieging this support level for several days, making regular raids into the area of the 29th figure. But it is not yet possible to gain a foothold in this price area: the pound is on the defensive, despite the pressure of dollar bulls.

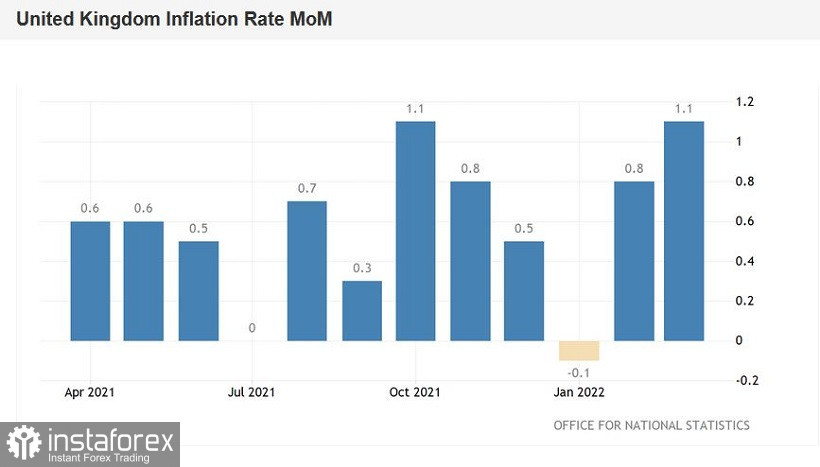

Today's inflation report turned out to be "on top" – literally and figuratively. The overall consumer price index on a monthly basis came out at 1.1%, thereby updating the four-month high. This component has been consistently declining for three months, and in January it fell into the negative area (reaching -0.1%). Therefore, the current growth (in February and March) has in some sense a significant, tendentious value.

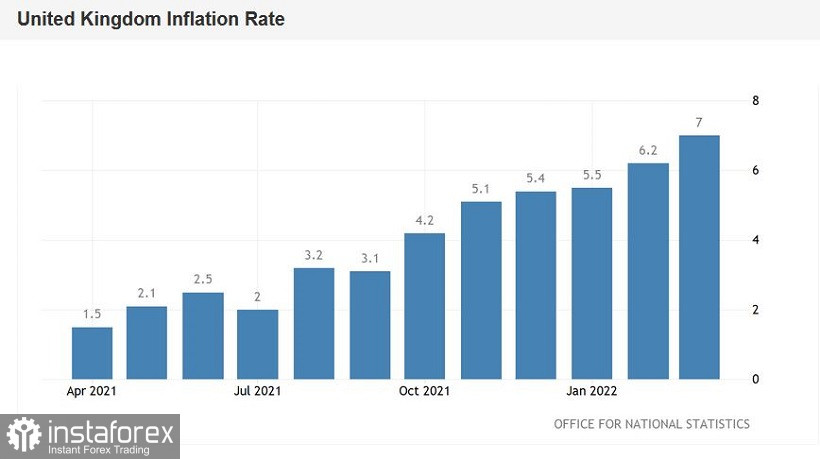

In annual terms, the index also showed a jumpy growth, reaching 7.0% (in the previous month it was at the level of 6.2%). This is a long-term record: the indicator showed the strongest growth rate since April 1992. Core inflation showed a similar trend. The core consumer price index jumped to 5.7% (this result is also a long-term record).

In addition, a significant increase in the producer price index was recorded in March, both in monthly and annual terms. A similar dynamics was demonstrated by the producer price index.

On the one hand, such a significant increase in inflationary indicators was due to many factors of a temporary nature. But on the other hand, the release itself is certainly important. And not only in an emotional context, but also in a practical plane.

The likelihood of an interest rate hike following the next meeting of the Bank of England (May 5) has now largely increased, although more recently, Governor Andrew Bailey, voiced skeptical comments about this. In fact, he questioned the advisability of raising interest rates at the May meeting. In the course of his recent speeches, he several times referred to "the current unstable situation." Therefore, the market began to hear more and more often the idea that at the next meeting the English regulator could disappoint supporters of a strong pound.

Also, let's not forget that one of the members of the Committee, John Cunliffe, voted against raising the rate at the March meeting, in favor of keeping it at the level of 0.5%. The lack of solidity was supplemented by rather cautious wording of the accompanying statement. The regulator de facto tied the issue of raising the rate to inflation, pointing out that the further policy of the regulator will depend on inflation, namely, on the dynamics of its growth.

That is why today's report actually leveled fears about the prospects for tightening monetary policy. The phlegmatic reaction of the market to this fact suggests that the pound is moving exclusively in the wake of the US currency. The GBP/USD pair is still at the bottom of the 30th figure, despite the growth of British inflation and the high probability of a rate hike by the British regulator.

On the other hand, yesterday's data on the growth of US inflation also did not help the bears of the pair to gain a foothold below the 1.3000 mark. After an impulse decline to the target of 1.2990, the price turned 180 degrees and returned to its previous position. The multi-day siege of the key support level has so far led to nothing: sellers cannot gain a foothold in the area of the 29th figure.

Note that US inflation in March showed record growth, reaching 40-year highs. After this release, the probability of a 50-point Fed rate hike at the May meeting has largely increased. In my opinion, it is now safe to say that following the results of the June meeting, the Federal Reserve will make a similar decision.

But, despite the general strengthening of the greenback, the pound restrained the onslaught of dollar bulls: the GBP/USD pair remains above the 1.3000 mark so far. This suggests that short positions are risky at the moment – it is necessary to wait for a downward break. In this case, the main target will be the 1.2920 mark – this is the lower line of the Bollinger Bands indicator on the W1 timeframe. In any case, longs should not be considered now, since the dollar is in high demand throughout the market, due to prevailing anti-risk sentiment and hawkish expectations.